What is Ethereum?

If you've been checking cryptocurrency news or following the recent digital currency bull market, you've probably been hearing one word as much or even more than Bitcoin: Ethereum. Ethereum prices have been rising even more sharply than Bitcoin, there's been an attack on Ethereum Classic, and yes, Ethereum Classic vs. Ethereum (a.k.a. ETC vs. ETH) is an important distinction. With this mix of good and bad news and plenty of terms that are unfamiliar even to the world of Bitcoin, it's easy to be left asking "What is Ethereum?" and "Why should I care about it?" even before you ask "Should I invest in Ethereum?" While, as always, Invity isn't here to give financial advice, we want to fill you in on what this innovative altcoin is, the state of Ethereum in 2020, and why it might be that Ethereum is a good investment for you and for the increasingly technological world of the future.

Bitcoin vs. Ethereum

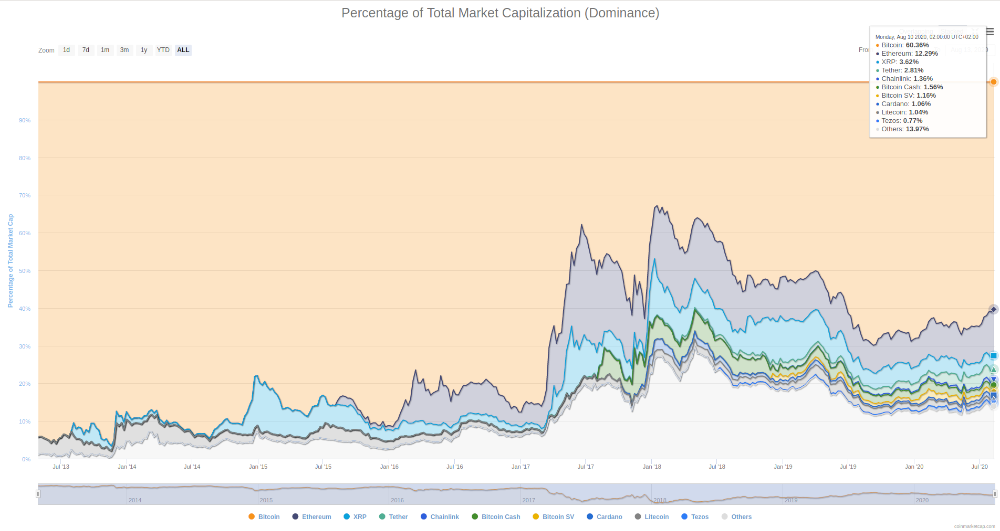

In many of the broadest ways, Ethereum is similar to Bitcoin, the crypto most users start with and know the most about. Bitcoin and Ethereum are both systems built on a blockchain, allowing users to make direct, secure transactions directly over a decentralized network. Both systems use their own tokens, bitcoin and ether, to track the flow of value and work across the system (note that "Ethereum" and "ether" are typically, though technically incorrectly, used interchangeably to refer to these tokens). Both systems' tokens can be bought with and sold for fiat currencies, or can be exchanged for other virtual currencies. Finally, these two systems dominate the digital currency markets, together accounting for nearly 75% of the value tied up in crypto markets.

It should also be noted that Bitcoin and Ethereum each have numerous spin-off, or "forked", currencies that are related to but usually worth far less than the "main" versions. It's usually safe to assume that the terms "Bitcoin" and "Ethereum" refer to the versions with the greatest value and the largest followings, but for total clarity, currencies are typically paired with their ticker symbol. For example, Bitcoin (BTC) is distinct from Bitcoin Cash (BCH), which is distinct from Bitcoin SV (BSV), and Ethereum (ETH) is distinct from Ethereum Classic (ETC). And given ETC's problems in 2020, it's probably best to stay away from it altogether.

Ethereum's edge: smart contracts explained

But digging even slightly beneath the surface reveals major divisions between the two leading cryptos—from their technical attributes all the way to their guiding philosophies. The Bitcoin blockchain and the Ethereum blockchain aren't just two entirely separate sets of records, they're written in two entirely different languages. Bitcoin's is simpler, so simple, in fact, that transactions are limited to straightforward exchanges of data from one computer to another. This is like using everyday cash: someone asks you for a certain amount of money, then you transfer that amount directly to their bank account. This is the main reason why many see Bitcoin as a potential digital replacement for dollars, euros, and the like.

