Truths and myths about Satoshi Nakamoto

Whether you've spent a few minutes reading an introduction to Bitcoin or you're devoted to following all the latest crypto news, one name is certain to come up over and over: Satoshi Nakamoto. A genius to some and little more than a mascot to others, Satoshi is both key to Bitcoin's origins and a major mystery—that much everyone in the crypto industry can agree on. But what do we really know about this figure, what is speculation, and what is just plain FUD? Invity, your friend in crypto, is here with your need-to-know info about Nakamoto.

What do we know about Satoshi Nakamoto?

In one of our earliest articles more than four years ago, we defined Satoshi Nakamoto as one of the key cryptocurrency terms to know for beginners (a great refresher on the basics of Bitcoin!). Not much has changed:

Satoshi Nakamoto is the name given to the mysterious person or group of people who wrote a paper laying out the technology behind a new digital currency in 2008 and then created Bitcoin in 2009.

This alone was enough to secure fame for Satoshi, including as the name for the smallest division of a Bitcoin—one satoshi, or sat. But Satoshi's story is much more interesting than a single sentence.

The first Satoshi sighting

In late October of 2008, a research paper was circulated on the Cryptography Mailing List, a relatively niche internet community interested in "cryptographic technology and its political impact". This paper, titled Bitcoin: A Peer-to-Peer Electronic Cash System and written under the name "Satoshi Nakamoto", outlined a decentralized, open-source digital currency and would eventually become known as the Bitcoin white paper (PDF warning). Satoshi claimed to have been working on this idea for at least a few years, which is evident given its philosophical and technical depth.

In the white paper, Satoshi identified trust as the biggest problem in the age of the internet-based economy: trust that merchants are providing goods and services in good faith, trust that customers are buying and sending money with the same good intentions, and above all trust that financial institutions—including central banks in control of fiat money supplies overall—will mediate disputes fairly, accurately, and in a timely manner. The costs of basing a financial system around trusted institutions are more expensive transactions, a certain tolerance for fraud, and more uncertainty for all involved. Most of us can agree with Satoshi that uncertainty simply isn't what you want when it comes to money, especially when the internet allows business to take place more quickly and across more borders than ever before.

But Satoshi wasn't just writing with easier e-commerce in mind. In the background, the 2007-2008 financial crisis—the "global financial crisis" or GFC—was nearing its climax. Mere weeks before publishing the white paper, major banks in several countries had collapsed and required "bailouts" by governments around the world. Whether or not this saved the global economy is debatable, but the broader implications were clear: financial institutions are routinely mismanaged and unaccountable, and governments are happy to play along. The modern world demands that the average person trusts these institutions in order to survive, but these same institutions are fundamentally untrustworthy.

The solution Satoshi proposed was "an electronic payment system based on cryptographic proof instead of trust". The white paper went on to outline some of the greatest hits of Bitcoin: a blockchain built on proof-of-work computing where transactions are secured by the keys of the people who actually use the system. The result would be a "trustless" network, one where any user could check that their payments were working as promised but no individual user—even a "power user" like a too-big-to-fail bank—could change, disrupt, or censor the money system itself. This trustlessness is one of the key ways that Bitcoin derives its value.

The birth of Bitcoin

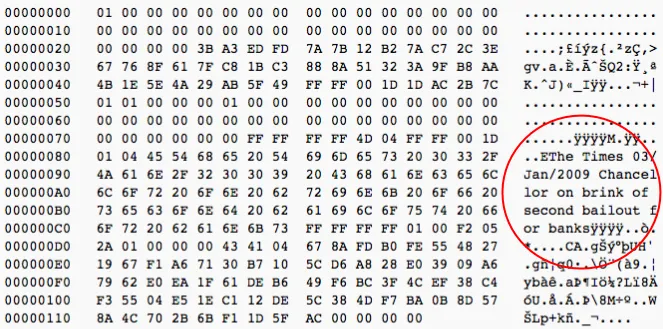

In January of 2009, Satoshi put the white paper into action by mining the first blockchain block—the "genesis block". Embedded in this block was a message, "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks", citing a headline in a British newspaper as a comment on the instability of the traditional banking system.

Satoshi continued to get Bitcoin off the ground for the next year or so. During this time, accounts belonging to Satoshi continued to communicate with Bitcoin communities, update the Bitcoin source code, and mine transactions, eventually amassing around 1.1 million Bitcoins in the original "genesis wallet" and others. This was and is more than any other single entity.

But then, Satoshi disappeared.

Okay okay, so it wasn't quite as dramatic as your average ghosting. Access to Bitcoin's code was handed over to a prominent developer, various Bitcoin-related web domains were transferred to Bitcoin true believers, and Satoshi continued responding to messages until April of 2011. But past that? Satoshi claimed to have "moved on to other things" and hasn't been heard from since. Even the million or so Bitcoins on Satoshi-linked addresses haven't moved—not even as Bitcoin prices have made the stash worth billions.

