Stablecoins: The Safe Space of Digital Currencies

Cryptocurrencies are known for their wild swings, their almost never-ending fluctuations, their pulses; it's their highs, their lows, their tendency to be volatile, and all their unstable proclivities that make them loved by speculative investors and traders. Yet despite the high volatility that cryptocurrencies have come to be synonymous with, stablecoins have managed to occupy a vacant niche, staking their claim in a significantly different place than other cryptocurrencies.

According to CoinMarketCap, stablecoins account for almost ten percent of the entire crypto market capitalization, a figure that is likely to rise in the near future. In a world filled with the excitement of speculation and bull runs and the freezing panic of bear periods, why have stablecoins won so much backing? And why are they so important?

Why stablecoins are necessary

Why are stablecoins in the crypto conversation and why are they a major feature of many investment portfolios? What exactly do they offer?

The necessity of stable crypto tokens is not far-fetched, it lies there in the open, in the underlying reason why most cryptocurrencies exist: mass adoption.

Currencies, of course, are meant to be stable: it only makes sense to buy and exchange with money that everyone generally agrees has similar value from day to day, making stability a necessary ingredient for any chance of mainstream adoption. The view shared by many crypto enthusiasts is that cryptocurrencies can only achieve mainstream adoption as a medium of exchange if their values are stable and reliable enough. Perhaps even more reliable than fiat currencies.

The irony is, of course, that the closest the crypto world has been to mainstream adoption has been driven by outrageously volatile memecoins. Despite the attention meme tokens have gathered, memecoins are not often backed to last the test of time; they are unstable, unpredictable, and often controlled by circumstances that are not in keeping with the underlying tenet of the cryptocurrency space, which is decentralization.

Stablecoins, unlike memecoins or even Bitcoin, offer a completely different proposition. They are created specifically to offer the same stability often associated with fiat money like US dollars or euros while offering the same global ease of use that cryptocurrencies do. For a crypto skeptic, a stablecoin could be the friendliest introduction to the cryptocurrency space.

So what exactly is a stablecoin?

A stablecoin is a stable cryptocurrency.

Literally. Stablecoins are designed to not fluctuate with the constantly swinging crypto market, even despite their technical similarity to some of the top cryptocurrencies in the world like Bitcoin and Ethereum.

Stable crypto tokens first entered and stirred new conversations in the latter end of 2013, when the financial world entered a new reality. To the jubilation of crypto enthusiasts, Bitcoin soared above $1000 in November 2013, and central banks around the world began to publish warnings, looking for ways to curb the “decentralized genie” that threatened the stability of the financial system. Those familiar with the predictability of traditional investment argued that something had to be created to introduce a level of reliability to the fast growing—and highly volatile—cryptocurrency ecosystem.

The solution was “stable cryptocurrencies”, an ingenious creation to help fight FUD and connect cryptocurrencies to the real world.

Why stablecoins are stable

Stablecoins are often pegged to a real-world fiat currency or another valuable asset such as the US dollar, gold, or even other cryptocurrencies like Bitcoin or Ethereum.

