The Widening World of Crypto: Decentralized Finance

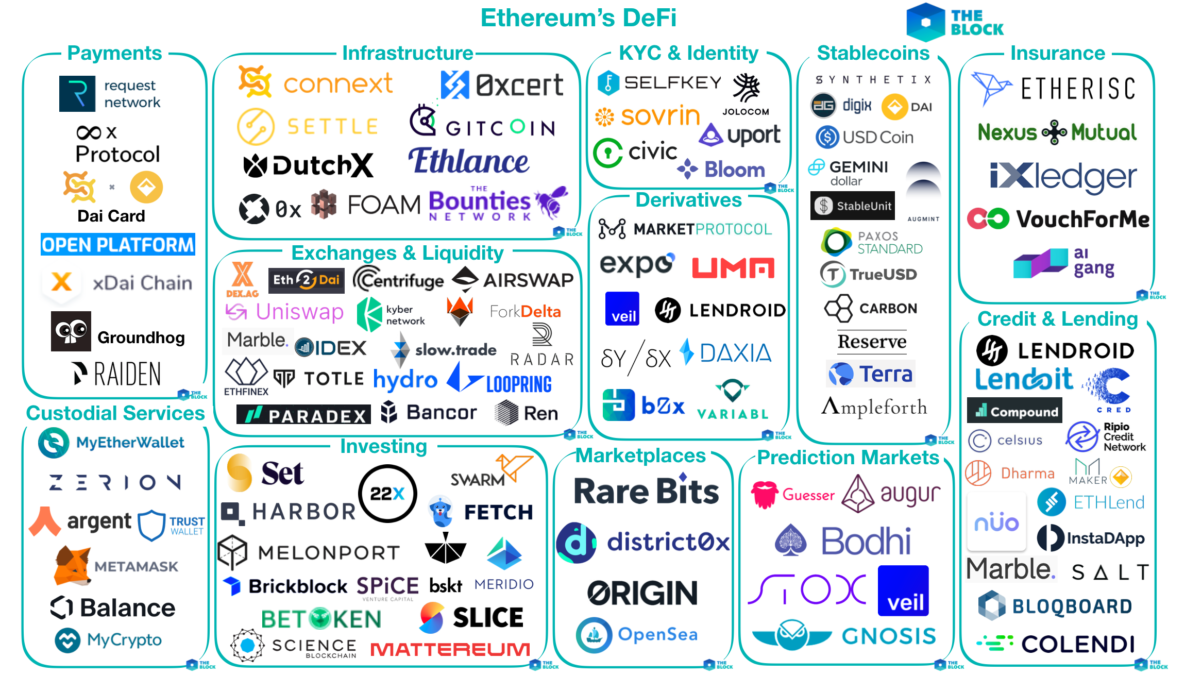

Our previous post about Ethereum (ETH), the most popular digital currency system after Bitcoin, mentioned some of the potentially earthshaking uses for its smart contracts and dapps, including one mysterious but exciting term—"decentralized finance", or "DeFi". In just a few years, the blockchain technology behind smart contract and dapp capabilities has exploded beyond a few handfuls of unrelated programs for insurance or ad hoc agreements between individuals: an entire online finance ecosystem comparable to traditional banks and investment firms has arisen. The implications of this "alternative" DeFi system on crypto users and the world at large is immense, and the only way to take full advantage of it is by buying crypto. So while this post isn't offering advice about any of the financial instruments discussed here, we'll still attempt to give you an idea of the possibilities offered by DeFi—and why the world of crypto is so excited.

"Regular" finance vs. decentralized finance

Before discussing the exciting effects of DeFi, it's important to define our terms and understand what DeFi is in the first place. As mentioned above, DeFi stands for "decentralized finance", but since Bitcoin, Ether, and other cryptocurrencies are already essentially forms of money that can be passed from one person to the next thanks to a decentralized, globe-spanning computer network, you may rightfully ask why we need a new term—finance and money are interchangeable, right?

