Cryptocurrency Terms to Know for Intermediate Users

By now, you've probably read our first guide to the most important crypto terms, and maybe you've even downloaded the Invity mobile app or started buying and exchanging crypto with the Invity comparison tool. But, as with everything, the deeper you invest in crypto, the more specialized the language becomes and the more you need to know. That's why we're back with an updated alphabetical glossary of common crypto terms so you can continue to build your confidence in the world of Bitcoin and altcoins. Whether you're curious what sets proof of stake apart from proof of work or whether you're looking to the future of the crypto economy, Invity's got you covered!

block

A block is a set of data that makes up a blockchain. Each block contains a batch of the most recent transactions made on that blockchain network as well as an encrypted and compressed version of the previous block; on the Bitcoin blockchain, each block contains 1 megabyte of data ("block size"). Once a block is cryptographically confirmed ("mined"), each transaction is recorded and linked to all previous transactions all the way back to the network's birth. This ability to trace each transaction is what makes cryptocurrency networks so trustworthy by preventing issues like double spending.

block reward

Block rewards are given to the first cryptocurrency miner to find the correct hash for a given block. This is intended to pay back the miner for investing their computing and energy resources, and is also the way new cryptocurrency enters the crypto economy. Since April 2024 (the date of the most recent halving), the block reward on the Bitcoin blockchain is BTC 3.125.

dapp

Dapp is short for "decentralized application". By assembling interlocking layers of smart contracts, dapp developers can create sophisticated blockchain-based programs that perform complex functions, from issuing loans to creating games. Many dapps are built on the Ethereum blockchain (which you can read more about in its own blog article), though other blockchains like EOS also exist. Dapps are a central feature of the emerging DeFi economy.

DeFi

DeFi is short for "decentralized finance" and describes a blockchain- and cryptocurrency-based economy that carries out the same functions as the fiat currency-based networks of banks, lenders, investors, traders, and insurers that currently dominate the world economy. Building a highly secure, decentralized "alternative" economy has been a central goal for many cryptocurrency users dating back to the founding days of Bitcoin; such an economy would bring much-needed accountability to the global economy and would offer more economic opportunities to disadvantaged people across the globe.

More at The Widening World of Crypto: Decentralized Finance

dollar-cost averaging

Dollar-cost averaging ("DCA") is an investing strategy often used with volatile assets. Investors don't try to make the most of a single large investment by trying to buy at the lowest point and sell at the highest; instead, they make smaller investments of regular amounts at regular times. While this may not result in the massive capital gains that a perfectly timed investment can make, it is a low-stress strategy that generally results in positive returns and minimizes overall risks.

While Invity isn't here to give investment advice, we do think that DCA can be valuable when applied to cryptocurrencies, and setting up a regular purchase plan is disarmingly simple in the Invity mobile app.