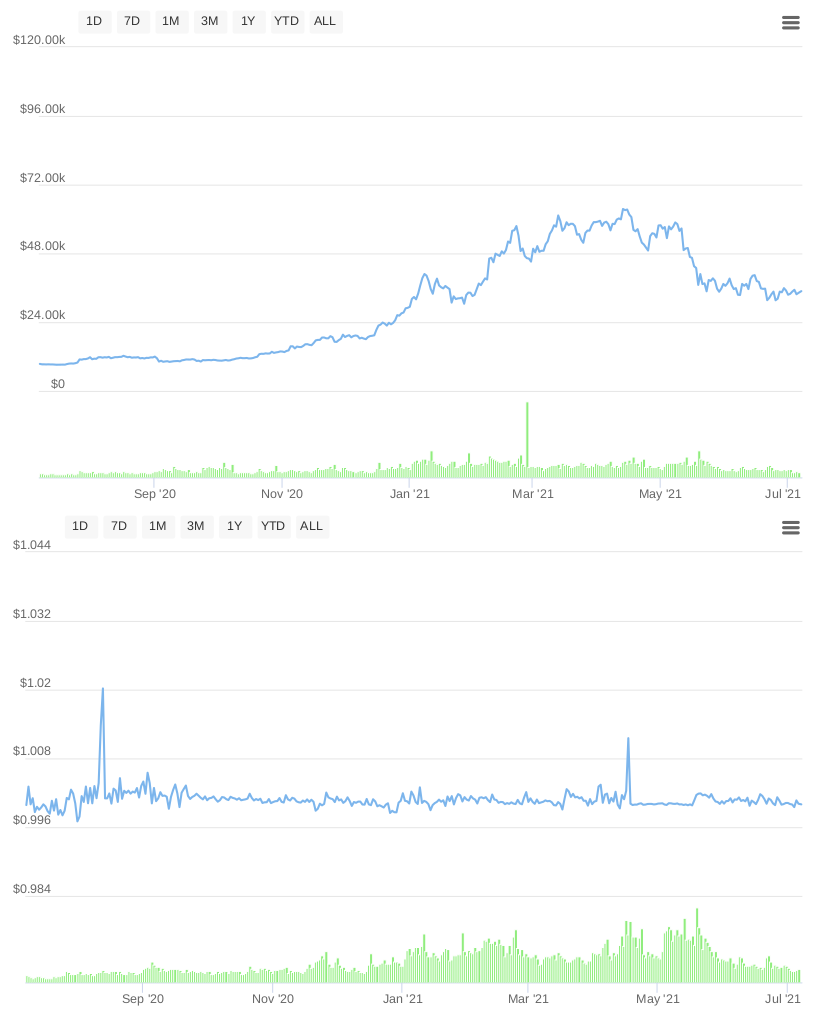

Pegged, in this sense, means the value of the stablecoin is tied at a predetermined ratio to the value of the asset that backs them; in other words, if the value of a dollar goes up, the value of a dollar-pegged stablecoin will typically go up as well. This is different from typical cryptocurrencies like Bitcoin, which are not pegged to anything; their value is instead based on the market rate people are willing to pay for them at any given time. For this reason, stablecoins are often categorized by the asset which backs them.

While most stablecoins hold the assets they are pegged to as collateral, assets are sometimes not enough to explain the unusual stability associated with many stable tokens. Technical differences also account for different stability mechanisms like specialized trading algorithms.

For example, stablecoins backed by dollars often work through a more intricate method referred to as investor arbitrage flows. Just one of the many stability methods available, this method incentivizes investors to deposit fiat USD when the price of a stablecoin rises above the predetermined fiat-to-stablecoin ratio. Stablecoins backed with crypto and tokens that are non-collateralized may employ even more complex algorithms to keep the balance of the currency in check.

What are the different types of stablecoins?

There are four main categories of stablecoins.

Fiat-backed stablecoins

The first and most common type of stablecoins are fiat-backed tokens on public crypto blockchains. A fiat-backed stablecoin is often pegged at 1:1 to a stable fiat currency like the US dollar. Fiat stablecoins are easier to understand relative to other types of stablecoins.

In a typical fiat-backed scenario, issuers of stablecoins declare their backing in real dollars, in a bank account or a package of government bonds in a 1:1 ratio. This is to say, 1 token almost always costs 1 dollar, and its price rarely deviates by more than tenths of a percent.

The most popular of the existing stablecoins—Tether (USDT)—began in 2014, and at the beginning of 2021 its capitalization exceeded $25 billion. Like the vast majority of stablecoins pegged to fiat currencies, USDT is denominated in US dollars. Users of fiat-backed stablecoins hardly think about their actual backing, as their usability is familiar. Their price stability is supported almost without the use of market or technical methods; like using dollars in day-to day transactions, USDT relies on faith that the US dollar will maintain its value.