Actually, "finance" here is more than just the cash or crypto in your wallet. Think about loans, interest, stocks, bonds, real estate, gold—all the assets that have value and that you discuss with your financial advisor or have to mention on your tax return. These valuable things along with the people and institutions that manage their flow between people and around the world form what's known as a financial system. You're intimately aware of this system even if not by that name: banks, credit unions, stock traders, investors, insurance companies, and central banks all play parts in how value is exchanged in today's world.

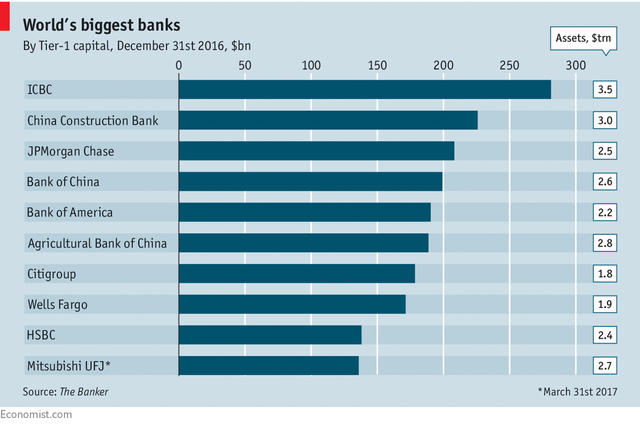

This financial system has more or less kept the world turning throughout the 20th century, but it has some major problems. If you lived through 2007-2009 or if you've seen the movie The Big Short, you'll know one of them: centralization. A small handful of major actors—think JPMorgan Chase, Goldman Sachs, Credit Suisse, and the like—control so much of the world's wealth that the failure of any one of them can easily precipitate the crash of the whole world system. Even in the best of times, when greed-driven decision-making by these massive actors isn't causing economic meltdowns, these institutions control such a vast swathe of the economic landscape that they can officially and unofficially set the rules for who can and cannot participate in the world's finances and how. So it's no accident that Bitcoin, the first cryptocurrency, was founded in the immediate aftermath of the financial crisis to give people control over their finances.

Bitcoin and its relatives do this fairly well by allowing people to make simple purchases and payments free of oversight by banks or governments. But far from only letting you be your own bank, DeFi aims to take this much further buy covering the whole range of assets that are far more complex than simple peer-to-peer payments. Remember loans, interest, stocks, bonds, commodities, futures—all the things that make up the word "finance"? These can all be translated to the digital space and traded across worldwide, cryptographically secured networks—blockchains—nearly automatically thanks to protocols, smart contracts, and dapps. This not only means that all the features that make up the 21st century financial system can flow with little to no overhead costs, it also means that they become available to almost anyone with an internet connection. To get a better look at just how revolutionary these changes can be, let's look at two main features of DeFi.

