The Ultimate Guide to Safely Storing, Buying, and Trading Crypto

On the Invity blog, we have published a series of guides aimed at making the fundamentals of crypto accessible to as many people as possible. This article is the culmination of that effort, rounding up everything that people should know when getting involved with crypto into a single practical resource.

For further information or a plain-English explanation of any part of this article, check out our individual guides to important crypto terms for beginners.

Step 1 - What is crypto?

If you’re here reading this, you probably know that cryptocurrencies are essentially virtual money or assets. Behind the scenes, most cryptocurrencies use blockchain technology to enable decentralized, worldwide networks in which people can trade with one another.

Check out our plain-English guide to blocks and blockchain technology.

One of the most innovative features of the crypto industry is that it exists without people having to rely on banks and other third parties. By existing on decentralized networks, cryptocurrencies instead empower users directly—across borders, without censorship, and for the benefit of all.

Cryptocurrencies can be used as a store of value, an investment, a way to tokenize and trade products and services, as a way to enable decentralized finance applications, and a lot more. One of the most readily praised features of crypto today is that it can be used to send money to the unbanked and transfer large sums of money at a comparatively lower cost.

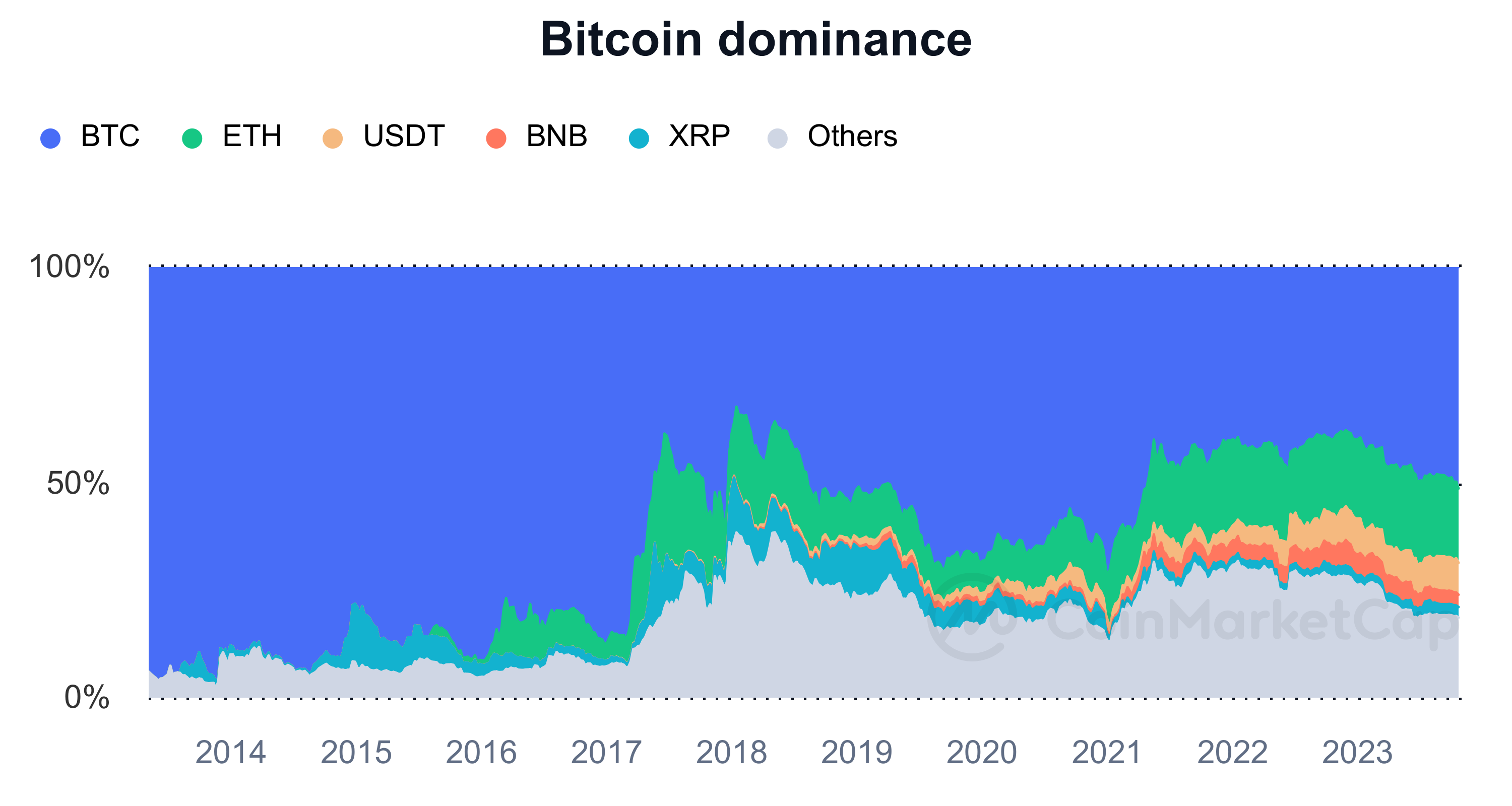

The most popular cryptocurrency in the world is Bitcoin, both in terms of its market cap and its public recognition. However, new projects and digital assets continue to gain interest and have amassed massive followings of their own. Notably, the crypto industry is not a race; there's room for many "winners" in this ever-growing decentralized landscape.

Step 2 - How do I safely buy and store crypto?

The first thing you need to do in order to actually get started with crypto is find a reputable exchange on which to make your transactions. The simplest introduction is the Invity mobile app, allowing you to buy and save bitcoin with just a few quick taps. For more experienced users, the Invity.io exchange comparison tool is a one-stop shop for every type of crypto transaction: fiat-to-crypto (Buy crypto), crypto-to-crypto (Exchange crypto), and even crypto-to-fiat (Sell crypto). Many exchanges allow you to directly purchase dozens of different digital assets directly by spending your local currency—whether that’s USD, EUR, HKD, or many other worldwide options.