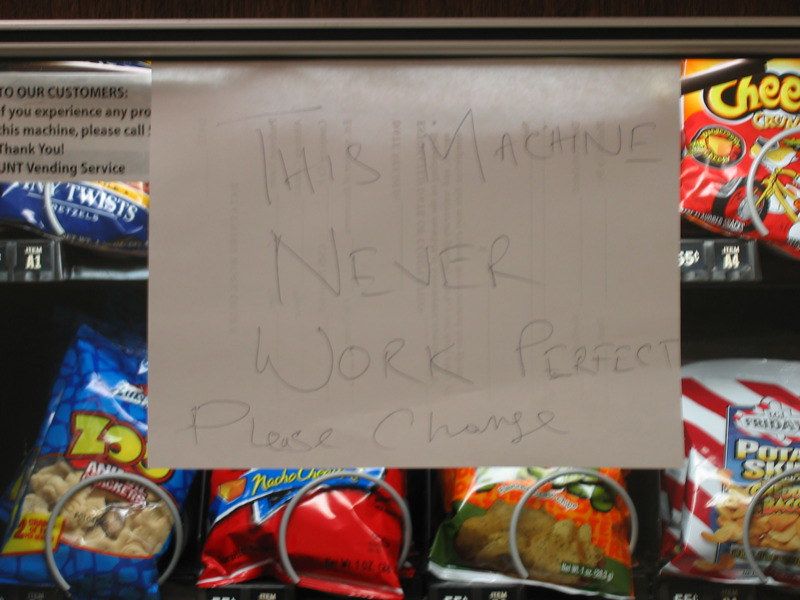

Ethereum's language, however, is much more complex (it's "Turing complete"). Basically, this type of language can be used to solve any problem. More practically, this language makes certain outputs happen based on certain inputs. Nick Szabo, a computer scientist working in this area, compares this to a vending machine: if you put in a certain number of coins (verified by a scanner), and if you then punch in the right code (verified by the machine's circuit board), then the machine will give you the soda you want.

The same principle can be used for more complex sets of inputs and outputs; take car insurance, for example. If you sign a contract and if you pay your premium and if you get into a qualifying accident, the insurance company will pay you a certain amount of money. However, this contract still requires a lot of third party verification to work properly: to sign a contract you need government identification like a Social Security number, to pay the premium you need a bank, and to know if your accident qualifies you need a claims adjuster and/or a police report. Then there's also the risk—on both sides—of dishonesty: a driver may be using a stolen identity, or the adjuster may say a dent wasn't caused by your accident and refuse to pay.

Ethereum, its complex language, and its very nature as a blockchain system all aim to make these types of interactions automatic and secure, reducing or eliminating both the need for third-party verification and the risk of fraud. Inventively, these are called "smart contracts". Real-world examples of smart contracts include a travel insurance program through an insurance giant, governing informal and for-profit organizations, voting in elections, and many more possibilities. Plus, since the Ethereum blockchain features a unified but flexible set of rules ("ERC-20") for working within its environment, developers can make their own tokens to carry out the contracts they want. All of these features have enabled the emergence (and rapid growth) of an entire online financial system known as "decentralized finance", or "DeFi".

Next-level smart contracts: decentralized applications

Remember how we said that Turing-complete languages can solve any problem? Well, if you stack enough different smart contracts on top of one another, eventually you'll be able to give an output for any input—meaning you've made a computer, albeit a virtual, highly secure one rather than one made out of silicon chips. This multiplies the possibilities of Ethereum: more than just creating one-off insurance contracts or mortgages, users can run full-fledged, secure programs on the Ethereum blockchain. Known as decentralized applications, or "dapps", these range from games to wagering platforms and more besides.

Issues with Ethereum: scalability, delays

So far this article may have painted an overly rosy picture of the world's second-place cryptocurrency. But as with anything, there are problems Ethereum still needs to work out. Perhaps the most urgent is easing congestion on the network, which has led to increased transaction times, technological demands, and transaction costs. Not helping the situation are constant delays from developers working on "Ethereum 2.0", a set of features intended to stabilize the ecosystem. It remains to be seen whether the network can be scaled up in a useful and timely way.

Still, when all is said and done, dapps and smart contracts in Ethereum mean that this system is good at solving problems Bitcoin can't; conversely, Bitcoin is better at things Ethereum isn't suited for. In other words, if someone who describes themselves as a "Bitcoin maximalist" is tearing down Ethereum, often they're comparing apples to oranges. Even if neither is perfect, the world of Ethereum shows a lot of promise for the future—and people are beginning to take notice. That's why you should keep it in mind the next time you invest in crypto—and with Invity, you can buy crypto instantly, including Ethereum.

Cover photo: Ethereum by QuoteCatalog, licensed under CC BY 2.0.