Commodity-backed stablecoins

Stablecoins can be backed by other familiar assets too. Commodity-backed stablecoins offer an even more interesting alternative that helps investors diversify their holdings. There are many different commodities that can be used to support these types of stablecoins, especially precious metals such as gold, silver, and even palladium, though gold remains the most popular. This is not a surprise given that gold has been a store of value for millenia and many already have some amount of gold in their traditional portfolio.

A precious metal backed stablecoin that uses gold as a peg leverages the novel strengths of digital assets and the safety of a metal proven over the years. In other words, commodity-backed stablecoin tokens simply represent gold and are easier to exchange. Commodity-backed stablecoins work by taking a certain set amount of commodity to create base prices. With Tether Gold (XAUT), for example, 1 ounce of physical gold equals 1,000 XAUT.

What is even more illuminating is that gold can be fractionated through the use of stablecoins, meaning that more people can actively invest as they do not need to buy whole ounces of gold. They can buy any amount of stablecoins they want: it's all backed by gold.

Crypto-collateralized stablecoins

Crypto-collateralized stablecoins are backed by other digital currencies like Bitcoin or Ethereum.

A crypto-backed stablecoin runs on top of a public blockchain backed by its underlying cryptocurrency—for example, ETH. When redeeming tokens, the user receives ETH back into their wallet.

But to compensate for the volatility of the underlying crypto, the stablecoin is actually over-backed. In other words, tokens do not correspond 1:1 with the underlying asset like in many fiat-backed coins. For example, the equivalent of $1,000 in ETH can be requested to issue the equivalent of 500 dollars of stablecoins. Even if ETH loses 30% of its value, the stablecoin remains covered.

Thus, with the help of price regulation algorithms, a stable crypto asset is created without the participation of fiat currencies and the traditional financial system. Unlike USDT and other fiat-backed tokens, crypto-backed stablecoins are decentralized and are not subject to a single issuer and regulators.

Popular examples of crypto-backed stablecoins are MakerDAO’s DAI and Havven.

Non-collateralized stablecoins

Non-collateralized stablecoins are also called “algorithmic” stablecoins. In this case, the stablecoin is supported only by its value through a smart contract.

The security in the form of ETH is locked in a smart contract and a crypto asset is launched on this basis. Price stability is achieved by a method called collateral debt position (CDP) mechanism. Put simply, if the total demand for the stablecoin increases or decreases, the contract is automatically expected to adjust the number of coins in circulation to keep the price stable.

Algorithmic stablecoins have become quite popular in recent years and a good example is the Defi Dollar (DUSD).

Government and bank stablecoins

Central banks immediately perceived cryptocurrencies as a potential threat to the stability of traditional financial systems and have issued warnings and detracting statements about the possible dangers of the rising crypto industry almost since day one.

Yet after several years of observing the cryptocurrency market, the central banks of many countries realized that cryptocurrencies were indeed inevitable, and a central bank issued stablecoin seemed to be the most logical way forward to preserve their entrenched power while capitalizing on some benefits of crypto.

Central bank digital currencies (CBDC) are very close to ordinary non-cash money. They are digital currencies but ones firmly controlled and regulated by the national central bank issuing them, and are, unlike other stablecoins, centralized. To many, however, the fact that these tokens are government-issued and subject to central governance are two major violations of the very concept behind cryptocurrencies.

The only government stablecoins currently in existence are Venezuela’s Petro, which was the first to be issued in 2018, and the Sand Dollar token, piloted in the Bahamas the next year. The Sand Dollar has in fact been implemented far more successfully than the Petro: it is regulated similarly to the Bahamian dollar and is accepted throughout the island nation.

