Bitcoin Wealth Distribution, Part 1: Haves and Have Nots

As the Bitcoin price stays steadily high and altcoins continue to rise, there's more money than ever flowing around the crypto economy. But as you buy Bitcoin instantly via the Invity mobile app, you may be wondering just how your portfolio stacks up. It's easy enough to read about the Winklevoss twins becoming billionaires or Vitalik Buterin's net worth multiplying, but there are just as many average Joes whose cryptocurrency holdings have helped them put down payments on homes or just have a more comfortable retirement. The truth is that wealth distribution in the crypto space, while not easy to measure, is more egalitarian than in traditional markets. This adds yet another dimension to the revolutionary nature of digital currencies. In this two-part series, we're going to zoom out from "how-to" crypto topics and instead take a look at the wider economic and social aspects of Bitcoin and your favorite altcoins. By the end, we hope to show that you don't need to be a whale to see the benefits of crypto—in fact, even a little bit will go a long way in the end. But first, we need to understand the problem that crypto proposes to solve.

What we mean when we talk about wealth distribution

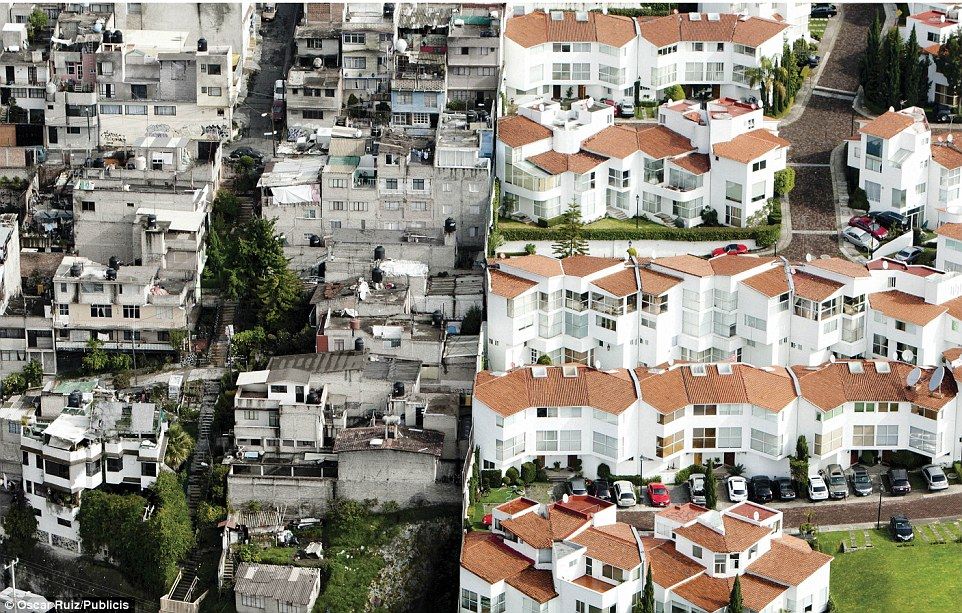

It's all too easy to think of the distribution of wealth in terms of Bernie Sanders talking points or as tables of countries arranged by their score on an obscure coefficient. But when you think about it, we all deal with wealth every day, even if we don't think of ourselves as wealthy. Wealth is what we have after we've paid our debts: it's what we get to keep from our paychecks after paying a mortgage and car payment, it's our savings, our retirement plan, our car, home, and whatever else we have that is "worth" something. Similarly, most of us instinctively know that all this wealth in the world, once it's all added up, isn't claimed equally by the billions of people on planet Earth. We all know there's a minute privileged class with more money, businesses, stocks, houses, you name it than could ever be counted. And we're all equally aware, even if sometimes we try to ignore it, that there's a much larger underclass without enough to feed or house themselves—if they're lucky enough to even have that. In short, what we mean when we talk about distribution of wealth is who are the haves and who are the have nots, and how much the haves have.

