Crypto FAQ: What is KYC (Know Your Customer)?

As the cryptocurrency industry develops, the rules that dictate how crypto businesses interact with customers are developing alongside it. One of the key developments that we’ve seen over the past years has been the increased emphasis on know your customer (KYC) practices as a way of legitimizing the industry and excluding bad actors from taking part.

Today, as crypto opens to more mainstream investors and more newcomers want to get started with crypto, you'll likely have to meet a few KYC requirements first. Luckily, this article will serve as a simple guide to what KYC means for Bitcoin investors and what it actually entails.

What does KYC mean?

KYC stands for "know your customer" or "know your client". This is a term that encapsulates the set of practices which financial businesses are mandated to follow when allowing customers to use their services. In both traditional financial institutions like banks as well as up-and-coming companies that deal with assets like Bitcoin, KYC is a legal requirement that helps increase transparency and reduce fraud. Basically, KYC helps businesses know that they're not dealing with people or funds with illegal backgrounds. For this reason, you’ll often hear KYC used in conjunction with terms such as anti-money laundering (AML) and combating the financing of terrorism (CFT).

When it comes to the world of crypto, businesses once operated with very little in the way of rules or regulations. But as adoption has grown and legislators have identified a need to protect both the public interest and users themselves, we’ve begun to see some of the rules that were once only imposed on traditional financial platforms carry over to crypto trading platforms such as exchanges. In fact, in many parts of the world, cryptocurrency exchange platforms that do not conduct KYC may actually be behaving in violation of regulatory policy—though this ultimately depends on the specific jurisdiction’s rules.

For more on crypto around the world and regular crypto news updates, be sure to sign up to the Invity Beacon newsletter!

At its core, KYC essentially means that businesses need to know who you are before they do business with you. Whether you're opening a traditional bank account or investing in crypto, KYC usually requires users to present ID and basic personal information in order to complete transactions.

What information do I need for KYC?

From a user’s perspective, KYC is a relatively painless process.

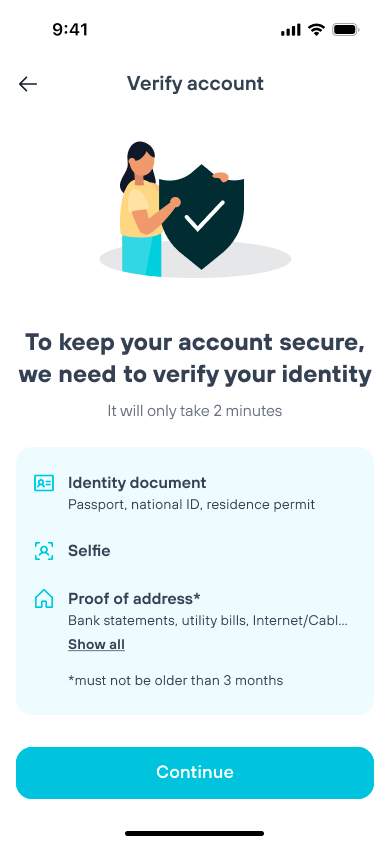

As an example, let’s pretend you’d like to buy Bitcoin with fiat—which you can learn more about how to do in our previous guide. More likely than not, you’ll end up making your purchase through a cryptocurrency exchange—for instance using the Invity mobile app, or via providers featured in Invity's comparison tool. Before you can actually convert your cash to crypto, however, it’s likely that the exchange will first ask for information that can be used to identify you.

Once again, the specifics of this process will ultimately depend on the exchange you use and where they are in the world, as not all countries have imposed KYC restrictions on cryptocurrency businesses just yet. But more than likely, you won’t be able to start buying crypto until you’ve completed the KYC process.

Users often have a handful of options when it comes to the documents that they provide. You may be asked for any combination of information and documents such as your driver’s license, passport, proof of address, full name, date of birth, and other relevant identifiers. Some may also ask you to take a quick selfie in a specific pose—this proves that you're you and not someone trying to buy crypto using stolen documents.

After you’ve submitted this information, you may need to wait for the business to manually check that the documents you’ve provided are legitimate before you can start trading. Fortunately, this entire process can take place online. This is also the case when you open up a bank account or join a platform that allows you to trade stocks. It often requires little more than some information about yourself, a picture of your ID, and a relatively short wait.

