Cryptocurrency Terms to Know for Beginners

Like most specialized fields, the crypto community has its own unique way of speaking. This can make talking about Bitcoin and altcoins especially difficult given that crypto uses a mix of technological jargon, finance-speak, and internet slang. But just as you don't have to be a techie to invest in crypto, navigating crypto terminology shouldn't be a barrier either. That's why Invity is here to help you ease into the world of Bitcoin and altcoins with our alphabetical glossary of common crypto terms, where each entry is defined as simply as possible. You'll soon be able to tell your wallet from your white paper, meaning you should be more confident than ever to get started buying or exchanging crypto!

Still haven't found the term you're looking for? Find even more in our Cryptocurrency Terms to Know for Intermediate Users!

address

A crypto address is similar to a postal address or an email address: it's where you'll receive your crypto when you buy or receive some as part of a trade, and another person's address is where you'll send your crypto if you're spending or trading crypto.

However, your address isn't where your funds "live"—your funds are part of the record made by the blockchain. Since the blockchain is publicly searchable, you should use as many addresses as possible and change your address for each transaction you make. This makes your funds difficult to track and is part of what keeps the crypto system and your money safe—so never reuse an address! Luckily, you can have as many addresses as you like. Your address is always the only information you need to share with another person if you're making a transaction.

More at Public Keys, Private Keys, and Key Safety and What is Blockchain Technology?

altcoin

Bitcoin was the first and is still the leading cryptocurrency; any digital currency that isn't Bitcoin is considered an altcoin (from alternative + Bitcoin). Some of the leading altcoins are Ether (ETH), Litecoin (LTC), and Monero (XMR), though there are thousands of altcoins in existence. Some altcoins are made to fill a very specific niche, some hope simply to compete with other coins, and still others are made specifically to be jokes or scams. Always do your research when investing in any coin!

blockchain

Blockchain is a form of distributed ledger technology (DLT), which is a public, decentralized method of keeping records of transactions between users. Traditional bookkeeping systems like banks rely on private central databases that track amounts and transactions; these are slow to use, vulnerable to cyber crime (like hacking), and prone to mistakes (like double spending). Blockchain technology avoids these problems by sharing the full cryptographically secured chronological record of each and every transaction between thousands of computers around the world, which "agree" that each transaction is valid (and therefore irreversible). It's this high level of security that makes blockchain-based technologies valuable, and thus gives each "coin" its value.

Each cryptocurrency has its own blockchain or blockchain-like system that records all the transactions of that type of currency. So if you want to know where you can "find", say, the Litecoin that you own, you would say it's "on the blockchain".

More at What is Blockchain Technology?

Bitcoin vs. bitcoin

Bitcoin—capitalized—refers to the concept of the digital currency known as Bitcoin; the capitalized version can also refer to the entire network that makes up this specific currency. The lowercase version—bitcoin—refers to "tokens", the units that actually hold value and are traded on the Bitcoin network. A bitcoin can be divided down to eight decimal points (0.00000000), or down to one "satoshi".

BTC

Each currency, digital or otherwise, has an abbreviation or ticker symbol associated with it. BTC is the currency abbreviation used when talking about bitcoins, like USD for US dollars or EUR for euros.

BTC is also used to refer to the original Bitcoin network; this differentiates it from competitors with similar names, like Bitcoin Cash (BCH) and Bitcoin SV (BSV).

consensus

Consensus is how decentralized networks like blockchain agree to add certain information to the network. One person on the network asks to add to the blockchain's record of transactions by generating a string of numbers and letters known as a hash. Other computers on the network then work on solving puzzles to make sure the hash meets certain requirements. Once another computer solves the puzzle and confirms that the original hash is acceptable, the network confirms—reaches consensus—that the transaction is valid, and it's permanently recorded on the blockchain. Proof of work and proof of stake are the most common consensus algorithms.

