Dollar-Cost Averaging: Bitcoin's Secret Weapon

As we've discussed before, Invity and many economists agree that it's a good idea to include crypto in a portfolio, and along with your collection of cryptocurrency investments comes the need to develop a Bitcoin investing strategy. As with other assets, treating altcoins and Bitcoin as an investment comes with risks due to markets and prices that can be volatile. Therefore the best way to invest in cryptocurrencies may be a method that minimizes risk and insulates individuals from market fluctuations as much as possible. Enter dollar-cost averaging: crypto purchases made in smaller amounts and at regular intervals may turn out to be the wisest use of your funds in the long run. Of course, this strategy may not be right for you, and Invity isn't here to give investment advice. However, this article will still give you an idea of what this strategy is all about and why it's something you might consider when thinking about how to include crypto in your portfolio. To top things off, this blog post will give you the background you need to take advantage of the DCA feature in the Invity mobile app!

What is dollar-cost averaging?

Put in purely economic terms by Forbes, dollar-cost averaging (DCA) is a way "to increase your exposure to an investment asset slowly over time instead of all at once. This allows an investor to reduce the risk associated with purchasing an asset that is highly volatile on a day-to-day basis while gaining exposure to the long term trends of the asset." For the rest of us, this means that instead of putting the full amount you want to invest into crypto all at once, you break the same final amount into a series of purchases of regular sizes made at regular intervals. This means you'll spend the same amount in terms of cash converted to assets, but you don't have to worry about buying at a bad time, like when prices are too high. This is especially vital for crypto, where volatility and uncertainties in the market are common—and sometimes huge. It's even possible that your money will go further and the value of your total holdings will be higher than if you had bought everything all at the beginning.

So why is this? The main reason is because you don't have to attempt to time the market; in other words, you don't have to try to find the exact time when a coin's price is low but ready to rise. Instead, the idea behind dollar-cost averaging is twofold. First, buying regular amounts of your chosen asset at regular times means you'll sometimes buy when the price is high—meaning you won't be able to buy as much crypto for the same price—but it also means you'll sometimes buy when the price is low—meaning you'll be able to add a lot more crypto to your portfolio that time around. DCA allows you to continue building your crypto holdings no matter what the markets are doing, which is important because...

...buying and then hodling over a long period of time means you'll be able to ride out the biggest swings in the markets. You won't need to worry about trying to get rich quick when everyone else is entering the market, nor will you have to worry about exiting the market as prices begin to fall. Especially when you take a DCA approach over many years, you'll likely benefit from a coin's overall upward trend in value. It's true that the returns are usually smaller than investing a lump sum, but you'll also be able to stick to a plan and take some of the risk and most of the emotion out of investing.

Put simply, using a dollar-cost averaging strategy makes your life as an investor easier. You don't have to choose when to buy into or get out of Bitcoin, you just have to choose how much to invest in crypto and how often. Of course, you should also choose which cryptocurrencies to invest in, since there are many different options that can help diversify your crypto portfolio. But once you've made these fairly simple decisions, you can "set it and forget it" and let your position grow. If you're already catching on to the idea, that's great; if it's still a little abstract, things will become clearer once we give some examples.

Applying dollar-cost averaging to crypto: a typical case

Imagine that after reading this article, you're really motivated to buy crypto—obviously! But also imagine you have two problems: you don't have a large sum of money on hand right now, and you also don't know what the price of crypto will do in the future, (especially since past performance is no guarantee of future results). Instead, you decide to use USD 100.00 from each of your paychecks to buy crypto monthly, no matter the price and indefinitely into the future. This automatic monthly crypto buy means all sorts of positive things for your investment. Mainly you'll slowly build up how much cryptocurrency you own. In this way, your crypto holdings in fact act more like a savings account, since you'll always have some crypto at your disposal and it will remain fairly liquid. You'll also probably grow your money slowly—sometimes USD 100.00 might buy BTC 0.00003 but other times it might buy BTC 0.00005. You can think of these "extras", whether small or large, almost like an interest rate you get on your traditional savings or other asset. Finally, constant regular purchases that insulate you from the market give you more peace of mind—especially for those with a long-term hodl strategy, low crypto prices sting less and the paranoia of jumping into the market at the wrong time is gone, while your gains remain small but sweet.

