Investing in crypto: What is the purpose of Bitcoin?

You've probably heard the term Bitcoin floating around the last few years—maybe in the news, on your Twitter feed, or even from your financial advisor. Perhaps you've even navigated the internet's cryptocurrency communities to fill yourself in about this relatively new development in the history of money. But you might have also found that these spaces can sometimes be dominated by know-it-alls and an obscure blend of terminology, so it's easy to be left with lingering questions. The good news is that you've found Invity, which does more than just provide the best way to buy crypto: it's also the best way to learn about cryptocurrency. We'll even help if you're starting from square one: this article will aim to answer fundamental questions like "Why is Bitcoin good? (and why is fiat money bad?)" and "Why should I invest in cryptocurrency?" so you can feel confident in yourself and your decision to get into crypto.

What is cryptocurrency? Wait, what is fiat money?

Every day, most people buy something at the market, get a bill, or add to their savings account. The common feature of all of these actions is money: the coins, bits of paper or plastic, and, increasingly, numbers on computer screens that help us make exchanges for goods and services, keep track of how much we owe, and store up value. Money has a long history with many different incarnations, but the examples you're probably envisioning, dollars, euros, pounds, are all examples of a specific type of money—fiat money, or fiat currency. The main thing to know about fiat money is that a dollar, for example, isn't worth anything on its own: it's just a piece of paper or a handful of metal. A dollar is only worth something because 1.) the US government says so, 2.) everyone else agrees. This leads everyone in the United States to work to maintain the value of a dollar as it flows from one person to another; this is most directly seen in structures like the Federal Reserve and other central banks that manage countries' money supplies.

So what's the problem with fiat money?

Buying a cup of coffee might be no problem individually, but looking at fiat money as a giant national (and international) system exposes numerous real problems. Here are just a few.

- Fiat can easily (and instantly) be destroyed or taken away. Your bank might freeze your debit card, a mugging can make your wallet disappear, or a house fire can wipe out the savings under your mattress. Worse still, entire countries, like India, can suddenly decide that some money is worth nothing—making life unlivable. Less blatantly but no less dramatically, companies can go bust and markets can crash, wiping out ordinary people's savings through no fault of their own.

- Fiat can be mismanaged. If a central bank decides that there are problems with the economy, they can decide to simply create more money out of thin air. Actions like this may be helpful at certain points (such as the 2008 and 2020 crises), but when done at the wrong time, for too long, or for the wrong reason, issues like hyperinflation can occur—with dire consequences for societal stability.

- Fiat is unaccountable. For all the faith that the 20th century has often put in the concept of democracy, the truth is that those managing the money we all use—and thus our collective ability to participate in the economy—are often not democratically accountable. At best, heads of central banks are appointed by elected officials, and at worst, top corporate bankers need only have gone to all the right schools and learned how to climb the company ladder. This sets them apart from the real consequences of economic mistakes and greed.

