Mining Crypto: The Engine of Blockchains

Arriving as a central feature of Bitcoin as proposed in 2008, "mining" is the process that currently allows most cryptocurrency transactions to become part of the blockchain while the whole network stays decentralized. For some, mining also serves as a way of making money in the crypto landscape, while others view it as their duty as network participants. Regardless, it's an important term for both crypto traders and new users to understand.

As part of our ongoing series exploring important terms in the crypto world, this article tackles the difficult question of "What is crypto mining?" while also offering insight into why it's important and the benefits it offers. And of course, we aim to do this all in plain English.

Why "mine" crypto?

In the world today, financial institutions are given significant control over the spending activities of their users. For instance, they can prevent you from spending your own money on certain products or on entire platforms, and they are free to charge high fees for even basic services like transfers and withdrawals. Worse still, those without the ability to create bank accounts are largely locked out of access to essential services, whether that's online shopping, building up a credit score, getting a loan, or receiving money from their overseas family. These factors are consequences of the fact that traditional financial platforms rely on centralized authorities—mainly banks—to track and vouch for the legitimacy of all transactions.

It would be easy enough to try to empower a broad base of users rather than a small handful of institutions by creating a decentralized system. However, such systems inevitably encounter one long-standing issue: the Byzantine Generals Problem. Despite the strange name, this term refers to a rather simple but very useful analogy that helps us make sense of a core issue that decentralized networks face—or faced, prior to the invention of cryptocurrency mining.

Briefly, the Byzantine Generals Problem asks you to imagine that an allied group of generals must coordinate a plan of action in order to reach a uniform decision that guarantees the best outcome for the whole group. However, some of these generals may intentionally or unintentionally provide incorrect information to the others. The existence of conflicting information places all participants at threat of being divided in their approach and failing as a consequence.

In a decentralized financial system, the Byzantine Generals Problem means that some network participants could give false information in order to disrupt the integrity of the network and approve illegitimate transactions. The most benign result of illegitimate transactions being approved would be discrepancies between one set of records and another, while a more sinister outcome would be rampant fraud. In other words, to have a fully legitimate system, there needs to be a way of achieving consensus even if the accuracy of the information provided by some participants cannot be trusted.

The Bitcoin white paper presented a solution to this issue in the form of Proof of Work and mining. In this system, each miner assumes that every other miner (or general, per the analogy) could potentially give false information and therefore cannot be trusted. This is why Bitcoin and several other blockchain projects are often praised as being “trustless”. They remove trust from the equation entirely by replacing it with information that can be proven and checked countless times by mathematical algorithms.

This solution to the Byzantine Generals Problem presents the largest benefit of cryptocurrency mining: it allows the network to rely on neither a central authority nor naïve trust in other participants in order to operate safely and transparently.

How does cryptocurrency mining work?

Essentially, crypto mining is just a way to A.) access the computer resources necessary for the purpose of helping a decentralized network determine which transactions are legitimate and B.) incentivize users to continue loaning their computer’s resources so the network remains functional.

When someone attempts to send a transaction, volunteers known as "miners" allow the network to piggyback on the computational resources of their device in order to conduct a series of processes. The first of these processes is taking attempted transactions sent at a similar time and bundling them into blocks. These blocks then await being added to the blockchain, at which point the transactions they contain will become official and the recipients will receive their funds.

Before the block can be added to the blockchain, the network needs a way of knowing which blocks are duplicates, incorrect, or intentionally fraudulent. The solution employed by Proof of Work (PoW) cryptocurrencies like Bitcoin is to have each miner race to determine the answer to a complex mathematical equation. Since the answer to this equation is extremely complex and cannot be reverse engineered, the only way to crack the code and therefore verify the block is for a computer to continuously generate long strings of characters until one of them is correct.

This large-scale guessing game then rewards the owner of the first device to generate the correct hexadecimal number. As their prize, they are given the block reward plus the transaction fees contained within the block they helped approve. By incentivizing participation through financial rewards, the still-anonymous inventor of Bitcoin found a way to ensure that networks based on blockchain technology and mining are always operational without having to rely on people volunteering purely out of the kindness of their heart.

What are mining farms?

Computers are able to generate guesses at the fastest rate that their resources allow. This means that state-of-the-art devices can make more guesses in a shorter amount of time, giving them a higher chance of being the first to verify a block and receive its reward. Your computer’s ability to generate a certain amount of guesses per second is known as a hash rate.

This means that crypto mining is a combination of luck and the computational resources that are available to a miner. Since we know that having more computing power at your hands increases your odds of receiving a payout, sticking many devices together takes things a step further by creating a huge advantage over individual computers.