More at Dollar-Cost Averaging: Bitcoin's Secret Weapon

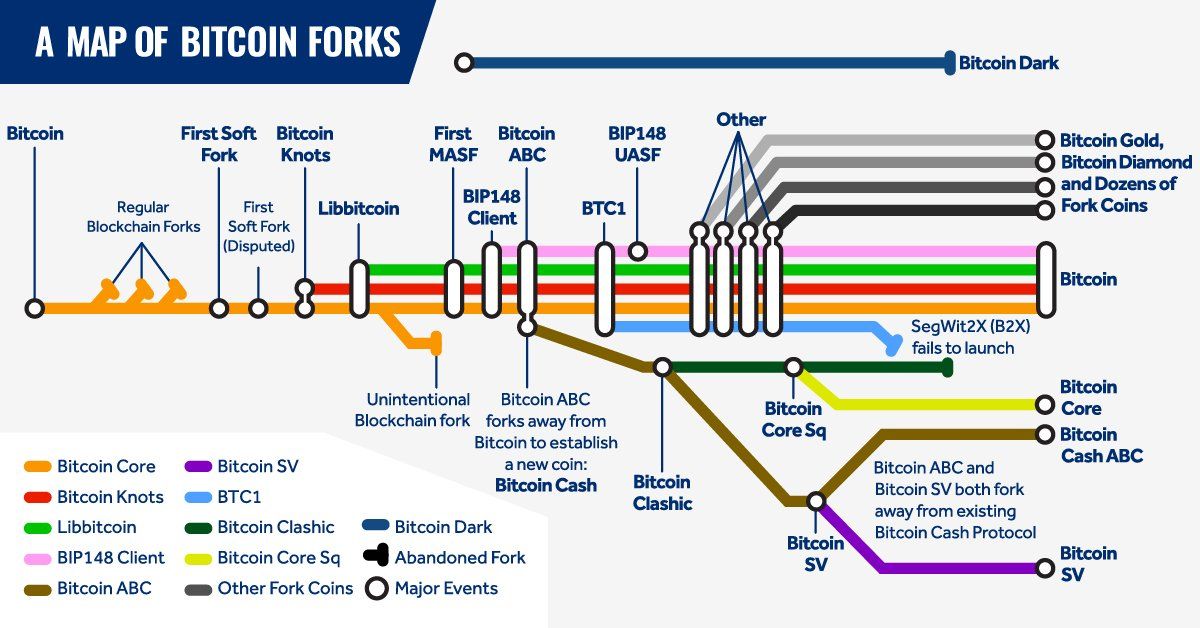

fork

In cryptocurrencies, a fork implements a fundamental change to how a blockchain functions. In a "hard fork", the changed blockchain can't work with older versions, meaning it splits off from the old version; typically a new token is created for the new fork while the original continues on its own. In a "soft fork", the new and old versions work together and no new coin is created; this is usually used to implement relatively cosmetic changes and stricter protocols.

Forking can be a contentious event in the cryptocurrency community. For example, in 2017, the block size limit of the Bitcoin (BTC) blockchain became an issue; a hard fork took place to increase this block size and Bitcoin Cash (BCH) was created. The technological detail that differentiates the two forks reflects a much larger philosophical split: some view cryptocurrencies as stores of value while others see them as mediums of exchange. There is still bad blood between BTC and BCH factions today.

halving

A halving (or "halvening") is when a blockchain's block reward is cut in half. For Bitcoin, this is a regular event that happens every 210,000 blocks, or roughly every four years. Halving is a way to continue to encourage miners to process transactions by releasing the finite supply of Bitcoins while also fighting inflation by increasing the currency's scarcity. Halvings have occurred four times in Bitcoin's history, most recently in April 2024, and are often associated with a rise in Bitcoin's value.

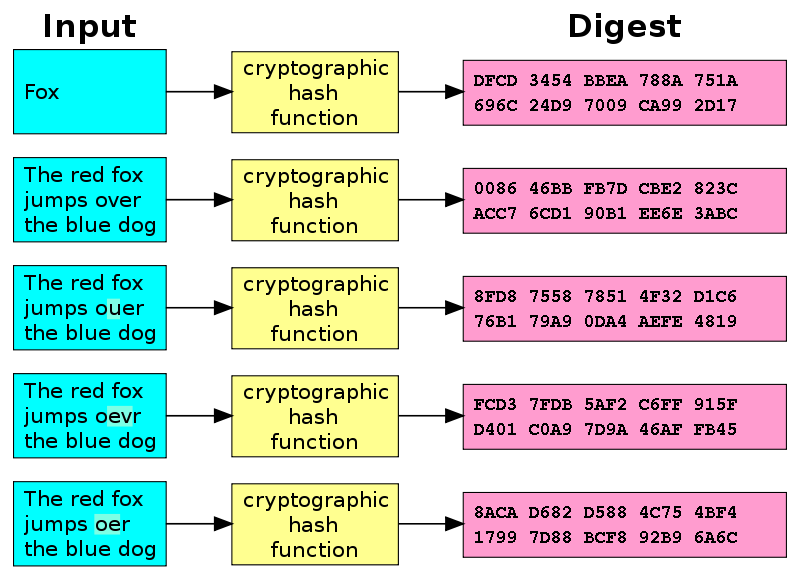

hash

A hash, short for "cryptographic hash", is the output when a set of data (like the amount and time of Bitcoin transactions contained in a block) is processed through an algorithm (a "cryptographic hash function"). This output, regardless of the length of the input, is a fixed-length set of numbers that cannot be reverse engineered to find out the original data. Due to a mathematical principle called the "avalanche effect", even a small change to the input data will result in a radically different hash. These characteristics are part of what contributes to the security of cryptocurrencies and prevents tampering with the data in the network.

