What's the Best Bitcoin Wallet? (and How Does One Work?): Crypto Wallets Explained

Before you can buy, exchange, or do anything else in the world of crypto, you need a cryptocurrency wallet. But crypto wallets are more than—and in many ways different from—the wallet you probably have in your pocket right now. They're like your bank, your bank account, your signature, and your safe deposit box all in one: they facilitate sending and receiving coins, let you check your balance, and keep your personal information safe but still usable. Since these pieces of technology are complex and central to the digital currency economy, it's vital to understand what they do and how to choose the best crypto wallets. Our explainer will do just that: we'll start by giving a basic overview of how wallets work in the world of virtual money, discuss the types of wallets that are available, and then close out by giving our recommendations for the best wallets for crypto users. So whether you're choosing your first Bitcoin wallet or you're looking to upgrade, this article should arm you with the information you need to go out and choose a crypto wallet that suits your needs.

How do crypto wallets work anyway?

Crypto wallets work differently from the wallet you keep in your pocket or purse: they don't actually hold your coins, since your coins only exist as an entry on the blockchain. Wallets simply give you access to the blockchain and ensure that you are the only person making transactions in your name with your coins. Put in slightly more technical terms, wallets create, store, and allow you to use your secret private key. And since every other piece of information you need for interacting with the blockchain and with other crypto users is derived from the public key, wallets also let you manage your public key and generate and manage the addresses you use for each transaction. If we pick up the analogy from the introduction, your wallet works like a bank, your private key is like your signature, and your public key is like your bank account number.

Wallets provide security

In the real world, banks stay relatively safe by relying on many different security features: cameras, security guards, heavy doors, and coded keypads. A wallet may not have physical guards, but most still have layers of security features, which is one of the main benefits of the wallet system. Better yet, most of these features are under your control—meaning you're your own bank.

First, there's the actual data of the private key itself, which is a number unique to your wallet that is created when you set up a Bitcoin wallet. Your private key is both randomly generated using a complex algorithm and long—usually 256 bits, or 64 characters—making it really, really hard to guess. This is further complicated by the fact that most users don't even know their key in the first place: you're often only presented with a seed phrase of random words that can be used to recreate your private key if, for example, your wallet is lost or stolen. By following seed safety guidelines like keeping your seed in a secret physical spot, it's not only nonviable to guess a private key, it should also be next to impossible to access or accurately guess a seed phrase.

But there are still more security benefits that most wallets can provide. Modern wallets should generate their own addresses for each time you receive bitcoins or your preferred altcoin. These addresses are mathematically related to the public key, which in turn is related to the private key. However, the mathematics that connect all of these pieces is so complex that the time and cost to reverse engineer them simply wouldn't be worth it; put simply, using different wallet-generated addresses adds a second layer of uncrackable safety to each transaction. And this is to say nothing of the benefits of using passphrase protection and two-factor authentication (2FA) to access the wallet itself, which are features you're probably familiar with from your email account or banking app.

The takeaway:

- Anyone with your private key or seed phrase can act as you and spend your money.

- You're responsible for protecting your private key and seed—and therefore your money.

- Use a wallet to protect your digital money as well as your bank protects your fiat money!

What types of crypto wallets are available?

But even now that we've established what a crypto wallet does—broadly, provide security for and access to your "crypto identity" and your funds—there's still one hurdle before choosing which wallet is for you. See, while all wallets fill the same niche in the process of using digital currencies, they don't all provide the same level of security. There are five main types of wallets, listed here in order from least to most secure: paper, online, mobile, desktop, and hardware wallets.

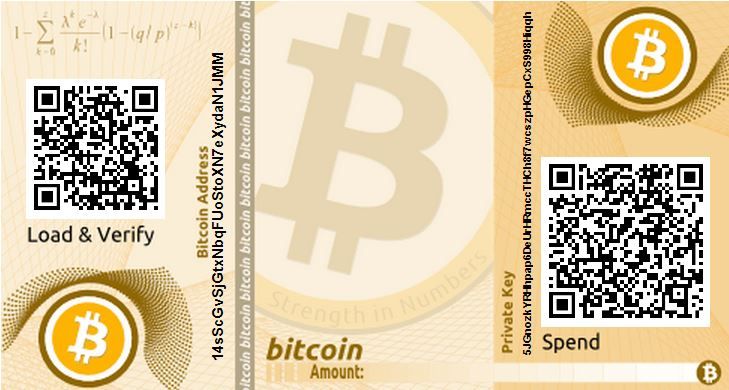

Paper crypto wallet

In the early days of crypto, there wasn't a robust ecosystem of high-security wallets, and users realized that they were vulnerable to hacking when their wallet information was stored online. The solution was simple and surprisingly low tech: write their private key on a piece of paper. As effective as this was, the drawbacks soon became clear: not only was this tedious, there was a real possibility of writing the key unclearly on the paper or entering it incorrectly online. More dangerous still, no matter how carefully you store it, paper is always vulnerable to water and fire damage, and more than a few users have lost their funds permanently after a disaster or even a small spill. This method is not recommended, though using a written backup (or multiple, all laminated or engraved and kept as securely as possible) for your seed phrase is still a best practice.