More at How Blockchains Decide: A Guide to Crypto and Consensus

cryptocurrency

Cryptocurrency is a form of money that is not issued by any government or central bank. Instead, crypto only exists on and is supported by a user-owned, decentralized global computer network that records every transaction and encodes (cryptography is the art of writing or solving codes) it in a blockchain. This unique system makes transactions highly secure and ungoverned by borders. Cryptocurrencies usually also have specific uses like providing anonymity when dealing with your funds or allowing you to automate your spending when certain conditions are met. The secure nature of these currencies, their various specialized uses, and the support of users give digital currencies their value in relation to other currencies like dollars.

The terms cryptocurrency, crypto, digital currency, and virtual currency can all be used interchangeably. Bitcoin is often used as a shorthand for digital currency, though Bitcoin is only the most common and most well known of this type of money.

fiat currency

Fiat currency, fiat money, or sometimes used interchangeably with sovereign money, is money issued by a government and supported by that government. In other words, fiat currencies (like US dollars, euros, or yen) are not useful or valuable in and of themselves (like gold, silver, or cattle), they only have value because a government, its central bank, and the people living under that government agree that they do and take steps to maintain those values. The relatively centralized and unaccountable structures that control the value and flow of fiat currencies make them highly vulnerable to mismanagement, resulting in problems like inflation and deflation.

hash rate

Hash rate is how many mathematical guesses per second a crypto mining machine can make. The more guesses a machine can make, the more likely it is to be the one that solves the puzzle that confirms a crypto transaction. Faster hash rates don't make transactions faster since the difficulty of the puzzles adjusts over time, but faster rates do make mining more attractive and potentially more profitable.

hodl

Originally a typo of the word "hold", hodl has become a word of advice or even a state of mind for those who prefer to resist spending their coins no matter how crypto markets are behaving. "Hodlers" see cryptocurrencies as investments.

More at Crypto Day Trading vs. HODL Explained: Flow, Strategies, Terms

mining

Mining is both how crypto transactions are confirmed and how new bitcoins and other coins are created. Computers, usually specially designed "mining rigs" with high hash rates, perform large numbers of mathematical operations per second in a competition to confirm a code generated by a block of transactions. The first computer to correctly confirm the code signals to the rest of the network that the transactions are acceptable and is compensated for its effort in new bitcoins (a "block reward").

peer-to-peer

Peer-to-peer (P2P) is a way of creating a decentralized network; in other words, each participant ("peer" or "node") can interact directly with any or all of the other participants. Peers can share work, resources, or information without a central choke point, reducing or eliminating risks such as censorship. This is a key concept in how blockchains, cryptocurrencies, and DeFi are organized, and users can even buy cryptocurrencies on peer-to-peer exchanges. Peer-to-peer concepts also appear to varying extents in applications like file-sharing, social networks, and the sharing economy.

private key

A private key is a long code unique to each wallet that makes sure a user is the only one spending their crypto; it's kind of like the signature on a check. The private key uses complex math to generate a unique public key and therefore each address. Luckily, this process is so complex that reverse engineering a private key from an address is prohibitively time consuming and expensive. Most users won't deal with their private key directly; instead, a seed phrase, which holds the same information as the private key, is provided when you set up your wallet.

Since your private key is the literal key to your funds, there's a saying among crypto users: not your key, not your coins. This means always owning your own private key, never revealing your key to anyone, and always keeping your key (and/or your seed phrase) in a safe place that's not connected to the internet.

More at Public Keys, Private Keys, and Key Safety

public key

Like a private key, a public key is a long code unique to each wallet; you can think of it as your bank account number. This code is encrypted (hashed) and shortened to create the addresses you use when making transactions. The double layer of public on top of private keys is part of what makes crypto networks so secure.

More at Public Keys, Private Keys, and Key Safety

Satoshi Nakamoto

Satoshi Nakamoto is the name given to the mysterious person or group of people who wrote a paper laying out the technology behind a new digital currency in 2008 and then created Bitcoin in 2009. The true identity of this person or group is unknown, leading to years of speculation, and so Satoshi has become something between a myth and a mascot for the crypto community.

