Crypto FAQ: What is a bitcoin?

Cryptocurrencies are constantly making headlines these days: they form a multi-billion-dollar industry, they seem poised to shake up longstanding ways of doing business, and they're becoming more and more a part of everyday finance. But spend some time surfing around online, and one recurring question is still...what is Bitcoin? To kick off our blog series of frequently asked crypto questions, we'll tackle four basic questions that will help you feel more confident about the new world of crypto: What is Bitcoin?, What is a bitcoin? (yes, there's a difference!), How many bitcoins are there?, and Where are my bitcoins?!

What is Bitcoin?

Searching for a good answer to this simple question can really lead you down some rabbit holes. But the truth is actually pretty simple: Bitcoin is money. Like the dollars in your wallet or the euros in your paycheck, Bitcoin can be spent, earned, or saved. The end, thanks for coming to my TED Talk.

Okay, so that's not really the end: of course there's something that makes Bitcoin different from dollars, euros, pesos, dinars, or whatever. In fact, there are a number of somethings that make Bitcoin special, even revolutionary. Luckily, though, we'll still end up with a nice, neat phrase that answers our initial question pretty well.

Bitcoin is digital

One thing you probably already know about Bitcoin is that it's a digital currency. This doesn't mean that it's something that's just talked about and used online, it's actually fundamental to what Bitcoin is and does. It also means that, unlike a dollar bill, you'll never hold a bitcoin in your hand (despite what the cover photo of this blog may suggest).

If you think about it, using a digital currency really isn't a great leap from how we already spend money every day. The money in your bank account is mostly just figures on a computer screen. Most of us use debit cards to pay for things without ever trading paper or coins. And Wall Street buys and sells commodities or entire companies exclusively through computers—as fun as it is to imagine, no big sacks of cash physically change hands from second to second. So given these similarities, what makes Bitcoin as digital money different from the digital money you spend with your debit card?

The answer is who keeps track of Bitcoin and how. When you spend money using your debit card, your bank checks that what you're spending lines up with what you have in your bank account: if the bank sees you have enough, the transaction goes through; if you don't, the transaction is declined. It's essentially a giant list, or ledger, tracking incoming and outgoing amounts for every customer.

Even with lots of banks in the world—from your town credit union to Wells Fargo—their records are still relatively centralized: millions of people may rely on a single bank to accurately keep a single giant list of where money is flowing. If this list isn't accurate, whether through accident, negligence, or criminality, big problems can result. In other words, the centralized nature of the banks we rely on means there are just a few points of failure that can bring the whole system crashing down.

Instead, Bitcoin uses a record-keeping mechanism called the blockchain. Simply put, a blockchain ledger records every transaction and does so in a way that is nearly impossible to falsify and keeps thousands of copies of that same ledger around the world that can be checked for accuracy by anyone, anytime. The result of using the blockchain ("distributed ledger technology") is a decentralized banking system that keeps your money secure, keeps fraud out, and maintains a resiliency that traditional banks can't match.

Read our whole article on what blockchain technology is and our series on all the parts of a blockchain.

