What is Bitcoin's Hashrate and Why Should You Care?

When talking about cryptocurrencies, the hashrate is a unit that can be used to inform miners of their potential earnings and indicate the overall health of a decentralized network. While an inherently complex topic, building an understanding of the hashrate as a unit of measurement will allow those involved in crypto to better understand the landscape as a whole.

This article provides a simple guide to what the term "hashrate" (also known as "hashing power") actually refers to. It's part of our ongoing effort to help people of different levels of familiarity all understand the most important crypto terms.

What is a hashrate?

As we covered in a previous plain-English guide, cryptocurrency mining is a process that allows Proof of Work networks—like Bitcoin—to operate without any involvement from a centralized third party. Instead, the network essentially tasks participants’ computers with trying to guess the answer to a complex algorithm.

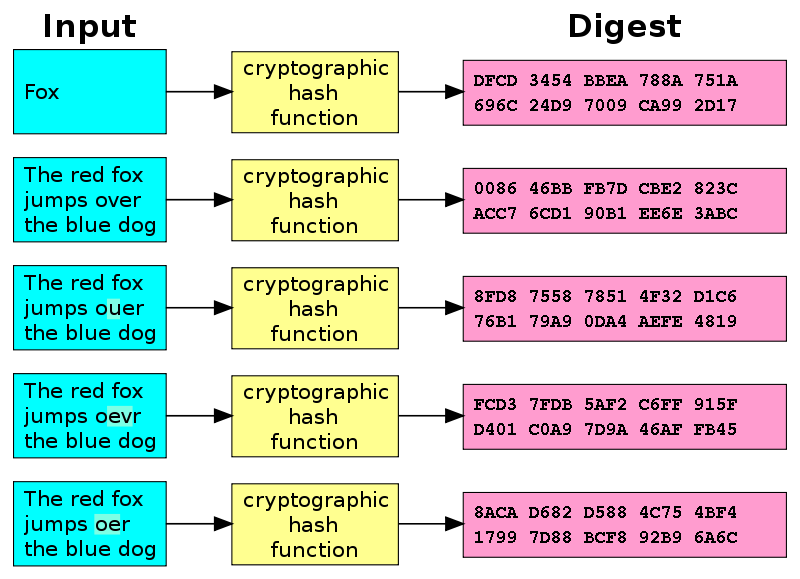

The algorithm used by Bitcoin and several other PoW cryptocurrencies is known as the SHA-256 hash algorithm. The inputs of this algorithm are all the transaction data contained in a block, while the output, the answer, is the result of this data being run through a complex mathematical blender.

From the network’s point of view, this algorithm is predictable, producing an answer that is always fixed in length and format: a hexadecimal string containing 64 characters. The algorithm also adjusts based on how many miners are making guesses at once in an automatic process known as difficulty adjustment. Adjustments allow the difficulty of correctly generating the right string to change every 2,016 blocks (approximately every fortnight) in order to ensure that blocks are mined at a relatively constant rate of one block every ten minutes.

From the perspective of miners, however, the result of the algorithm is unpredictable, meaning there is no real way to reverse engineer the process or automatically know the right answer. Instead, their best bet is to allow their computer to continuously generate guesses until it finds the correct string of letters and numbers. The owner of the first device to guess correctly is financially rewarded in the form of a block reward and all of the transaction fees contained within the block.

In order to make sense of this system, we need a way of measuring the race between miners who are trying to verify blocks. This metric is known as the hashrate or hashing power. It refers to the amount of guesses that a device can make in a given period of time. It is measured in hashes per second (H/s) and typically expressed in:

- Kilohashes: thousands of hashes per second (kH/s)

- Megahashes: millions of hashes per second (MH/s)

- Gigahashes: billions of hashes per second (GH/s)

- Terahashes: trillions of hashes per second (TH/s)

- Petahashes: quadrillions of hashes per second (PH/s)

- Exahashes: quintillions of hashes per second (EH/s)