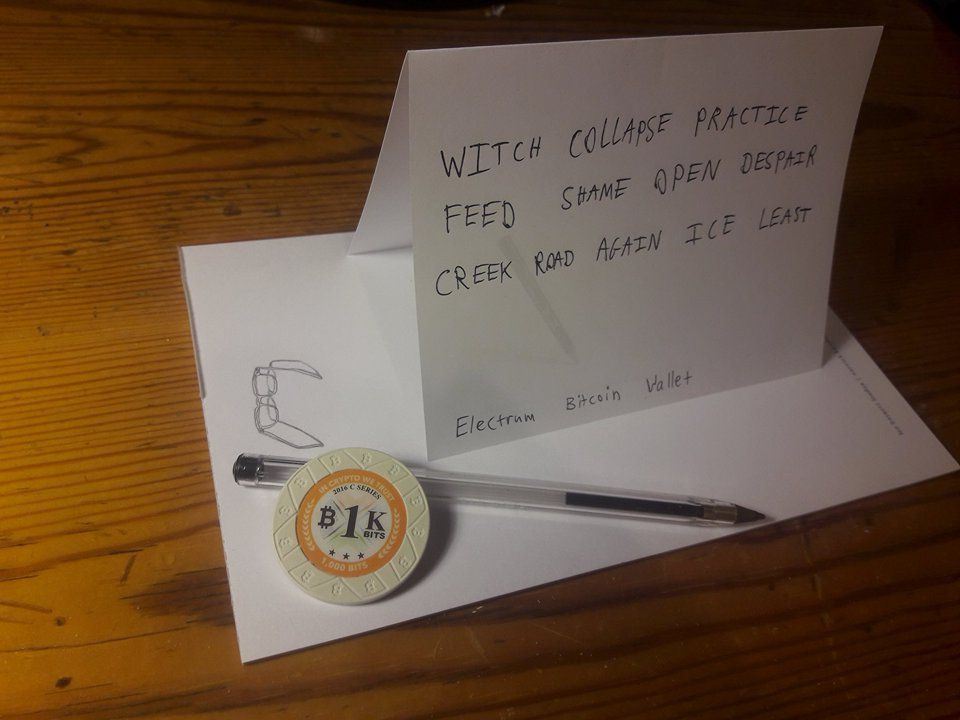

seed phrase

A seed phrase, recovery seed, or mnemonic seed is a string of between 12 and 24 random English words in a specific order. This phrase is related to your private key and so can be used to access your wallet and your funds; the idea is that words are easier to remember and input correctly. Like your private key, you should never reveal your seed phrase to anyone, and you should keep it in a safe place disconnected from the internet.

More at Seeds of Security: Introduction to Recovery Seed Phrases

shitcoin

Shitcoins are altcoins that have become worthless over time or were never able to generate much interest or value in the first place. Some crypto users who call themselves "Bitcoin maximalists" believe that Bitcoin is the only worthwhile cryptocurrency and thus all altcoins are shitcoins.

stablecoin

Stablecoins are cryptocurrencies whose values are permanently connected to the values of assets outside of the crypto space, typically commodities or fiat currencies. Tying themselves to "real" assets intends to provide many of the benefits of digital currencies while reducing the volatility of crypto assets; whether this is actually successful is debatable. Examples of stablecoins include Tether (USDT) and Facebook's Libra.

wallet

Crypto wallets are unlike wallets you keep in your pocket in that they do not store your coins; your coins exist only on the blockchain. Instead, crypto wallets protect your keys, facilitate sending and receiving coins, and allow you to check your current balances.

There are four main types of wallets, listed in order from least to most safe: online, mobile, desktop, and hardware. These can also be classified as "hot wallets" (those connected to the internet; online and most mobile) and "cold wallets" (those not connected to the internet or only intermittently so; many desktop and all hardware wallets). We strongly recommend using a hardware wallet for maximum security, though there are some good hot wallets.

More at What's the Best Bitcoin Wallet? (and How Does One Work?): Crypto Wallets Explained

whitepaper

A white paper describes the technical and business details of a particular coin. It should tell you what makes the coin unique and why it should succeed, and so this should be one of the first documents you read thoroughly before investing in a coin.

Cover photo: Definition of blog by Doug Belshaw, licensed under CC BY 2.0.