How Blockchains Decide: A Guide to Crypto and Consensus

Most cryptocurrencies aim to be decentralized in an attempt to empower users rather than authorities like governments or big banks. In fact, many proponents argue that decentralization is a key feature of the entire crypto movement. But without having someone in charge, how do decisions get made in the networks that allow digital assets to function? And how can bad actors be prevented from taking advantage of a complex system that no one person owns? The answer lies in the various consensus mechanisms that cryptocurrencies use.

This guide will explain what "consensus" refers to in terms of cryptocurrencies, and is part of Invity’s ongoing effort to make important crypto terms accessible to everyone.

What is consensus in the crypto world?

If you were the boss of a company and wanted to order pizza for the office’s lunch, there would be very little to stop you from doing so—you're the boss, after all. On the other hand, if you were hanging out with four friends and one wanted to order pizza and another wanted to order burgers, how would you reach an agreement? Since you all presumably have equal say, there is room for disagreement and opposing arguments. But at the end of the day, you need to find a way to reach a decision or everyone will go hungry.

At their most basic level, consensus protocols or mechanisms are just ways to reach an agreement among people who are on a mostly level playing field. When it comes to cryptocurrencies, this usually means reaching a conclusion based on inputs from different people with different opinions.

As another example, we can examine how decisions are made in a country like the United States. In this context, democracy functions by having the public vote on which officials to elect. Then, these officials are supposed to represent the interests of their voters when discussing and voting on bills.

In the crypto world, consensus mechanisms serve as governance models that aim to allow everyone to have their say. The fate of Bitcoin, for instance, is not controlled by a boss barking orders. Rather, it is in the hands of a decentralized network of users who represent both their own interests and the interests of the broader cryptocurrency movement.

Why do cryptocurrencies need consensus mechanisms?

Setting the rules of the system

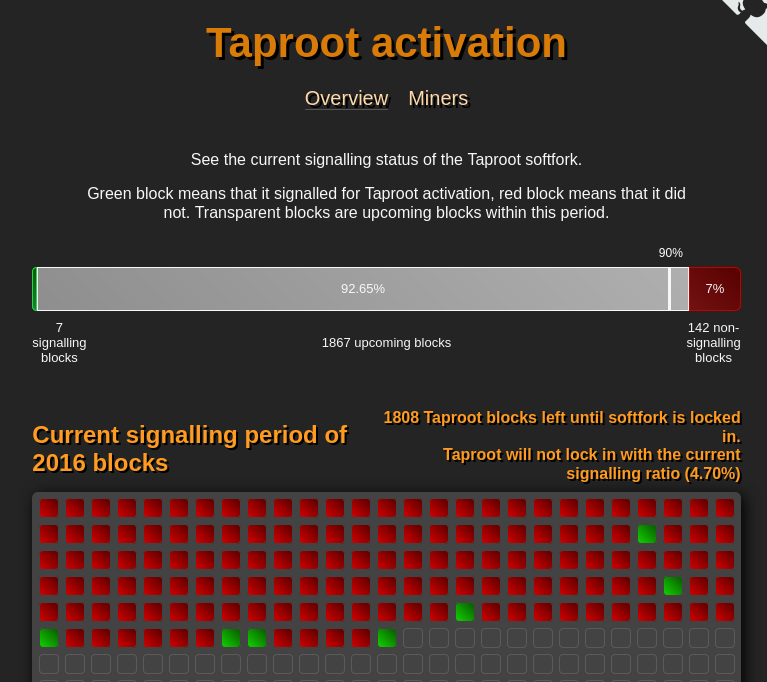

Since they are still a new technology relative to other systems, cryptocurrencies are constantly evolving and proponents of cryptocurrencies are constantly attempting to address the major challenges they encounter as these digital assets grow and change. For Bitcoin in particular, these challenges include high transaction fees and energy costs. In 2021, for instance, Bitcoin miners approved the digital asset’s first technical upgrade in four years, called Taproot. As CNBC reported, this upgrade addresses these challenges and improves the efficiency and privacy of Bitcoin transactions. It also makes smart contracts more affordable and enables them to take up less space on the blockchain.