In proof of work mining, cryptocurrency mining rigs compete to create a hash for each new block that conforms to a narrow set of criteria (a "target hash"); essentially they are searching for the one right answer to a complex mathematical problem. The higher a mining rig's hash rate, the more guesses it can make in a certain amount of time. Once one computer finds this correct answer, others check it; once a sufficient number of computers agree that the hash is correct, consensus is reached, a block is considered "mined", and the data is permanently added to the blockchain.

Lightning Network

The Lightning Network is a proposed improvement built on top of the existing Bitcoin blockchain (a "layer 2 solution") that aims to increase Bitcoin's scalability and make crypto more feasible for everyday transactions. Users of the Lightning Network open direct channels between one another, creating a dense peer-to-peer network. The blockchain is only updated when these channels are opened or closed, easing traffic on the blockchain.

proof of stake

Proof of stake ("PoS") is a way some blockchain systems reach consensus and thus verify transactions. This method requires "validators" who deposit a certain amount of crypto as collateral (a "stake") for the right to validate transactions on that network; the more crypto locked up for longer, the greater the validator's standing in the community. Those holding stakes validate ("forge", rather than "mine") blocks in proportion to the stake they hold and are rewarded with transaction fees. Verifying fraudulent transactions would be impractically costly, requiring users to have at least 51% of the currency on an entire network, and amassing this amount is further discouraged due to the risk of losing or devaluing the stake a validator has invested.

The PoS method has its benefits: it is less energy intensive, potentially more secure, and encourages decentralization since costly hardware is not required. However, it was only recently implemented on a large scale and may discourage the circulation of crypto. Currencies that currently run on a proof of stake basis include Cardano, EOS, Tezos, TRON, and most of all, Ethereum which changed to a proof of stake system ("Ethereum 2.0") in 2022.

proof of work

Proof of work ("PoW") is a way many blockchain systems reach consensus and thus verify transactions. This method has the most to do with the other terms on this list: mining rigs compete to find the correct hash, which is then checked by other computers on the decentralized network. The first to solve the problem is rewarded with a block reward and the transactions are unalterably added to the blockchain. This process requires a large amount of computing and electrical power, making it impractical to amass enough power to verify fraudulent transactions; this is what provides proof of work systems their security.

The PoW method has its benefits: it is thoroughly tested, and encourages the exchange of crypto. However, it is highly energy intensive and leads to a certain degree of centralization, since amassing the technology and know-how to make mining cost effective is expensive. Most cryptocurrencies, including Bitcoin, Litecoin, and Monero, run on a proof of work basis.

A review of the more familiar proof-of-work process and an explainer on how the proof-of-stake method differs. By Simply Explained.

satoshi

A satoshi, or "sat", named after Satoshi Nakamoto, the inventor of Bitcoin, is the smallest unit a Bitcoin can be divided into; these are the "cents" of Bitcoin. One satoshi is equal to BTC 0.00000001. If you hear of people "stacking sats", they mean scraping up every extra satoshi they can.

Stack sats.

— Bitcoin Magazine (@BitcoinMagazine) September 25, 2020

Live life.

It's that simple.

scalability

Scalability is the ability for a blockchain to deal with a large number of transactions on its network. Blocks are limited in size (the number of transactions each block can contain) and are mined at a relatively consistent rate; this means that the more transactions there are on the network, the longer users may have to wait for theirs to be verified. Forks and layer 2 solutions like the Lightning Network are proposed methods of making blockchain systems more scalable, in turn making them more attractive for everyday transactions.

smart contract

Like real-world contracts, smart contracts simply enforce which outputs happen based on certain inputs. In the real world, third-party verification is required to make these contracts work properly: in an insurance contract, for example, you need government identification to sign a contract, you need a bank to pay your premium, and you need a claims adjuster to make sure your situation qualifies for a payout. Smart contracts can carry out the same functions but use blockchains to make the contracts automatic and secure, reducing or eliminating third-party verification and the risk of fraud. Smart contracts are key to the functioning of dapps and DeFi.

Cover photo: Dictionary by QuoteCatalog.com, licensed under CC BY 2.0.