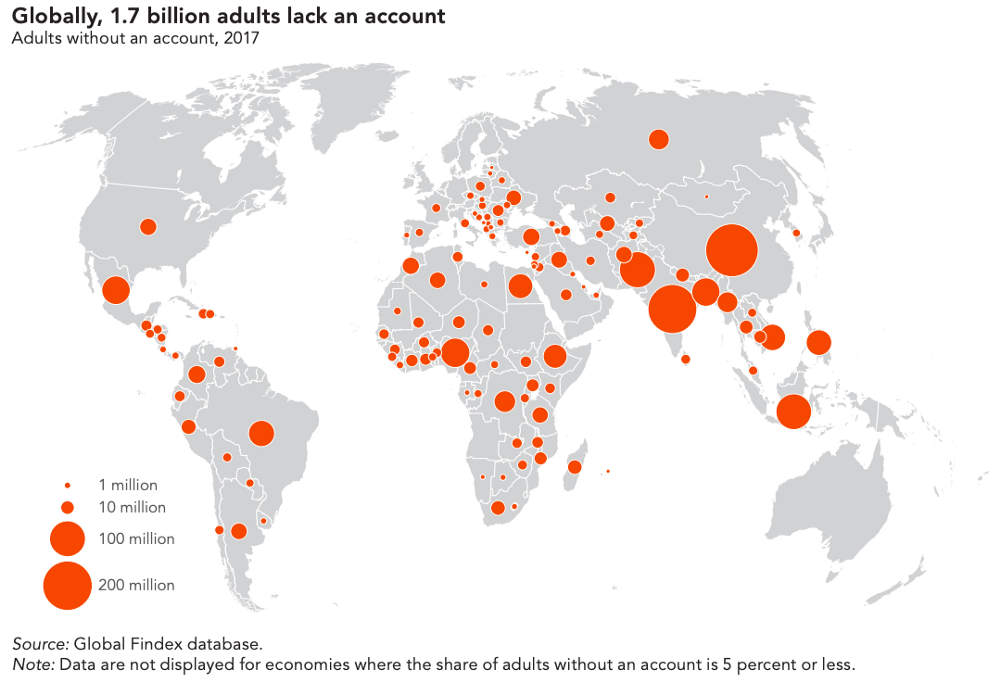

- Fiat is highly concentrated. The system of wealth creation we know today has been in place for hundreds of years, and by some accounts longer than that. While there have certainly been plenty of success stories and reversals of fortune over time, the truth is that today most wealth is highly concentrated and unequally distributed. And since wealth begets wealth, many people around the world are cut off from taking advantage of higher standards of living and economic opportunities simply because they start out poor.

So what is crypto?

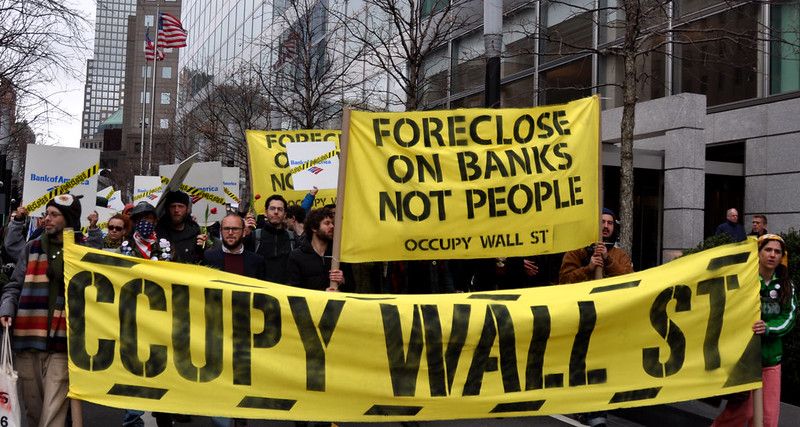

All of these problems came to the surface in 2008 in what we now know as the Great Recession. Loans and banking tools had been abused for years, governments had ignored warning signs and compensated with massive bailouts, and the poor and middle classes were financially destroyed across the world while the rich only got richer. A figure known as Satoshi Nakamoto reflected on this worldwide disgust with the existing order of things and harnessed the power of the internet to propose an alternative: a monetary system built around a digital currency that is trustworthy, transparent, and directly in the hands of the people.

- Cryptocurrencies are accountable. Digital currencies wouldn't exist without the blockchain, a complete, open, and unfalsifiable record of every transaction made and every coin created. While the exact identity of users are obscured, any user can see when coins are created and when they change hands—so there's no fudging the numbers.

- Cryptocurrencies have no manager—and so can't be mismanaged. Blockchain technology doesn't have a central bank or a chancellor of the exchequer: an identical record is distributed among countless nodes in a worldwide network. This network is fixed in the way transactions are processed and how many coins can ever exist. The result is a monetary system that operates according to rules agreed upon and overseen by its participants.

- Cryptocurrencies have intrinsic value. Unlike fiat currencies, which are worth something because everyone agrees that they are, digital currencies are made of something valuable: trust. Since blockchain transactions can't be faked and can be double-checked by anyone, a sense of permanence comes with creating and using digital currencies. And with no authorities who can freeze or seize coins, your funds are yours, period—another clear source of value.

- Cryptocurrencies are open to anyone. The minimum requirement for participating in the crypto economy is a mobile phone, a technology that is booming across the globe. This means that creating, receiving, and spending crypto can be done by anyone, even the millions with no access to traditional banks. What's more, crypto transactions can be performed across borders of all kinds, opening new markets for buyers and sellers alike, or simply making it possible to send support to parts of the world that need it. Thus crypto's potential to reduce inequality and distribute wealth more equitably on a global scale is one of its most revolutionary possibilities.

When looking at the built-in flaws of fiat currencies and how the world is only becoming more interconnected and less equal, it's clear that an alternative is needed. What's also clear is that a solution already exists: crypto doesn't just have benefits, cryptocurrencies are the future. Luckily, you've found Invity, best way to buy bitcoins and altcoins and get into the world of crypto.