Applying dollar-cost averaging to crypto: an atypical case

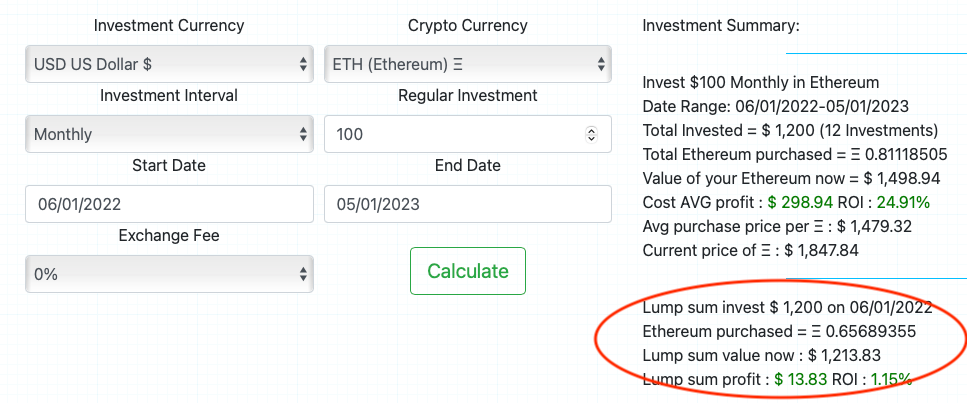

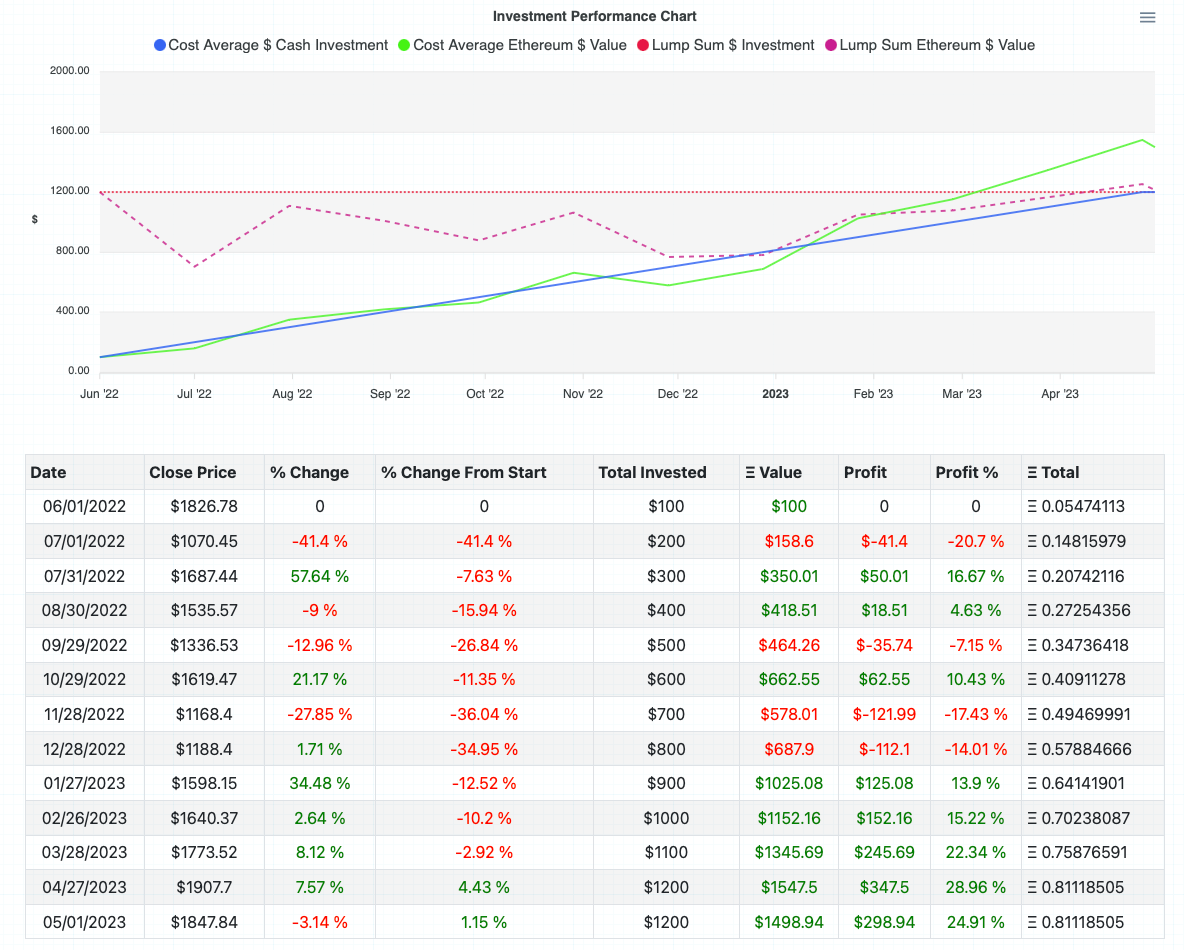

Again, we have to stress that DCA typically offers smaller returns on your investment. However, sometimes, especially with altcoins, you can also be pleasantly surprised. Imagine that a year ago, in June 2022, you got a nice windfall, maybe USD 1,200.00, and you decided you wanted to use it to invest in crypto. You could have started right away by putting the whole amount into Ether, and you would have been able to buy about ETH 0.65689355. If you decided to hodl this amount for a year, this Ether would have gone through some ups and downs for an overall rise of about 1.15%. After a year, your ETH 0.65689355 would today be worth around USD 1,213.00—not great, not terrible.

But you could have also spread your investments out; perhaps you instead spent USD 100.00 on Ether once every month for a year starting last July. You'd still spend only your USD 1,200, but due to the rises and falls in Ether's price, you would have actually bought around ETH 0.81118505. The ability to gather larger amounts of ETH when prices were lower combined with the general upward trend would mean that your USD 1,200.00 would have transformed into USD 1,479.32—a 24.91% return after only a year!

So whether you see small returns or large ones, Invity sees a dollar-cost averaged savings-style approach as a real breakthrough for the crypto industry. After all, more traditional assets like 401(k)s and IRAs already typically rely on small regular contributions. That's why we've included the recurring purchase DCA feature into our mobile app. You can also take advantage of our Buy crypto feature for greater manual control over your crypto purchases. Now with your knowledge of dollar-cost averaging, you're ready to take your future into your own hands and make crypto part of your portfolio!