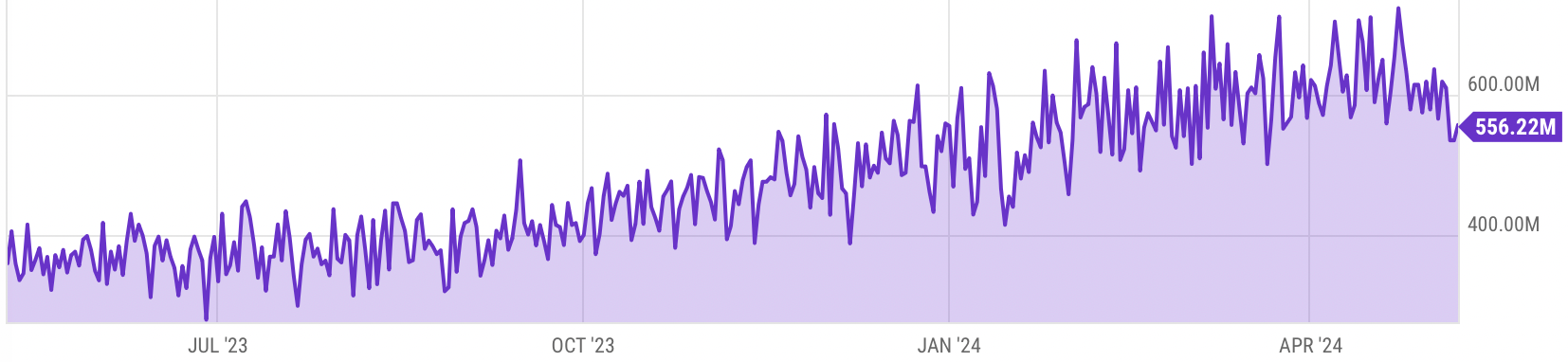

Online tools allow interested individual miners and mining pool participants to estimate the hashing power of their device(s). After factoring in electricity costs and the mining difficulty, this information can then be used for miners to get an idea of their potential daily earnings. To put these numbers in perspective, a single high-end mining rig might be capable of a few dozen TH/s, while the entire Bitcoin network currently accounts for a total estimated hashing power of around 556 million TH/s (556 EH/s).

What the hashrate means for the health of decentralized networks

When looking at a network’s total hashrate, we’re essentially considering the entire volume of computational resources that are being offered to the network for the purpose of crypto mining. This means that, with a higher hashrate, a larger or more powerful number of devices are serving the network in a way that allows it to stay decentralized.

As a result, a high hashrate can indicate that there is a lot of interest in mining a specific cryptocurrency—typically due to it offering significant financial motivation. In addition, a high total hashrate makes a network more impervious to security threats.

One of the most commonly discussed threats in a decentralized system, for instance, is the risk of a 51% attack. This term refers to malicious actor(s) manipulating a network by contributing the majority of its hashing power. This would then allow them to compromise the integrity of the network by double spending. When a decentralized network has a high hashrate, the absurdly expensive cost of the resources needed to hold a 51% stake through mining, and the impracticality of even obtaining control of the necessary physical components, prohibits any individual or group from taking control.

