Crypto Day Trading vs. HODL Explained: Flow, Strategies, Terms

Invity.io is pleased to announce its new partnership with ChangeNOW, a fast-growing crypto exchange who shares our values of simplicity and instant accessibility to cryptocurrency services.

What is ChangeNOW?

ChangeNOW is a secure non-custodial service for instant crypto-to-crypto exchanges. It's a handy and extremely user-friendly platform available to users without registration. ChangeNOW has more than 250 coins available for exchange and does not impose any limits on transactions.

Our partnership with ChangeNOW will offer a series of educational articles suitable for all audiences, but most appropriate for individuals with traditional investment knowledge but limited technical know-how.

Our first article in this anticipated series considers several terms and stuff to know when getting started with crypto, like whether you should consider day trading or hodling strategies when it comes to investing in crypto. Please note that Invity is not offering investment advice, and all information shared is for educational purposes only.

What does HODL mean?

The term “hodl” occurred first in 2013, on the then-famous Bitcoin TalkForum. The accidental innovator of this word, known by his moniker “GameKyuubi”, strung out a frustrated post on the BitcoinTalk forum titled: “I am Hodling” after admitting to downing a bottle of “whisky”.

"WHY AM I HOLDING?” GameKyuubi wrote. “I'LL TELL YOU WHY. It's because I'm a bad trader and I KNOW I'M A BAD TRADER. Yeah you good traders can spot the highs and the lows pit pat piffy wing wong wang just like that and make a millino bucks, sure no problem bro!"

And this is how the “hodl” solution was born: a misspelling, but a refreshing term for novice traders who are tired of the grueling technicality of day trading.

Hodling is simple. When you hodl, you put your coins in your wallet and do nothing but wait. The crypto market might swing low or lower and even much lower than the position you bought it, but still you hodl. You don’t sell. You don’t sell until the market recovers and goes high enough, eclipsing even the high positions you dream of. It is only then you sell. You don’t care how long this takes: 6 months? A year? Two years? You wait.

Hodling is a relatively straightforward process that helps you avoid market timing errors as common in day trading. Hodlers can decide to buy dips and wait patiently for highs, or to buy a particular cryptocurrency according to a scheduled calendar regardless of its price at that moment. The fancier term for the latter strategy is called “dollar-cost averaging”, and it is a possible technique for hodlers who believe in the long-term progress of a particular coin.

Day trading

Day trading is quite the opposite of hodling. Positions are averaged on the short term while trading daily with crypto, as opposed to long term positions when you hodl.

In crypto day trading, 2% profits can be seen within 5 minutes of only pushing the purchase button; however, the reverse of this can also happen moments after committing to a trade. However, under most market conditions, if you can learn to capitalize on gains, you can soon outpace a hodler when it comes to returns on your investment.

How do you day trade? To trade efficiently on any desired market, you will need huge pools of supply and demand, which is exactly what crypto exchanges like ChangeNOW offer. The ChangeNOW exchange provides you the chance of either owning a particular currency or speculating using its brokering services.

There are 250+ crypto coins available on the ChangeNOW platform, providing you with hundreds of markets to begin your trade, including opportunities to trade coins like Bitcoin for lesser known coins. ChangeNOW, unlike many exchanges, requires no account creation, and offers you a liquid market to begin your trade at any time. That means you can just go to Invity's Exchange crypto tab, type in the crypto you have and the crypto you want to end up with, and select an offer from ChangeNOW.

Day trading capitalizes on the huge volatility of the crypto market and requires a good comprehension of a market’s fundamentals and technicals, as well as an awareness of the nature and moods of the cryptocurrency world. So before you begin day trading on the crypto market you should be familiar with sufficient risk management methods and common technical terms like support and resistance, bear and bull markets, and FUD. Read on for more about these common crypto trading strategies and terms.

Portfolio diversification

Portfolio diversification is the practice of the ultimate investment rule: “Never put all your eggs in one basket.” When investing in any asset, there is always a risk of its depreciation, but there are ways to reduce the risks. One of them is diversification. When you diversify your portfolio, it means you allocate different levels of investment to various assets, in this case various cryptocurrencies.

You can choose to buy and hold Bitcoin for example, while also trading Dogecoin on the short term, or going long on Cardano. On ChangeNOW, there are a variety of crypto tokens available at your disposal to create the perfect diversified platform. From common options like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Polygon (MATIC), Cardano (ADA), Stellar (XRM), and Polkadot(DOT), to newer options like Internet of Computer (ICP), Algorand (ALGO), and Kishu.