Top 5 examples of stablecoins

1. Tether (USDT)

Tether is the largest stablecoin in the cryptocurrency market. Tether represents nearly 55% of the capitalization of all stablecoins, or more than $60 bn in mid-2021. Tether (USDT) is indexed 100% to the dollar, or 1 USDT = 1 dollar.

Founded in 2014, Tether is managed by Jan Ludovicus van der Velde of Tether Holdings Limited. The parent company is located in the British Virgin Islands, with a subsidiary Tether Limited based in Hong Kong, and is consequently linked to the Bitfinex exchange platform.

2. USD Coin (USDC)

USD Coin is the 8th most valuable cryptocurrency. Launched in September 2018 by Coinbase and Circle, USDC is based on the Ethereum Blockchain and is pegged to the US dollar.

This ERC-20 stablecoin is very transparent about its reserves and quantities in circulation, and is known to be regularly audited. Recently, Visa integrated USDC into its payment services in the United States, recording a major milestone for stablecoins across the world.

3. Dai (DAI)

Dai is run by a public governance organization: Maker DAO , which sets it apart from other stablecoins. The capitalization of the Dai is nearly $5 billion as of mid-2021. The presence of public governance and guarantee systems based on other cryptocurrencies makes Dai a special stablecoin, and one of the leading crypto-collateralized options available on the crypto market.

4. Tether Gold (XAUT)

In addition to USDT, Tether also offers a virtual currency pegged to the price of physical gold. As of March 31, 2021, the company held nearly 85,000 ounces of gold, valued at $136 million at the time and ensuring the same amount of tokens and ounces in reserve. Tether GOLD (XAUT) is less prevalent than USDT with a capitalization of $100 million in mid-2021. Tether GOLD reproduces very exactly the variations in the price of a physical ounce of gold.

5. True USD (TUSD)

True USD (TUSD) describes itself as the “first regulated stablecoin backed by the US dollar” and has carved a growing reputation in the cryptocurrency industry thanks to its consistent independent audits, and has more than 1.5 billion tokens in circulation.

The US dollar-backed ERC-20 stablecoin is fully fiat-collateralised and also offers legal protection against misappropriation of underlying USD.

Benefits of stablecoins to the industry

A cryptocurrency whose price is stable reassures many key players, starting with institutional investors who are mostly afraid of the risk of volatility (especially sharp declines), especially those located in countries in danger of inflation.

Investors also bet on stablecoins for a short time while waiting for crypto markets to stabilize again. Stablecoins might also be a more reasonable form of payment for retailers who are looking to receive payment in cryptocurrencies. If stablecoins prove their worth, more traders may be tempted to integrate them into their payment systems.

Traders and investors in countries where the dollar is ruled out or made illegal as a means of exchange can find USD-backed cryptocurrencies as an attractive option should they want to trade or invest in the US dollar.

Benefits of stablecoins to investors

Apart from stability and the ease of transfer that comes with stablecoins, they are also a great option to hold at high interest rates.

Unlike the high degree of unpredictability associated with most cryptocurrencies, especially memecoins, stablecoins are considered a safer bet for the future and a hedge against sharp market declines.

As discussed in this article, investors find it wiser to diversify investment portfolios with carefully chosen crypto tokens. Stablecoins not only offer an easy way to stave off a crypto bear run until it is over, it also offers investors opportunities to lend out their token for significant interest.

Loan providers like Celsius Network and Nexo operate similarly to banks by accepting USD stablecoin deposits and lending those deposits to traders for an agreed interest rate with the loan backed by crypto collateral.

As with any investment, investing in stablecoins comes with its own risks, and this article is no way investment advice. But we do hope it helps you understand even more of the many tokens available through exchanges like ChangeNOW. To improve your portfolio, you can trade or buy an array of popular stablecoins like Tether (USDT), Binance USD (BUSD), USD Coin, TUSD, Gemini Dollar, and hundreds more from ChangeNOW’s robust listing in Invity's comparison tool.

To get started with stablecoins today, try ChangeNOW in Invity's Exchange crypto feature!