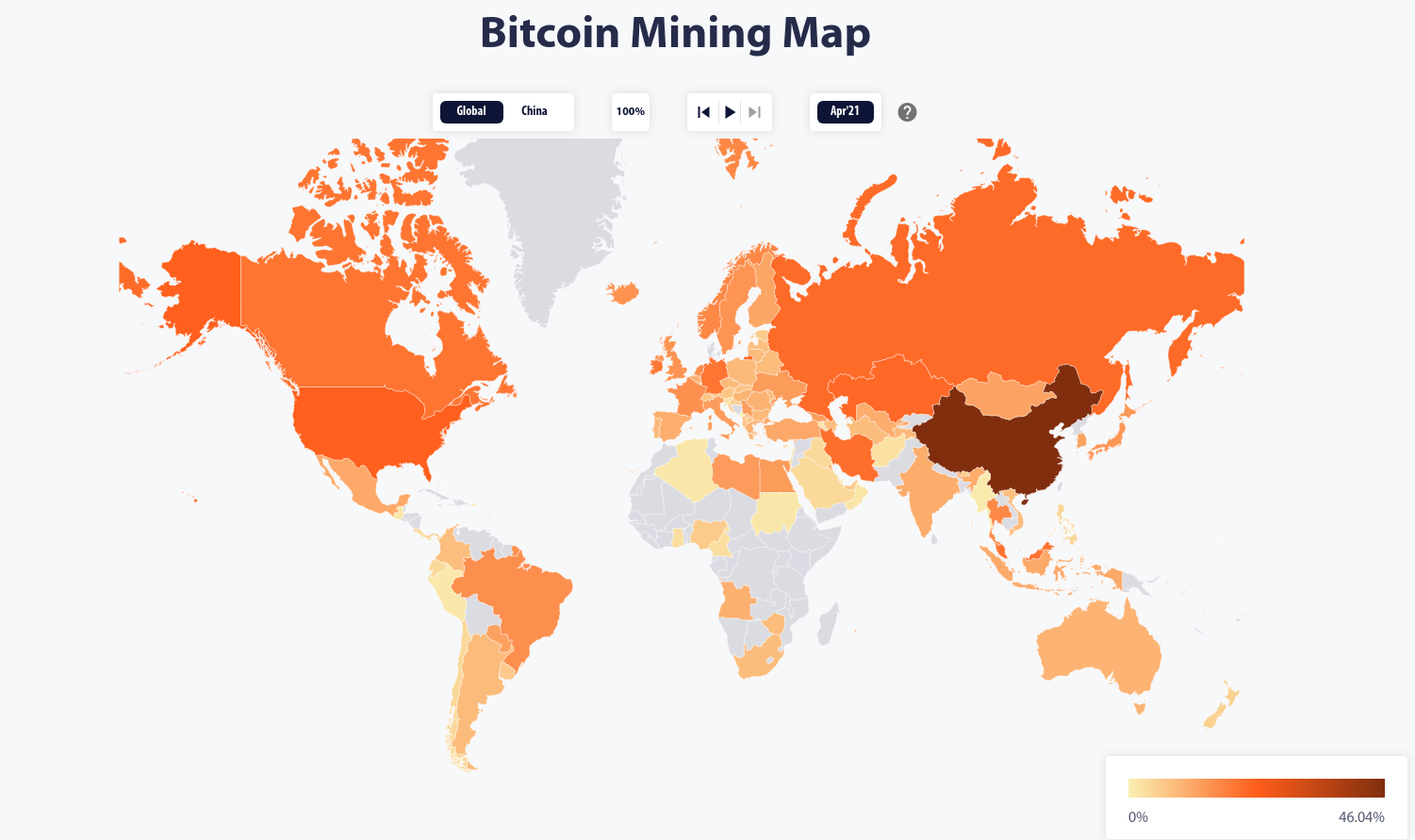

While such attacks can happen to smaller and less stable altcoin networks, cryptocurrencies as gargantuan as Bitcoin consistently boast high hashrates. However, there have been instances in the past where fears were raised over a single country accounting for a majority of Bitcoin’s hashrate. In 2020, for instance, Coindesk reported that Chinese miners were contributing most of Bitcoin’s hashing power. China, despite its frequent crypto crackdowns, has historically served as a popular location for miners and mining farms due to the production of necessary components in Asia and access to cheap electricity.

It is important to note that, even when they are consolidated in a single geographic region, miners have a diverse range of opinions and motivations. They would not be likely to all unite against their own self interests in order to attempt to hinder a cryptocurrency like Bitcoin. This further adds to the fact that high hashrates further lower the risk of a 51% attack and generally indicate that a decentralized network is healthy.

With some countries contributing notably more hashing power than others, paying close attention to crypto news and global regulatory action can help give investors an indicator of the constantly-changing landscape. For instance, the news that China cracked down on mining in June 2021 created a period where Bitcoin’s total hashrate dropped substantially. Fortunately, the asset’s mining economy has since recovered thanks to mining difficulty adjustments and miners relocating to more crypto-friendly countries.