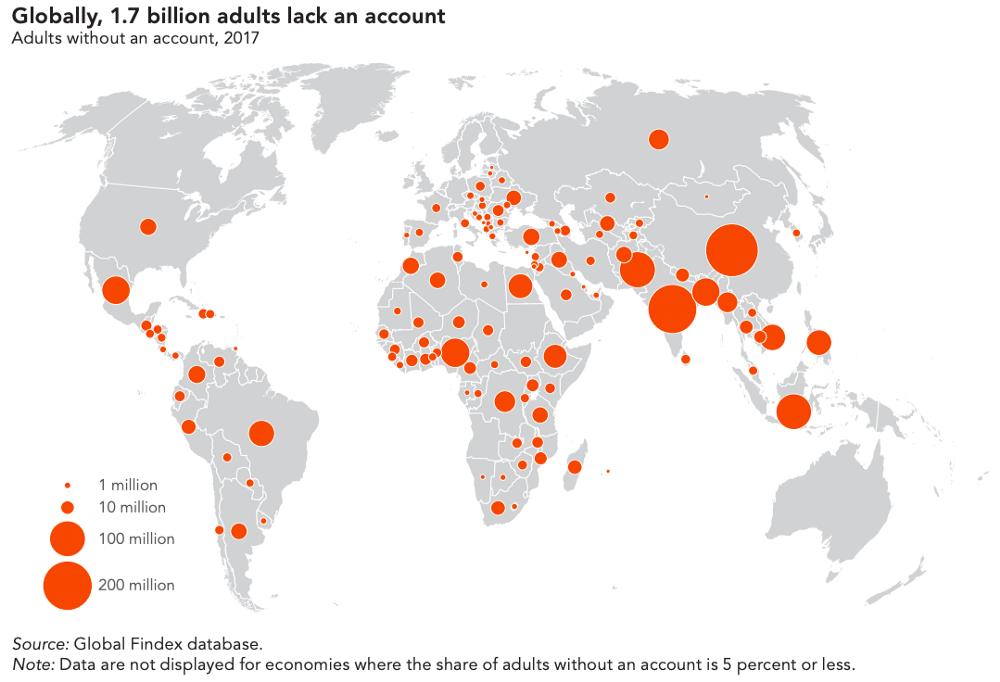

Bitcoin is global

Sure, you can send a wire transfer from your banking app, but there are still likely processing fees and wait times. This costliness is only compounded when sending money abroad, where fees can eat up a good percentage of the full amount. Even if you're sending a major world currency like US dollars, foreign recipients can lose a significant amount by exchanging the money you sent into their usable local currency. If you're sending cash that isn't a world currency to someone using a different non-world currency, there are likely to be numerous rounds of exchanges in the background just to get your money from A to B...each step of which chips away at the amount you sent. And that's all assuming that you can send money to someone at all—international sanctions can make this a tricky proposition.

Bitcoin solves the issues of borders, exchange rates, and fees. Since the blockchain is a worldwide network like the internet, it's extraordinarily hard to shut it down or really limit it much at all: money sent in Bitcoin will almost certainly get where it's going and doesn't need to jump through regulatory hoops. If you send money in Bitcoin, it will arrive in Bitcoin and will be spendable in Bitcoin, no exchanges or scam exchange rates involved. And since there's no banks in the equation, your fees will be limited only to the minimal transaction fees that support the Bitcoin network—nothing extraneous diverted to profit-seeking megacorporations.

Bitcoin is neutral

Remember how we said that banks are a centralized way of keeping track of money? Well it's possible to get even more centralized than Wells Fargo or Deutsche Bank: enter the appropriately titled central banks. Rather than overseeing bank accounts, central banks issue money and are responsible for the entire monetary policy of a given territory—two inseparable goals.

Let's break down the first part of their responsibility: central banks have a legal monopoly to issue money. It's easiest to think of this as printing banknotes or minting coins: you can't just write "1 dollar" on a piece of paper and expect your coffee shop to accept it, after all. But vitally, the money central banks create nowadays is fiat money: the value of a dollar, for example, isn't based on the amount of gold and silver the United States government owns, or some amount of cattle, or socially necessary labor time.

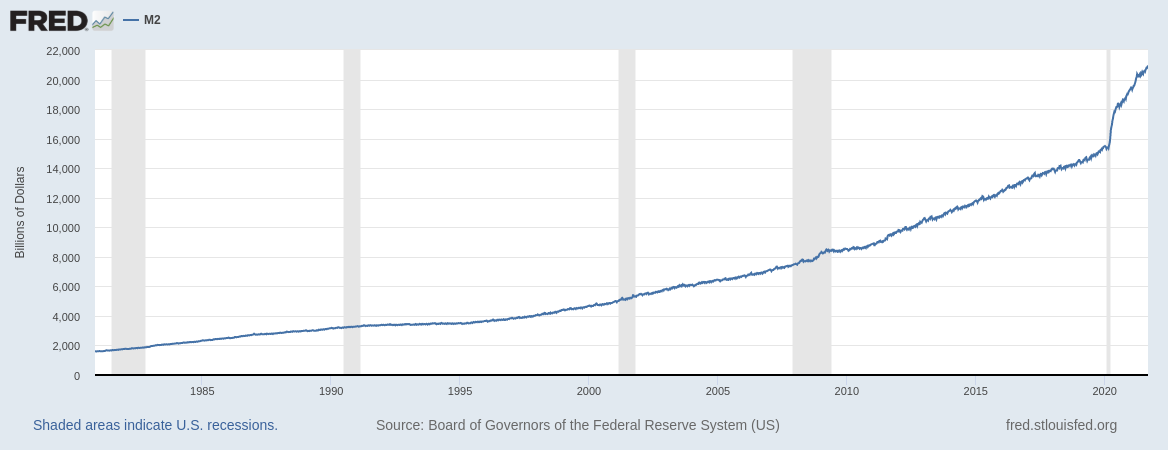

Instead, a central bank can essentially create money out of thin air, with value determined by faith that the central bank will manage it carefully. This process is indeed often closely watched by economists, and sometimes creating more money can help stave off disaster, for example COVID stimulus checks. This is the "monetary policy" half of central banks' mandates and is inherently political: "Should we create more money?" and "Who should get that money?" are answered mostly by the politicians in power during times of crisis.

