Crypto Transaction Fees: How Much it Costs to Send Bitcoin

As with other financial services, there's a cost associated with sending crypto from one person to another. The difference is that cryptocurrency transaction fees are not a way to make intermediaries rich but instead serve as a way to maintain the network and encourage widespread participation. A quirk of these fees, however, is that as the cost of maintaining the network fluctuates, so do the fees associated with sending crypto transactions. This means you may notice the cost of sending Bitcoin from one person to another rise or fall during different periods of time.

This article is another in our ongoing guide to crypto terms that everyone should know. In plain English, we'll cover how the price of transaction fees are set, what it means for you as a user, and how crypto transaction fees stack up against those in traditional financial systems.

What are crypto transaction fees?

When we’re talking about cryptocurrencies, a transaction fee (often abbreviated as "tx") is really just the amount of money it takes to successfully send digital assets from one crypto wallet to another. Fees are necessary because they compensate for the technological cost of sending transactions and incentivize other users to play an active role in keeping the network decentralized.

Different digital currencies have their own solutions to transaction fees, but Bitcoin’s fees are most commonly referenced throughout the industry. When you send a Bitcoin transaction from your public key—the digital address where your crypto is held—to someone else’s, you’re essentially just recording a set of information in a ledger anyone can read. This information includes relevant data about the transaction such as the recipient, sender, time, and amount. It's stored in a block as it waits to be added to the blockchain.

However, the recipient won't receive the amount you intend to send them until this information is proven accurate by the Bitcoin network and the latest block is added to the chain. Since Bitcoin is decentralized, there's no central authority that can simply step in and approve the transaction. That job is left to the users themselves, who contribute computing resources to checking that each block of transactions is accurate and then update the rest of the network. The volunteers who validate the integrity of blocks are known as miners.

Here, transaction fees are paid to the miner who validates a block first. This serves as a way to encourage miners to continue to donate their computing resources and to continue competing to validate the integrity of each block. This way, transactions can continue to be added to the blockchain and recipients can finally get the money that you intend to send them.

Why are Bitcoin’s transaction fees constantly changing?

Importantly, there's no fixed rule that determines how much a Bitcoin transaction costs to send. Similar to the Bitcoin price itself, transaction fees are essentially an matter of supply and demand: each user decides how much they want to spend and miners determine whether the proposed fee is rewarding enough. If you don't set a high enough transaction fee, it's possible no one will validate your block and the transaction will stay in a state of limbo.

But while the principle is the same, the supply and demand forces of transaction fees are distinct from those that determine the price of Bitcoin. Transaction fees aren't determined by how many bitcoins are in the world but how much computing power is available to process the number of transactions that exist at a given moment. Essentially, when not many people are trying to spend bitcoin, there's less traffic and blocks can be confirmed quickly without anyone having to spend much money.

However, when everyone is trying to trade bitcoin at once, there's too much activity for all transactions to be validated at the same time. In this scenario, the transactions with the highest fees end up being prioritized since miners understandably want to receive the largest reward they can for validating a block. This means that if you don’t set your fee high enough, you’ll be left waiting around for people to eventually make their way to your transaction, if they ever do.

As a result, people who want their transaction to be received in a reasonable time frame tend to pay higher fees on their transactions, which in turn encourages others to do the same.

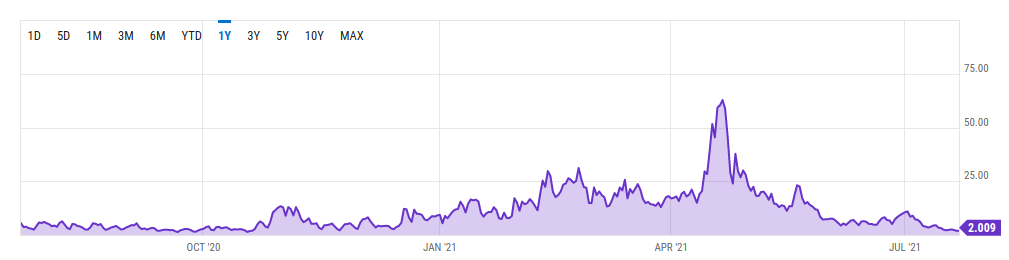

As Business Insider reported, the cost of sending a Bitcoin transaction was averaging around $37 during a peak in popularity in late 2017. According to CoinDesk, there was even a brief period of time in April 2021 where the average fee was roughly $59.

High fees during periods of high traffic are a key reason why proponents argue that new consensus mechanisms and scaling solutions are necessary for Bitcoin’s mass adoption. These developments aim to increase the network’s ability to handle higher numbers of transactions more efficiently, ideally resulting in less network congestion and fees that stay low.

It's worth noting that many cryptocurrency exchanges set the transaction fee for you based on market rates. When you buy, exchange, or sell crypto using Invity, transaction fees are included in the quotes you see in our comparison tool. If you use your cryptocurrency wallet to send fees outside of an exchange setting, say, to a friend, you can set the fee yourself. This lets you emphasize low costs or very speedy transactions or a balance of the two. As a tip, though, you should check the average transaction fee and price your transaction a little bit higher so that it's confirmed in a timely manner. If you’re not in a rush, it's still important to make sure that the fee is high enough that it doesn’t get stuck. If it does, you’ll likely have to help set it free by following some of the tricks in this Trezor guide.

What are the benefits of Bitcoin’s transaction fee model?

The main benefit of the transaction fee system employed by Bitcoin and many other cryptocurrencies is that it allows the network to stay free from a central authority.

As a point of comparison, money transfers rely on service providers to verify and process all transactions. These fees then allow the provider to do a lot more than just recoup its costs: it also profits substantially from its role as an intermediary. With Bitcoin, on the other hand, all participants in the network are equal. Other users are simply enticed to lend their resources towards verifying transactions by the fact that they could potentially earn the transaction fee as a reward for helping out. This process is called cryptocurrency mining, and it will be discussed at-length in our next guide.

Another benefit of the ways in which Bitcoin, Ethereum, and many other digital assets handle their fees is the fact that they are set at a fixed rate. If we go back to our money transfer example, most remittance service providers calculate their fees based on a percentage of the amount you're sending. In other words, it will typically cost a lot more to send someone $1,000 than $100. This also doesn't factor in similar fees if the money you are sending needs to be converted from one currency to another as it travels from point A to point B.

When it comes to remittances and non-commercial monetary transfers in particular, these percentage-based fees can be substantial, predatory, and prohibitive. Enter crypto: where your transaction will always cost the same amount regardless of how much you’re sending. For instance, the current average bitcoin transaction fee is valued at $2.63—regardless of the amount of bitcoin you’re trying to send. While that may discourage you from using BTC to buy a $3 cup of coffee, it usually works out to be a much cheaper option comparatively when you’re sending more substantial sums of money anywhere in the world. As a result, proponents praise Bitcoin as a way of facilitating cheap and efficient global remittances. Especially when combined with technological advancements that allow more people to use the Bitcoin network more efficiently, many are already taking advantage of borderless transactions with low fees in places where every penny counts, from El Salvador to underserved enclaves in highly developed countries.