Your digital assets are stored in what’s known as a cryptocurrency wallet. This wallet contains the two most important pieces of information of your crypto journey: your public key and your private key.

Check out our in-depth explanation of Public and Private Key Safety.

Your public key is like your bank account number: you can safely share it with anyone. Your private key, on the other hand, is more akin to a password: it needs to be kept private. This is because your private key is what actually grants you control of your funds. If you lose your private key, you won’t be able to access your crypto. Worse yet, if someone else knows your private key, they’ll be able to steal it.

There’s a popular saying in the crypto community: “not your keys, not your coins.” When you buy crypto from a centralized exchange, they usually store your funds for you. While this is convenient and good to get your first crypto experience, you don’t actually have access to your private key in this scenario. As a result, you’re basically relying on someone else to keep your funds safe.

That's why once you amass a notable amount of crypto, you should transfer your funds to your own hardware or software wallet as soon as possible. One of the Invity comparison tool's innovations is that it collects offers only from non-custodial exchanges, meaning this extra step isn't needed since your coins will always be sent directly to your wallet.

Hardware wallets are considered safest; they offer the ability to store cryptocurrencies offline on a physical device that works like a hard drive. Trezor, a partner of Invity, is widely regarded as the safest hardware wallet on the market by prominent outlets such as Cryptonews.com and the broader crypto community. Invity's services are conveniently accessible right in your Trezor device.

When you buy a hardware wallet, you’ll be able to generate a seed phrase that allows you to recover your funds if you ever misplace or damage your device. This too should be kept private.

Read: Seeds of Security: Introduction to Recovery Seed Phrases

Step 3 - How do I trade and spend crypto?