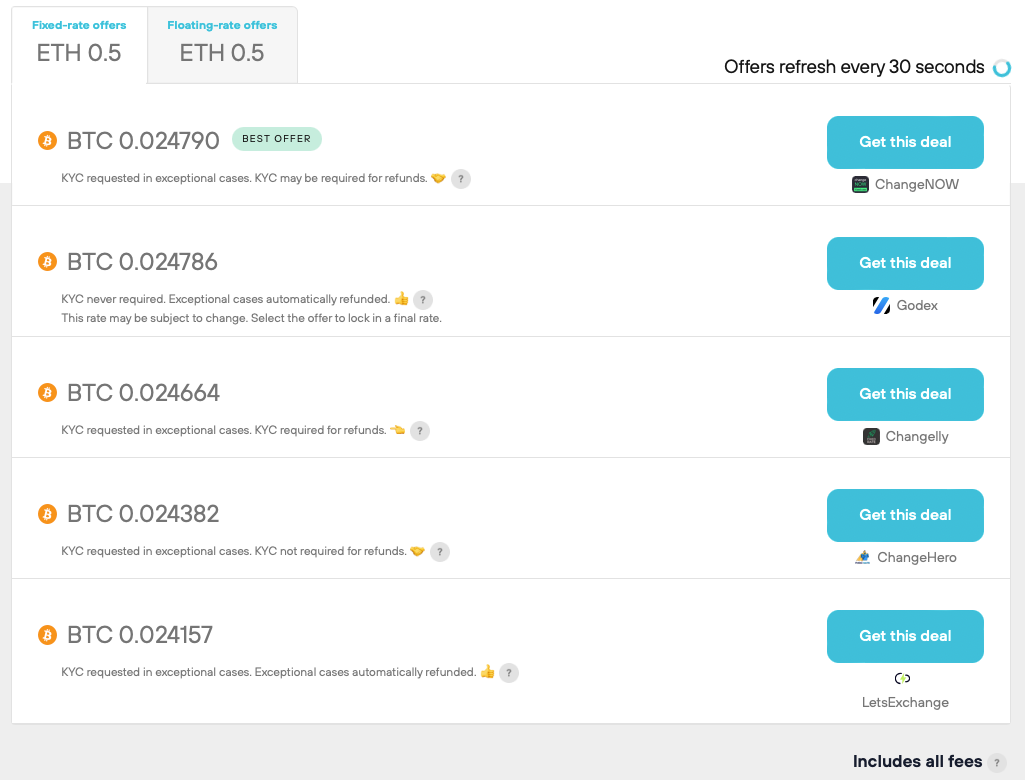

Once you've completed a provider's KYC process, though, you're usually good to go for every crypto transaction you make through that provider—it's a one-time thing. It's also good to know that KYC is mainly in play when you're buying and selling crypto: KYC isn't required for most crypto-to-crypto exchanges. Invity's comparison tool lets you know what to expect directly in the Exchange interface.

Why is KYC important?

Fundamentally, KYC procedures were established by regulators across the world in response to bad actors using blind spots in the financial system to commit crimes without detection. Its largest proponents often cite money laundering, terrorism, tax avoidance, and other criminal activity as reasons why it’s important for financial entities to know who they’re allowing to transfer large sums of money.

When it comes to the role of know your customer requirements in the cryptocurrency industry, it’s important to understand that KYC has largely emerged as a response to the industry’s popularity.

Prior to KYC producers becoming commonplace, it was much easier for people to trade fiat currencies to crypto with complete anonymity. This, in theory at least, could allow people to completely escape the eyes of regulators; there would be little to prevent these actors from engaging in criminal activity without detection. This line of thinking is at least part of the reason why crypto once had such a prevalent reputation as being a tool used only to launder money and purchase illicit substances and materials—which could not be further from the truth.

With the introduction of KYC to the world of crypto trading, some proponents believe that it actually helped clear the industry’s former stigma. In this sense, it instead gives digital assets legitimacy as they are bound by similar rules to the ones that safeguard traditional financial systems.

Is it possible to buy Bitcoin without ID?

Because the crypto industry is growing in popularity, regulations like KYC are inevitable. And thanks to KYC, crypto can still work toward establishing a self-managed worldwide system of banking and investment while keeping everyone involved safe—users, businesses, and the crypto ecosystem as a whole.