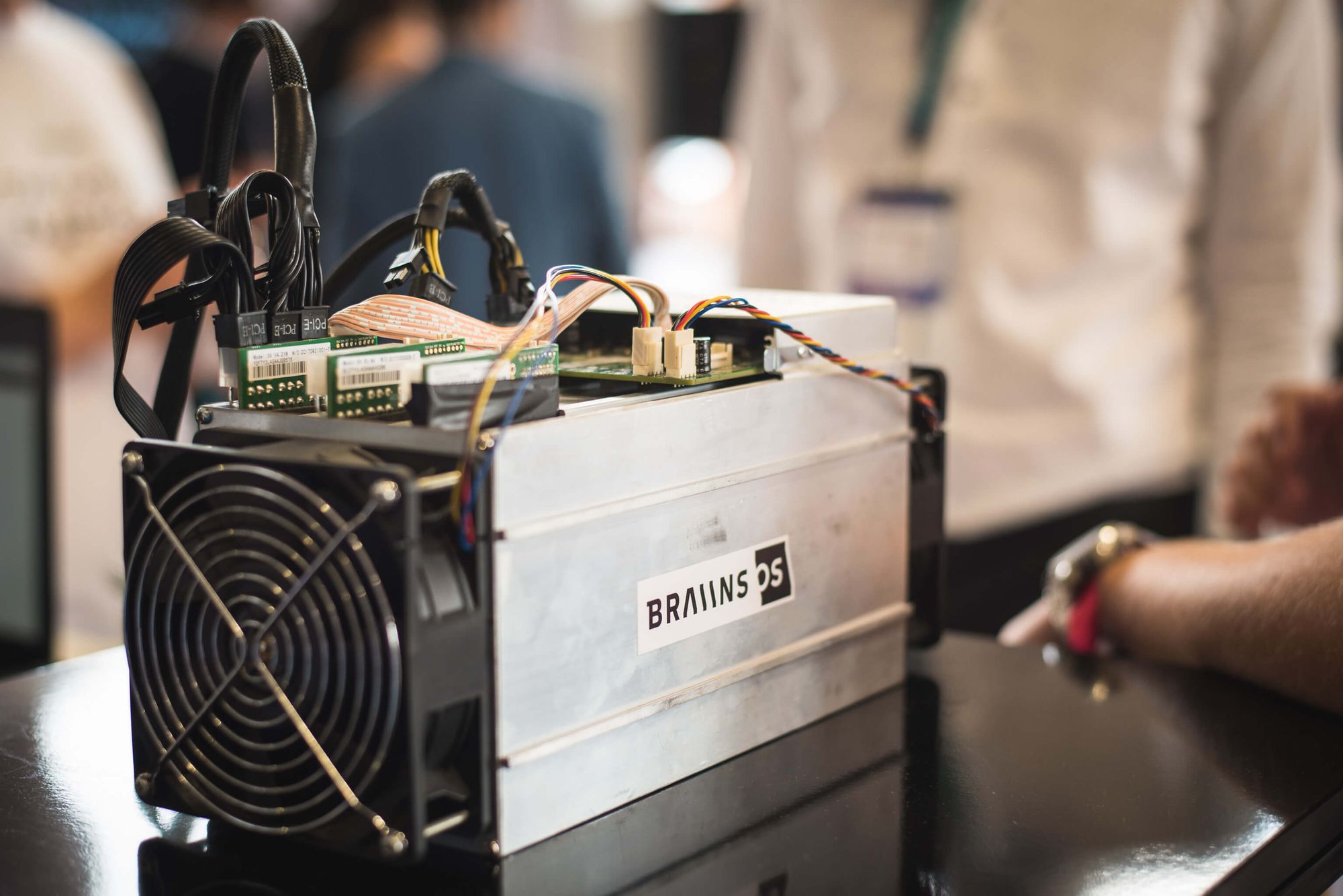

Places where many devices are simultaneously mining crypto are known as mining farms. Usually, companies create mining farms by sticking together devices made specifically to mine bitcoin and other crypto—known as "mining rigs".

The caveat here is that, in order for a mining farm to be profitable, the amount that it is likely to earn in a day needs to be higher than the amount of money it spends on electricity to power all of its devices. Since Proof of Work mining uses a substantial amount of energy, this means that companies usually launch mining farms in places where they can access cheap electricity. Many also are increasingly relying on lower-cost renewable energy sources or are mining crypto with energy that would otherwise go to waste, such as from hydroelectric dams.

What are mining pools?

A "mining pool" is a collection of users who pool their resources together in order to increase their overall chances of being the first to verify a block and receive a payout. If successful, the mining pool then divvies up the reward among users in the pool.

Different mining pools have different approaches to splitting the rewards between participants. Generally, your share is based on the amount of computing power that you are contributing to the pool.

While ordinary users may not have the resources available to them to earn a living mining at the current point in time when factoring in their energy costs, pools can serve as a way for everyday users to dip their toes into mining crypto. For some, this is a way to earn a little extra cash on the side, while for others it's a way to feel even more as if they're playing a part in a brand-new, decentralized financial revolution.

What are the downsides of crypto mining?

The largest downside to crypto mining is that the process is extremely resource exhaustive. With devices all over the world constantly generating solutions in an attempt to receive a block reward, digital currencies like Bitcoin have earned a reputation for being major consumers of energy.

However, scaling solutions could improve the energy efficiency of cryptocurrencies in the near future. In addition, the increasing use of green energy when mining would bring down crypto’s carbon footprint. Already, scaling solutions like the lightning network are improving the efficiency of Bitcoin transactions, and several mining farms are making use of renewable energy sources.

Overall, cryptocurrency mining is the way that Bitcoin, and subsequently other digital currencies, escaped issues that had long made the idea of a decentralized currency seem unworkable. While some proponents are looking to solutions that may escape the need for mining altogether and reduce crypto's energy consumption, mining currently stands at the epicenter of the decentralized landscape.