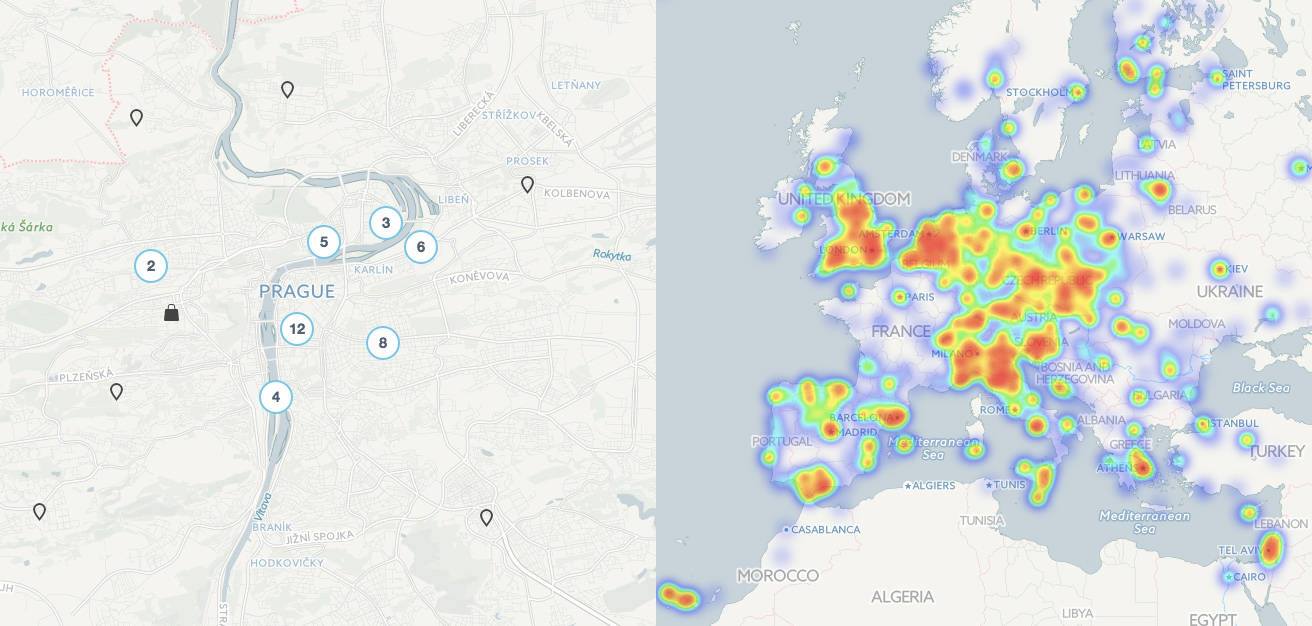

Once you’ve stored your crypto safely, you might be thinking of using it to purchase something or may want to trade a portion of your holdings. Luckily, paying for goods or services in crypto is really easy to do. In fact, there are more and more individuals and merchants who accept Bitcoin and other cryptocurrencies around the world. You can find a map of locations where you can spend your crypto (and add your own locations!) on our partner site, Coinmap.org.

Through accessing your wallet, you’ll have the option to send crypto by inputting the recipient’s wallet address and the amount you’d like to send.

Do note, however, that it's important to be careful when entering the wallet address that you’d like to trade with. Coins sent to the wrong address are extremely difficult (if not impossible) to retrieve.

Since cryptocurrencies are decentralized, a bank doesn't meddle or ensure that your funds get from point A to B. That job is left to the peer-to-peer network. But you may be wondering: how does a recipient actually end up getting their money?

The answer lies in consensus mechanisms. Check out our guide for a more complete explanation.

Consensus mechanisms are basically ways in which a decentralized system can make decisions like approving transactions. Cryptocurrencies such as Bitcoin use a mechanism known as Proof of Work. Here, thousands of computers race to guess the answer to a complex mathematical equation through a system known as cryptocurrency mining.

In this system, the first "miner" to guess the correct answer is financially compensated in the form of both a block reward and all of the transaction fees contained within the block. This means that, in order to have your transaction verified by the network, you’ll have to offer a large enough transaction fee to incentivize someone to include your transaction in a block.

Transaction fees are constantly changing in the crypto landscape, largely as a result of demand. For a full guide on how Bitcoin transaction prices are determined, check out our guide.

Step 4 - What’s next for the crypto industry?

The cryptocurrency industry is rapidly developing. It continues to grow both in terms of public interest and its underlying technology. As a result, some of the early challenges of the crypto landscape are actively being addressed.

For instance, cryptocurrencies are a lot more accessible to the everyday public than they once were. But with this rapid growth comes one of the industry’s largest challenges thus far: scaling. As Proof of Work cryptocurrencies like Bitcoin become more popular, the network tends to slow down, fees tend to increase, and energy consumption soars. In an effort to combat these issues, newer mechanisms like Proof of Stake have since emerged.

Check out our plain-English explanation of the Proof of Work vs. Proof of Stake debate.

There are also ongoing solutions that are allowing Proof of Work networks to use less energy and ensure that transaction fees are consistently affordable for day-to-day spending. One of the most popular solutions is known as the Lightning Network.

While it may feel like cryptocurrencies have been around for a while at this point, they are still a relatively new addition to our world. In fact, the first cryptocurrency, Bitcoin, was only outlined for the first time back in 2008. This means that there is significant room for exploration, adoption, and improvement. As a result, the landscape’s future ultimately rests in the hands of the public, which makes staying informed and educated about cryptocurrencies important on both an individual and societal scale.

Staying informed about the world of crypto is easier than ever: Invity is only part of a growing crypto ecosystem. Invity, Trezor, and Coinmap all publish free, informative blogs that make it simple to get started and learn more as crypto evolves.