Yet as more money is created, each dollar becomes worth proportionally less. This is called inflation. Most of us only see this when the price of bread goes up by a few cents or when we get a slight cost of living raise, but when this process goes wrong—like in Weimar Germany or Zimbabwe—your loaf of bread can end up with a 10-digit price tag and the whole monetary system falls apart. When even carefully managed inflation is charted over the course of decades, the danger of inflation in the "money printer go brrr" system of fiat money is apparent:

So how does Bitcoin solve inflation? Again thanks to its digital nature, Bitcoin's code ensures that bitcoins are only created at a set rate during the process of mining. No one can simply declare that there should be more Bitcoin, and the decentralized blockchain records will ensure there's no funny business. What's more, the number of new bitcoins that are created actually decreases over time, in theory making each bitcoin worth more rather than less. There's also an upper limit to how many bitcoins there will be: once all the bitcoins that can be created have been created, that's it: the digital currency that's in circulation will just continue to circulate.

So what is Bitcoin?

Bitcoin is money, yes, but the fact that it's digital, decentralized, borderless, and anti-inflationary is what makes it a very special kind of money. We can say that Bitcoin is global neutral money. But don't worry, you can still spend, earn, and save it just like dollars and cents.

What is a bitcoin?

You may have noticed throughout the sections above that sometimes our favorite topic was written as "Bitcoin" and other times as "bitcoin". While I may not be an expert editor, this (mostly) wasn't sloppiness. Instead, big-B Bitcoin refers to the whole system of the world's most popular blockchain-based digital currency. Meanwhile little-b bitcoin refers to the units that move across the Bitcoin system. A little tricky, perhaps, and not always a hard-and-fast rule, but you'll get the hang of it soon enough.

For more quirks of terminology, be sure to check out both editions of our crypto glossary: Cryptocurrency Terms to Know for Beginners and Cryptocurrency Terms to Know for Intermediate Users.

How many bitcoins are there?

A lingering question you might have is, if there's an upper limit of bitcoins that are possible, what is that limit? It's 21 million. There will only be 21 million bitcoins, full stop. Why are there only 21 million bitcoins? Well, it's based on an educated guess by the creator of Bitcoin, Satoshi Nakamoto. Agree or disagree, that number is hard-wired into the code of Bitcoin and it's not going to change. And as of this writing about 18.3 million bitcoins have been mined and are in circulation.

"But wait!" you say! "The price of Bitcoin is in the tens of thousands of dollars! How will I ever afford to buy one?!" Don't despair! Bitcoins can be divided into very small pieces. A single Bitcoin can be broken down to eight decimal places, in other words down to as small as BTC 0.00000001. This smallest unit is called a satoshi or "sat". If you want to convert your fiat money to Bitcoin today, USD 100.00 would get you about BTC 0.00198242. So who knows, one day your morning cup of coffee could cost you just a few sats.

Where are my bitcoins?

This is often a sticking point for some, but really it doesn't need to be. Since Bitcoin is a digital currency that you can't hold in your hand, it exists only as a piece of computer code that's an integral and inseparable part of the Bitcoin blockchain. You can check your balance at any time using a cryptocurrency wallet, which functions in a way like the banking app on your phone. So if you use online banking in any way, you're well on your way to understanding how to use Bitcoin.

Want a recommendation for the most secure cryptocurrency hardware wallet on the market? Check out Trezor hardware wallets, where you can also find the same Invity options you know and love!

So there you have it folks, some answers to some of the most common Bitcoin questions. We hope this helps you understand what the hype around Bitcoin is, and more importantly the really interesting and unique innovations this new type of money brings. And this article hasn't even touched on other crypto innovations like Ethereum and decentralized finance. So even if you aren't sure that crypto will change the world tomorrow, it's still a very interesting way to diversify your portfolio and Invity provides the easiest way to get started with crypto today!