But as a decentralized technology, updating Bitcoin is not as easy as it would be for a bank to simply update its website. After all, changes to Bitcoin’s core implementation require the broader Bitcoin community—made up of diverse users with diverse values and interests—to agree. Going back to the democracy allegory, bills first need to be voted on before they become law. Changes to Bitcoin's code work in much the same way.

Making sure transactions follow the rules

But reaching an agreement among different parts of Bitcoin's distributed network isn't just necessary to make changes to Bitcoin's infrastructure: agreement is required to make Bitcoin transactions themselves. From the original white paper, which first described Bitcoin back in 2008:

[Participants] vote with their CPU power, expressing their acceptance of valid blocks by working on extending them and rejecting invalid blocks by refusing to work on them. Any needed rules and incentives can be enforced with this consensus mechanism.

In this quote, Satoshi Nakamoto, the anonymous figure(s) who first conceptualized Bitcoin highlighted why consensus mechanisms are so important: they allow decentralized networks to verify the integrity of transactions.

When you spend money from your debit card, your bank works as an authority that is able to confirm that you have the amount that you are trying to spend. It then tells the merchant this information on your behalf. With a decentralized currency, the network doesn't have a central authority and needs a way to prevent fraud and other malicious acts that would make a financial network untrustworthy or completely nonfunctional.

Consensus mechanisms are a way to maintain the legitimacy of decentralized systems without a single authority. The network’s participants, referred to as nodes, either vouch for or shoot down each transaction after making sure that it follows the rules of the network. This often includes making sure that participants are authorized to spend the amount of money they claim to have. This process is constantly happening as the result of complex cryptographic problems being cracked by “miners”, typically without the need for direct input from the users themselves.

When the majority of nodes agree that a transaction is legitimate, it is permanently recorded to a public ledger that contains a complete directory of all previous transactions—the blockchain. If the transaction doesn't follow the rules, no majority will be formed and it will be denied. Through this process, the network is able to prevent malicious actors from attempting to trick the system without relying on a central authority.

It's also important to note how decentralization serves as a way of keeping the consensus process honest. For instance, it's theoretically possible to approve an illegitimate transaction by convincing a majority of nodes to approve it. This would require one person or a very small handful of people to own over 50% of all the computers that approve transactions; this is called a 51% attack. However, the more nodes there are spread throughout the world, the more unlikely it becomes that any one entity can control such a significant percentage of a network. This is a major reason why the Bitcoin community is so focused on creating a worldwide presence with high rates of direct participation from users. Conversely, it's also why both upstart coins without a broad network of support and government-issued central bank digital currencies (CBDCs) are often viewed with distrust.

What are the most popular ways for cryptocurrencies to reach consensus?

Two of the most popular consensus mechanisms at the current point in time are Proof of Work (PoW) and Proof of Stake (PoS). However, other cryptocurrencies make use of variations of these protocols such as Delegated PoW and Delegated PoS, or alternatives such as Proof of Activity and Proof of Capacity.

In another guide, we compared the major differences between these consensus protocols. It is important to note that major cryptocurrencies like Bitcoin and Litecoin currently use Proof of Work. Notably, Ethereum transitioned to Proof of Stake in 2022.

Proof of Work is considered to be highly democratized, as virtually anyone can dedicate their computer’s resources to a process known as mining. These miners then have to agree or disagree on changes and transactions in order to reach consensus. However, PoW is often the subject of criticism due to its high energy requirements and the fact that transaction speeds slow down and become more expensive when a lot of people participate.

When it comes to the specific consensus mechanism that cryptocurrencies use, many have their own distinct approach or have developed their own process. Regardless, each mechanism is simply a different way to make sense of the vast opinions and desires of people who do not follow orders from a central authority. Consensus introduces democracy to digital money and ultimately ensures that the fate of cryptocurrencies like Bitcoin remain in the hands of the users themselves.