So what we can definitively say is that Satoshi was the formative figure in getting Bitcoin started and paving its way to adoption by millions today. Trying to nail down more info, however, devolves into the realm of myth.

Myth 1: We know who Satoshi is

Probably the biggest Satoshi-related myth has to do with the identity of Satoshi himself—or Satoshis themselves. A relatively early article published shortly after Satoshi went quiet detailed much of the info that could be pieced together from Bitcoin's early days, including conversations with those who had communicated with Satoshi via email. This evidence, however, is limited and often contradictory.

Satoshi's name and one online profile, for instance, seem to identify him as a middle-aged man living in Japan. Satoshi's use of English, online activity patterns, and choice of headline to include in Bitcoin's genesis block, however, seemed to point to someone living in Britain. Others claim that the quality of Bitcoin's original code was too high for one person to create alone—suggesting a team of unknown size.

As the years have gone on and the crypto industry has expanded, more sleuths have tried to crack this case. Bloggers and journalists alike have even put forward specific names: Hal Finney, Dorian Nakamoto, Nick Szabo, Gavin Andresen, and Craig Wright most frequently. Most of these theories have been disproven to varying degrees or outright denied by the subjects; in other cases such as Finney's, the suspected Satoshi has died, perhaps closing the door to definitive proof one way or another. When it comes to Craig Wright, who has positively claimed to be Nakamoto, an English court determined in 2024 that he was not Nakamoto and had repeatedly lied about the fact.

With definite proof hard to come by, other theories have cropped up over the years. Elon Musk has been floated (he denies this), as has the idea that Bitcoin is a project fueled by a secretive government agency; even space aliens have probably come up at some point along the way. The simple truth is that we don't know who Satoshi is and we may never know for sure.

Myth 2: Satoshi is gone forever

This myth is even more speculative. If Satoshi truly was someone like Hal Finney, who passed away in 2014, it may be true that Satoshi will never reappear. But under most other circumstances, there's a good chance that the original Satoshi or Satoshis might still be around; to put it another way, there's a non-zero possibility that someone with access to Satoshi's wallet is still around.

As noted earlier in this article, Satoshi's activities during the early days of Bitcoin resulted in around 1.1 million Bitcoins amassing in his genesis wallet. At today's prices, that would be worth somewhere in the neighborhood of €60 billion, yet the coins haven't moved in over a decade. But the question lingers: what if, suddenly, they did move—what if Satoshi sells?

Obviously, this is uncharted territory and much would depend on how much BTC changed hands and under what circumstances. The general consensus, though, is that if a large amount of this limited resource began to circulate freely, supply and demand would almost certainly produce a massive Bitcoin price crash. This, together with a crisis of confidence and potential regulatory issues, could shake the very foundations of the crypto industry, potentially setting it back significantly. On the other hand, Satoshi "waking up" could lead to a rebalancing of Bitcoin wealth away from whales. A third possibility? There's short-term confusion that gets back to business as usual relatively quickly.

We may not have to wait much longer to find out either: early in 2024, the genesis wallet mysteriously received around 26 additional Bitcoins. Could this be a huge mistake, an expensive marketing gimmick, or could Satoshi actually be active again? It's impossible to say at this stage. We simply don't know what it would mean if Satoshi reappeared, to say nothing of if or when it will happen at all. The only thing we can say is that any new activity by Satoshi isn't impossible and would be immediate headline news throughout the crypto space.

Myth 3: Satoshi doesn't matter to Bitcoin today

Nearly 15 years after Satoshi introduced it, Bitcoin has grown to reach new levels of acceptance and maturity as an asset class around the world. Some commentators seem to think that one person or a small original group simply can't be relevant like in Bitcoin's early days—that Satoshi is better suited to the history books and meme pages than to the growing crypto industry. But even if you ignore the potential implications of Satoshi's 1.1 million BTC becoming active again, it simply isn't true that Satoshi isn't important anymore.

The system that sprung from Bitcoin's white paper isn't just a feat of technical and financial engineering: it laid out an entirely new idea about what money should be and how it should work. Satoshi was onto something in 2008 and is still onto something today: the problems with fiat money haven't been solved, nor has the fundamental unaccountability of those who control it.

The tech-based opposition to "trusted" institutions that Satoshi inspired still guides—and divides—heated debates throughout the Bitcoin community. Like when lawyers interpret constitutions or religious leaders decode sacred texts, Bitcoiners of all stripes routinely point to Satoshi's foundations when trying to settle anything from "civil wars" about network upgrades to relations with regulators on topics like KYC. If a proven Satoshi does come back from the dead, these debates will only become more complex and contentious; even if he doesn't, his spirit is still inseparable from Bitcoin as we know it.