Online crypto wallet

Online crypto wallets are a method in which a company maintains your wallet on their own internet servers. This is extremely convenient since you can access your funds from anywhere. But looking deeper, this is a really bad way to keep your money safe. There's a saying in the world of crypto: not your keys, not your coins. Since anyone with control over your key also has control over your funds, storing your wallet (and thus your keys) anywhere except under your direct control means your data is extremely vulnerable to hacking, seizure, unavailability, or really anything that a third party wants to do. Even if you think you trust a third party, don't sacrifice your security for a tiny bit of added convenience: don't use online crypto wallets.

Bitcoin advocate and author Andreas Antonopoulos explains the importance of owning your own keys.

Mobile crypto wallet

Mobile wallets are where the combination of convenience and security begin to enter acceptable levels. They're simple to download like any other app, they're portable solutions for spending crypto in the real world, and for the most part they're free and quite user friendly. Most also generate and keep your key on the phone itself, and you can (and should!) add layers of password and PIN protection.

However, mobile crypto wallets still aren't ideal from a security perspective. Since your phone is most likely connected to the internet, this makes mobile wallets a form of "hot wallet", which are always at least somewhat vulnerable to attacks from hackers and malware. In addition, phones are easy to steal or lose, which means your funds are gone for good if your wallet isn't sufficiently protected or backed up. A good guide is to use your mobile crypto wallet like pocket money: store only a small amount of crypto using this method if and when you know you're going to use it.

Desktop crypto wallet

Desktop crypto wallets are similar to mobile wallets in a lot of ways: they're programs that you download and run on your device, they generally generate and store your keys on the device itself, they're often free, and you can set up various layers of security. Desktop wallets also have some added benefits: most people don't walk around with their computers so they're more resistant to theft, and if you're very careful about how you use your computer, your desktop can be a "cold wallet" that disconnects your keys from the web.

However, this type of wallet also comes with drawbacks: most desktop wallets are still hot wallets, and most are dense and not friendly to beginner or even experienced crypto users. In general, desktop wallets occupy a strange space between mobile wallets and our final contender...

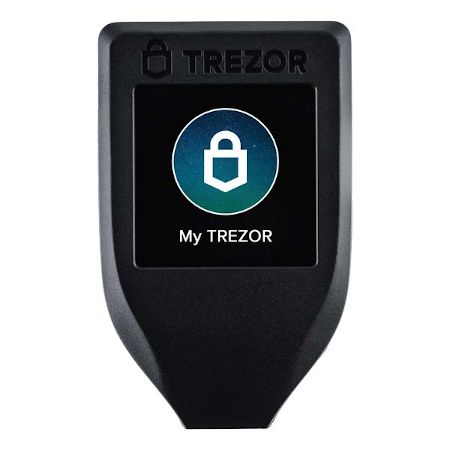

Hardware crypto wallet

...hardware wallets, which are the most secure way to care for your crypto assets. These physical crypto wallets are devices designed specifically to safely store your crypto. Their biggest innovation is that they're cold wallets—hardware wallets don't actually connect to the internet, they only communicate with your computer when they're connected with a USB cable. This means there's no way for anyone to access the keys generated and stored on your device. And since these devices serve only a single purpose, the teams that develop them spend their time developing the most effective security features, including those that users see and those that are deep inside the technical framework of the devices. As a cherry on top, hardware wallets are small—usually the size of a keychain—so keeping one in a safe is easy.

What is the best cryptocurrency wallet to use?

A crypto hardware wallet is the best wallet for crypto users, hands down. Any large amount of crypto should be kept on a high-quality hardware wallet. The first hardware wallet to hit the Bitcoin scene was built by Trezor. The Trezor Model T still leads the industry today thanks to lots of features like open-source development, cutting-edge security, frequent firmware updates, and the Invity-enabled ability to buy and exchange conveniently within the device itself. Do be aware that they come at a cost, usually around USD 150 for the latest models. A good guide is that if you have crypto that amounts to 10 times the cost of a hardware wallet, buying a reliable, ultra-safe hardware wallet should figure into your investment plan.

However, if you're just starting out or you're not sure you want to make the jump to a hardware wallet, there are a few good hot wallets to choose from. The Blockstream Green and the BlueWallet are both trustworthy, easy-to-use hot wallet choices, though we really do encourage you to use these only as ways to spend pocket money—large sums should be kept in hardware.

So now you can sleep—and buy crypto!—soundly knowing what you now know about wallets and keeping your crypto safe!

Cover photo: Bitcoin in wallet by Marco Verch, licensed under CC BY 2.0.