Distribution of wealth by numbers

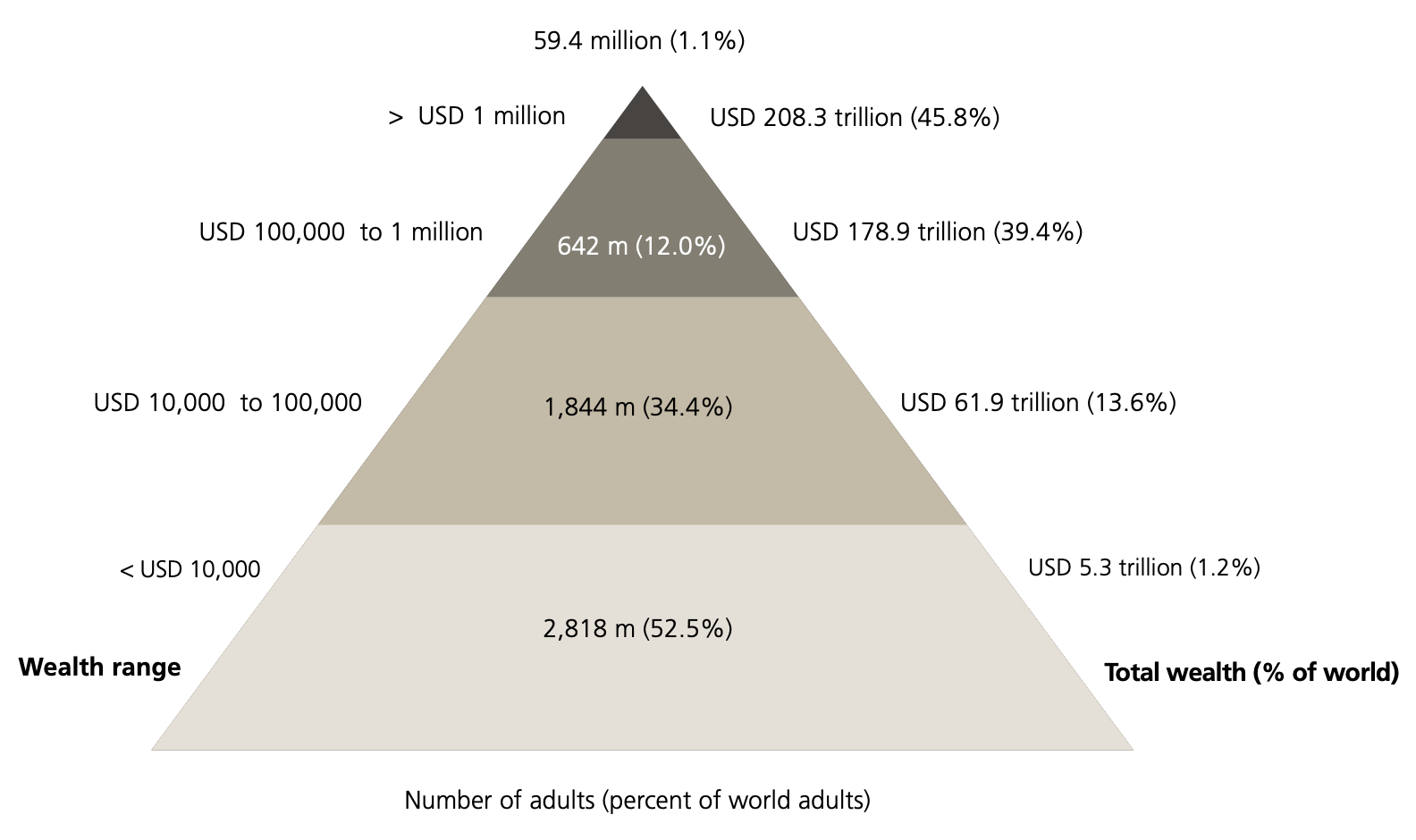

But while this is the harsh, tangible reality of wealth distribution, it can help to abstract things—slightly—into facts and figures. That's where a wealth pyramid comes in handy, and Credit Suisse's yearly report on global wealth includes a version that tries to account for all the wealth the world over. In the most recent edition, they illustrate how the peak of the pyramid—the smallest group, 59.4 million people, the literal "one percent" of humanity—lays claim to an estimated 44.5% of all the world's wealth. On the other end of the spectrum, the figures are almost precisely opposite: over 50% of the world's population controls a combined 1.2%. The exact breakdown of these ratios vary from country to country and from year to year, but although there's been slight decline in inequality recently, household wealth is very unevenly distributed.

So how did we get here?

The reasons for today's inequality are innumerable and interconnected. But a leading factor, and one so big that it essentially serves as the background noise of all other economic studies, is generational, systemic wealth accumulation. Old old money, like nobility, has stuck around for centuries; old money, like your Rockefellers, hit it big during the Industrial Revolution; new money began rapidly accumulating wealth during the tech boom of the recent decades. What these groups all share is not not just possession of economic capital but also access to political and social capital—more money, more goods, connections, favorable economic conditions, insider information, tax shelters—that help them keep their place at the top of the heap. This is why monarchies exist for hundreds of years, why there are "dynasties" like the Kennedys, and why even supposed rags to riches stories like Elon Musk aren't that at all. On a macro scale, this is why merchant states that rose to power at the beginning of the modern age or even before—Britain, France, the Netherlands—remain among the world's wealthiest countries today, centuries later. This steady accumulation leads directly to the uneven distribution of wealth—those with capital and power consolidating ever more, middle classes emerging but never threatening the process, and lower classes remaining shut out. This reality has been baked into the system we know for so many generations that the upper crust seems unbreakable.

Or seemed—until cryptocurrencies came along. It's dissatisfaction with this state of affairs amid 2008's Great Recession that motivated Satoshi Nakamoto to introduce Bitcoin. Soon we'll follow up with the second part of this series, examining how cryptocurrencies can help solve inequality as we know it, how lost Bitcoins fit in, and the role DeFi may be able to play. Until then, keep buying crypto and stacking your sats—you're on the right side of history!

Cover photo: The Great Seal by Jim Hammer, licensed under CC BY-SA 2.0.