Barbell strategy

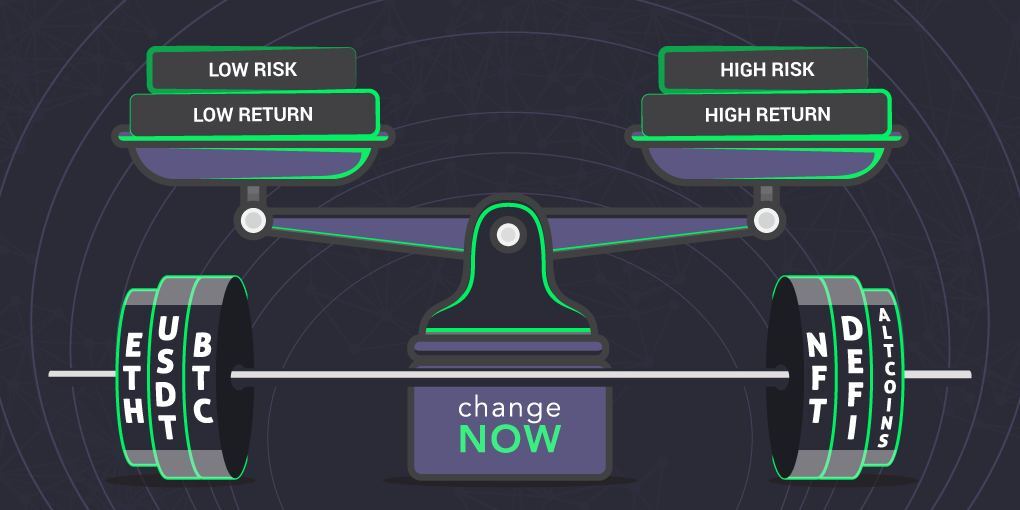

The barbell strategy is an unconventional strategy used by many investors. The barbell strategy was invented by world-renowned statistician and trader, Nassim Taleb, who specializes in unpredictability, randomness, and uncertainties—potentially making this strategy well suited to the sometimes volatile crypto markets.

His famous strategy is modeled after the barbell: common gym equipment made up of weights on each end and a bar in the center to join both.

On one side of an investing barbell, you may have investments that are high risk yet have a high payoff potential. On the other hand, there are investments with a low risk/reward potential. There are no investments in the portfolio that are categorized as “medium risk” or “average.” This means the barbell strategy is essentially a mixture of extreme high-risk investment and no-risk investment in the same portfolio while avoiding everything and anything in the middle.

The barbell strategy does a good job of shielding you against Black Swan (unpredictable, catastrophic) events, and ensures your whole portfolio is not susceptible to unlikely severe changes, yet also opens you up to benefit from more speculative assets.

Is it better to hodl or trade?

Which is the better trading method? To hodl over a long time or to accumulate gains daily till you strike it rich?

Of the two strategies, hodling is generally recommended to new crypto traders since it requires the least technical know-how and invested time. Hodling does, however, come with its own risks:

1. Traders who average at a high position in a market and with plans to hodl might have to wait a long time, even years, to take profits. This usually happens because new traders are most tempted to buy into a crypto token during a bull run.

2. When tokens finally do yield good profits, hodlers might not sell and take them. Hodlers are conditioned to hold onto their coins despite most market conditions, and might even hodl at positions where they are supposed to be selling.

Does this mean it would be safer to trade daily instead, despite its pitfalls? There is no clear answer. Successful day trading comes with knowledge and practice, and is definitely suitable for traders with adequate technical know-how and the will to risk it.

Common terms used in crypto hodling and day trading

Here are some common important terms you might come across in your foray into the crypto market, whether you're a hodler or a trader. For more terms, you can refer to our full glossary.

altcoin

An altcoin is a compound word derived from the words "alternate" and "coin," and it relates to every digital coin that is not bitcoin. If you constantly hear about a certain "altcoin" but can't discover a current value, it's probably because it doesn't exist.

Bitcoin

The most major cryptocurrency, founded by the enigmatic “Satoshi Nakamoto,” is still the one that gets all the attention and the most favor by hodlers.

bear

Someone who expects prices to fall.

bear market

A market where prices are in decline.

bull

Someone who expects prices to rise.

bull market

A market where prices are rising.

FUD

An abbreviation for "fear, uncertainty, and doubt". Often used in bitcoin forums to mock skeptics who are "spreading FUD", potentially leading to falling prices or disappointingly small rises.

dollar-cost averaging

Dollar-cost averaging ("DCA") is an investing strategy often used with volatile assets. Instead of making the most of a single large investment by trying to buy at the lowest point and sell at the highest, investors might make smaller investments of regular amounts at regular times.

While this may not result in the massive capital gains that a perfectly timed investment can make, it is a low-stress strategy that generally results in positive returns and minimizes overall risks.

support & resistance

Support is a price level that a coin price is not expected to fall below. Resistance is a price level that the coin can’t seem to rise above.

breakdown & breakout

Breakdowns and breakouts form when the support and resistance levels are violated. A breakout occurs when a resistance level is broken, while a breakdown happens when a downtrend continues well below a support level, sending the market into a panic of activities.

token

A crypto token is a denomination of a cryptocurrency. While a cryptocurrency operates independently and uses its own platform, a token is a virtual currency built on top of an existing blockchain. For example, Bitcoin is an independent cryptocurrency, while Dogecoin is an Ethereum-based token.

And for a comprehensive list of all tokens available on ChangeNOW, refer here.

Whether you're a hodler or trader, try ChangeNOW in Invity's Exchange crypto feature!