Accounts and borrowing for everyone

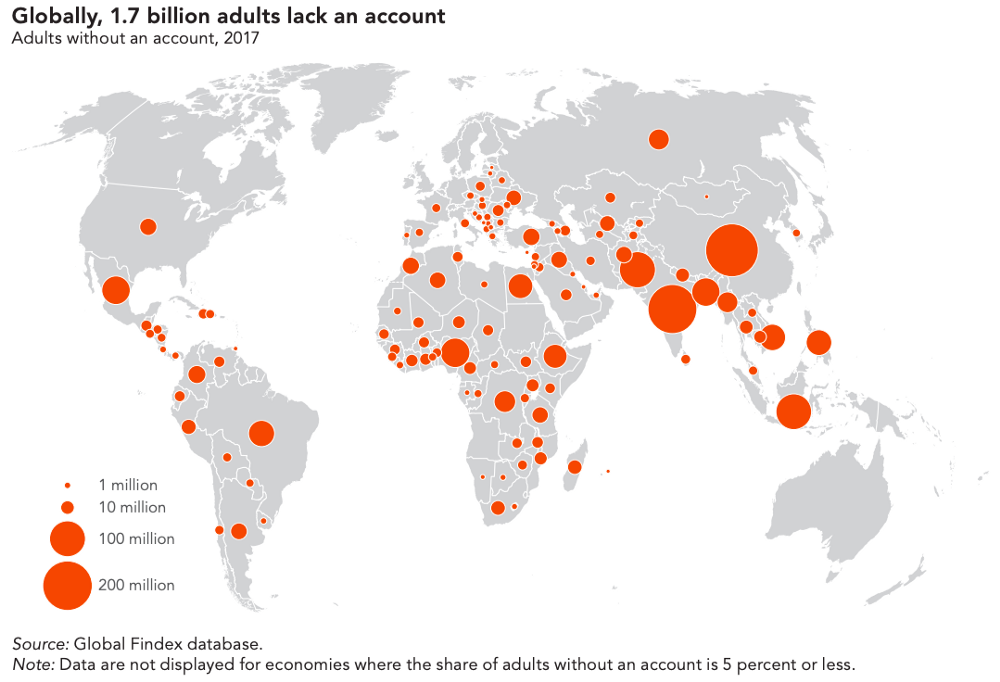

The greatest benefit offered by the decentralized finance ecosystem may also be its simplest. Around the world, an estimated 1.7 billion adults have no bank account. This seemingly minor issue cuts them off from the world economy: without a bank account it's difficult to save effectively, it's impossible to access reputable loans when they're needed (and to build up a credit score), and it's difficult or impossible to make money grow through interest or investing. The reasons for not having a bank account are many and varied: prohibitive costs to opening and maintaining an account, fear of depositing money somewhere where a government can easily confiscate it, or simply living too far from a brick and mortar branch. DeFi effectively eliminates barriers to entry for banking and finance, democratizing the world's economy.

It does this first, through accessibility. DeFi services are essentially available to anyone with an internet connection, which generally includes those with mobile phones as well. This number is high and growing and outstrips the number of people without bank accounts. Second, costs. DeFi services can be free or very low cost, owing to no need for bankers, brokers, or buildings compared to traditional banks. What's more, users can generally find somewhere to borrow funds of various amounts, including small or microloans; traditionally, smaller loans either aren't offered at all by banks or are offered by services with extremely poor terms that prey on the desperate. Finally, you can put your money to work by earning interest. Like a traditional bank, you can supply your crypto to a lender, who will use your crypto to make loans. For allowing them to do this, you'll earn interest in crypto—often much more than painfully small bank interest rates.

The tokenization of everything

What Bitcoin advocates have realized for some time is that money—whether fiat or digital—is really just a representation of value. A piece of green paper stands in for something called a dollar, and a string of eight decimals can stand for a certain part of a Bitcoin, which also stands for a certain number of dollars. But cryptocurrency is just one type of token, and there's no reason why a token can't represent other real estate, oil, gold, parts of companies, time, even Bitcoin—really anything can be turned into tokens. This, along with limited interference from third parties like traditional banks, simplifies and multiplies what can be done with their value: they can be transferred instantly, bought, sold, split into pieces, borrowed against, used to complete tasks, invest, and more. The ability to make nearly anything into a digital asset that is under your own control may hold DeFi's greatest promise.

Comprehensive self-managed finances

This introduction and focus on two aspects of DeFi has just begun to scratch the surface of how wide-reaching this parallel financial system can be. Stablecoins, options, derivatives, and more are all integral pieces of the decentralized finance space, and all with analogues in traditional banking and investment. Of course, as with any financial instrument, these all have risks. However, so many platforms are taking advantage of the freedom and flexibility offered by taking digital assets outside the established system that DeFi is, to some, beginning to offer a fully viable investment alternative to "TradFi".

But of course, it's not possible to use any of these exciting decentralized services without first entering the world of crypto or making sure you have the right coin for the job. The best way to do that is through Invity's Buy crypto and Exchange crypto features, where you can always compare rates from multiple exchanges to ensure you get the best deal.

Cover photo: Random, scale-free network by Simon Cockell, licensed under CC BY 2.0.