What is Blockchain Technology?

Since you're visiting Invity, you're probably familiar with Bitcoin and maybe even some major altcoins like Ethereum. However, to get the most out of investing in cryptocurrencies like these and to understand major innovations in the world of crypto, it's vital to understand how they work. The backbone of this understanding—and indeed to everything about cryptocurrencies—is blockchain technology: this is what allows Bitcoin transactions to take place between users across the globe in a secure way. Of course, building a worldwide financial network is no small task, so we're here to give a simple explanation of blockchain technology and an idea of what it is used for. While this blockchain primer is intended to be fairly straightforward, we'll need to use some technical terminology, so it's probably good to have our list of cryptocurrency terms to know at the ready (and its slightly more advanced second edition if you're feeling ambitious!). Once you've filled in your background knowledge about the blockchain, you'll be ready to use Invity to buy crypto instantly with more confidence than ever!

Setting the record straight: ledgers

Blockchain technology is, at its most basic, a specialized form of accounting. Normal banks, business, and individuals record incoming and outgoing transactions and the identity of the payers in a ledger. You probably do this when you balance your checkbook, track your monthly budget, or do bookkeeping for your business. Bookkeeping is a useful term to think about, since for most of human history ledgers have been kept as a large book or list of where funds and other products move. For the most part this works well if you keep good records and everyone stays honest. We all know, however, that this is just an ideal case: in reality, people often make mistakes, steal, cover their tracks, and do other things that make accounting unreliable at best or downright untrustworthy at worst. Records of digital transactions can be particularly problematic since they are vulnerable to hacking and unique discrepancies like double spending, where, since assets don't physically change hands, it's easier to get away copying and spending the same funds twice.

Of course, over time some solutions have appeared to fight bad accounting, like audits. When the IRS, for example, conducts an audit, they are likely comparing your records of transactions with known records of transactions from other sources. In this way, the more people with accurate ledgers, the more secure and accurate the system overall. Unfortunately, we all know it's simply not possible for everyone to be audited all the time. Or at least not till blockchain technology came around.