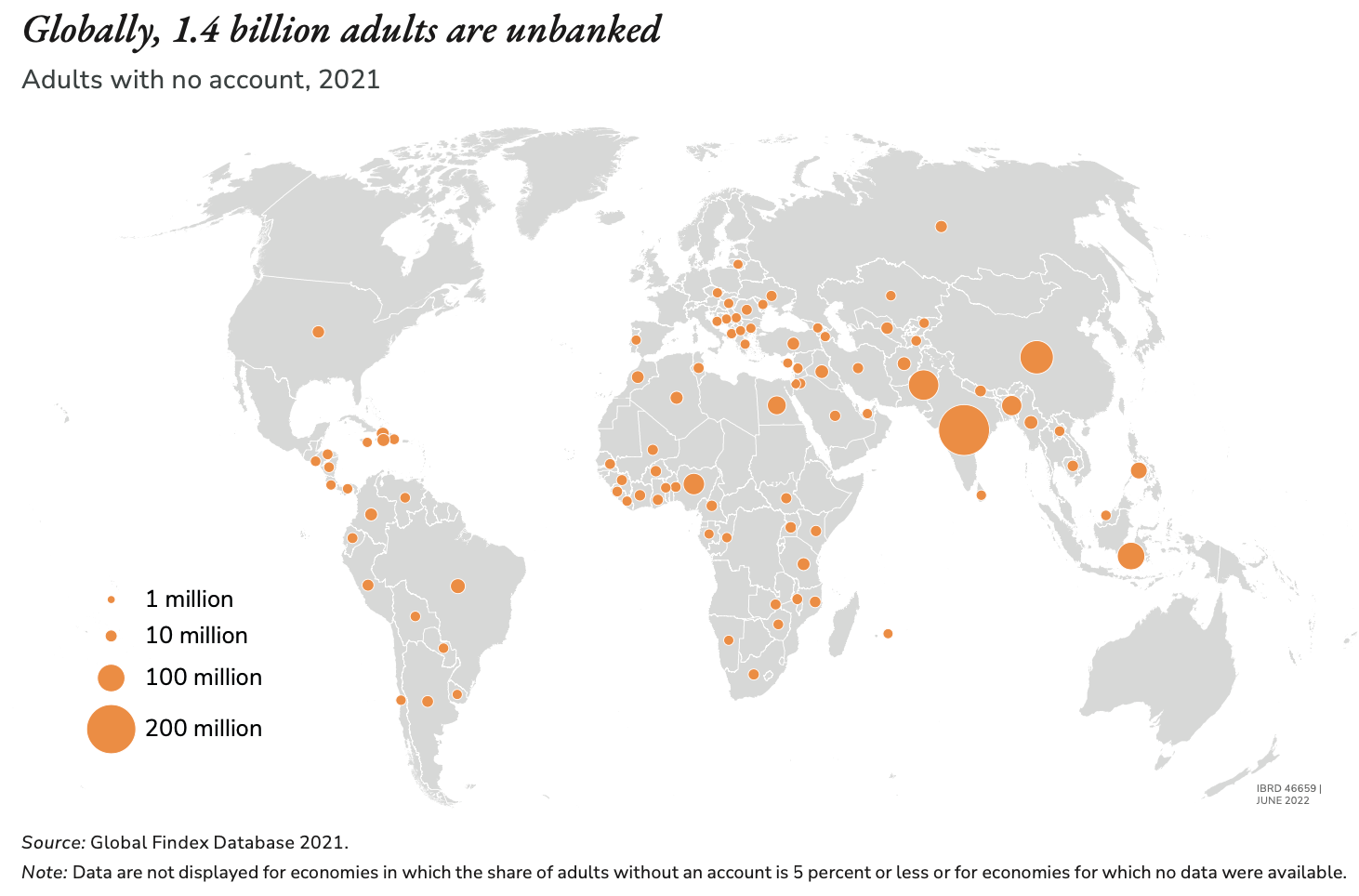

That said, there are still some legitimate reasons why some people may hesitate to provide identifying information when buying crypto. They may live in a part of the world where governments tightly observe and control who does what with their money. Or they may not have the documents required to pass KYC—this is especially common in developing areas with high unbanked populations. Or they may only have the ability to make small cash purchases of Bitcoin, making KYC-less crypto purchases a matter of convenience. For people in these situations, crypto may offer the biggest lifeline, and knowing how to buy Bitcoin without ID is vital.

KYC or no KYC is a hot topic in crypto circles and deserves an entire article of its own. Luckily our partner Trezor has written just such an article. You can browse our sister site Coinmap.org to find the nearest Bitcoin ATM, most of which do not require KYC if you're purchasing less than a certain amount. Some exchanges offer a non-KYC option when buying small amounts of crypto. Invity also enables you to buy bitcoin peer-to-peer in Trezor Suite, often avoiding KYC. For the most discreet experience, you can have a go at Vexl, brought to you by SatoshiLabs.

We hope you've enjoyed this latest article about what to know about Bitcoin, because KYC is a need-to-know crypto term. Be sure to check out the rest of Invity's blog for more crypto FAQs and other important crypto basics.

Cover photo: Money with magnifier by Jernej Furman, licensed under CC BY 2.0.