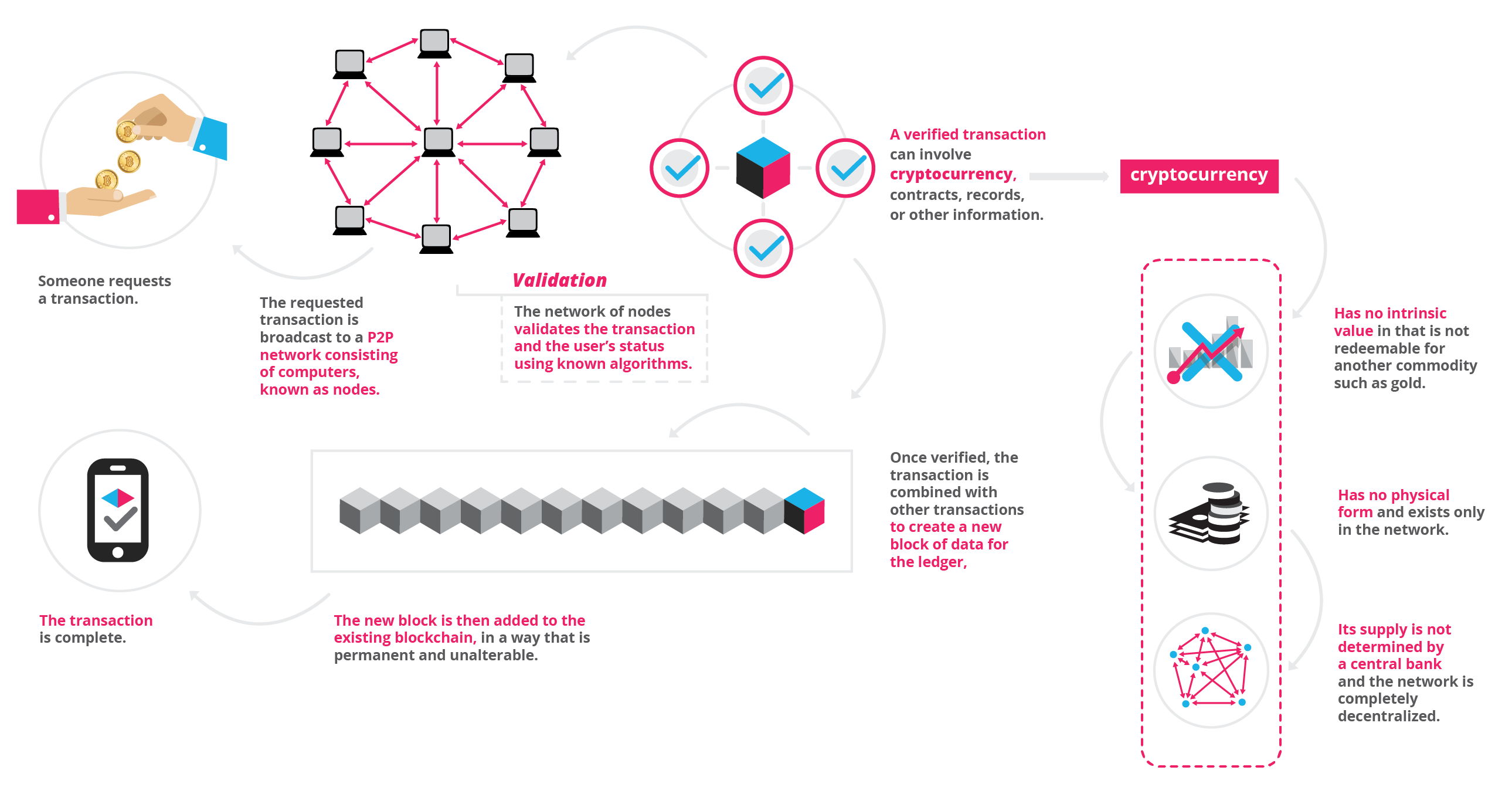

Blockchain is a distributed ledger technology (DLT), a single worldwide ledger listing every transaction made on a given network dating back to the beginning of that network. The "distributed" part means that the same list is constantly updated on countless different computers that can be anywhere and owned by anyone ("nodes"); this means there no central authority determining what transactions are and are not included in the ledger and there is no chance for discrepancies between different sets of records when it comes to who owns what and when things trade hands. What's more, anyone can use a "block explorer" to see this list and check information about any transaction, meaning everything is constantly auditable.

It's important to note that while ledgers are complete and distributed, each cryptocurrency runs on its own network and so has its own ledger. This is why you'll hear about the Bitcoin blockchain, the Ethereum blockchain, and so on; once you've established which currency you're talking about, you can simply refer to "the blockchain".

So how does a blockchain work?

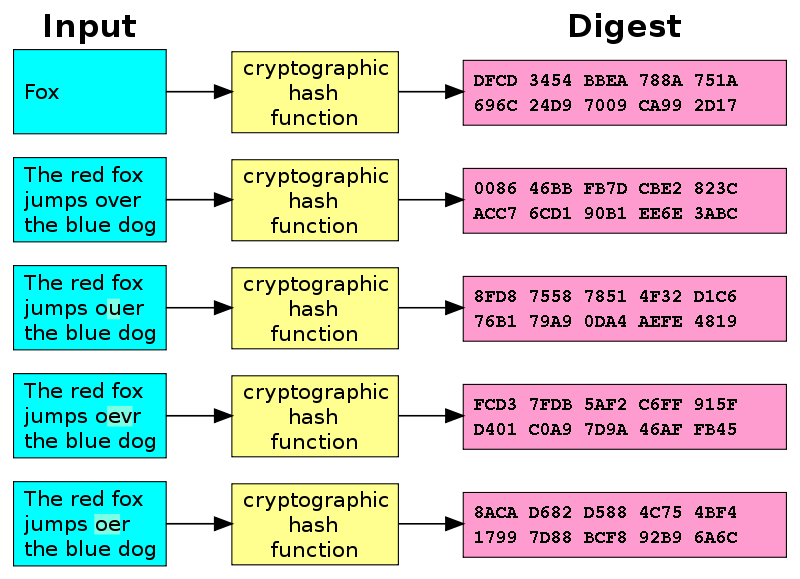

The way individual transactions are added to the complete ledger contained on a blockchain is what makes this a unique and highly secure form of DLT. (These are the two most technical paragraphs of this post, but they're really important!) Any two parties can agree to a cryptocurrency transaction and exchange their information. The data about this transaction—the addresses involved, the amount exchanged, the time the transfer was made—is included in a batch of the most recent transactions made on the network. This group of data is called a block. Crucially, each block also contains a compressed version of that network's entire ledger dating back to its start. As such, each block is irrevocably tied to each previous block—thus the "chain" part of "blockchain". This is one way that tampering with the blockchain is prevented: a fraudster wouldn't just have to make an illegitimate transaction in the current block, they would also have to make a change at some point in the ledger's past to show where they got the crypto they are currently trying to use.

Each block's data is then processed through an encryption algorithm to produce a string of characters called a hash. The nodes that make up the blockchain network are tasked with verifying that each hash conforms to the strict mathematical rules of the network. While different networks have different ways of determining how a block is verified (mainly proof of work or proof of stake) and by whom, the thing to keep in mind is that a majority of the network's computers have to agree that each hash looks the way it should ("consensus") and then permanently add it to the distributed ledger kept on each node. This is the second strong layer of security in blockchain networks: even if someone is able to change the copy of the ledger on one node to give themselves illegitimate crypto, they still have to convince a majority of other nodes that that change is okay. Since even the smallest change in a block's data results in a very different hash, it's very easy for computers to catch and reject illegitimate transactions.

Uses for blockchains

As we can see, blockchain is an incredibly useful tool for keeping complete, accurate, unchangeable records of how assets flow between people participating in a given network. Obviously these are extremely useful attributes when it comes to creating a network that deals with transferring money from one person to another, which is the most common application today—Bitcoin and similar cryptocurrencies are the best example. However, security and verifiability are vital to a functioning society and economy, so the potential applications of blockchain technology are growing daily. Assets like real estate, cars, and artwork can all be verified, traded, and traced on blockchains, as can products that make up long manufacturing supply chains or intellectual property. Will, inheritances, employment contracts, and insurance can be made stronger and more secure than ever. ID cards, medical records, and voting systems can take on better forms, making fraud and identity theft things of the past. And we are still only in the relative infancy of the blockchain era, so who knows what is still to come?

The main way to make sure that you can support a more secure future via blockchain technology—especially when it comes to your finances and investment—is to become part of the blockchain systems that are already in use. Use Invity's Buy crypto feature to invest in Bitcoin today, or use our Exchange crypto to get a sense of the subtle differences between different blockchain-based currencies out there.

Cover photo: Merritt Square Mall, Merritt Island FL by Rusty Clark, licensed under CC BY 2.0.