What Are Blocks in Blockchain?

Blocks are, quite literally, the building blocks of cryptocurrencies and blockchain technology. By understanding how they function, you can begin to make much better sense of what the crypto industry is built on and even some of the controversies that are discussed among certain parts of the crypto community.

Continuing our series on important crypto terms for both beginners and experienced traders, this guide provides a plain-English introduction to blocks.

What are blocks?

Blocks are digital packages of information. When we’re talking about cryptocurrencies like Bitcoin and Ethereum, we can think of a block as simply being a bundle of transactions.

Each block serves as a record that contains pertinent information that can be used to audit the network. Thanks to the publicly-available and permanently recorded information stored within blocks, the network can be checked by both internal consensus mechanisms and by any outside observer who chooses to do so.

When it comes to Bitcoin and most popular cryptocurrencies, each block stores the size of the block, the time that it was created, and information about transactions such as the sender and receiver’s public keys and how much crypto is involved. Each block also contains the answer to a mathematical equation that "miners" are trying to solve—more on that in our next article.

Crucially, each block also contains information that ties it to the block that precedes it. In order to become officially recognized by the decentralized system, blocks have to be introduced in the correct sequence. If there is any attempt to verify a block out of order, it will be shot down by the network. This helps prevent malicious or unintentional corruption of the network’s integrity and is the origin of the "chain" portion of the term "blockchain"—each new block is tied to each preceding block.

The interrelated, publicly available nature of the transactions that make up a blockchain is the value that drives the cryptocurrency movement and a slew of other recent innovations based on this technology.

What are the benefits of storing information in blocks?

Blockchain technology was first outlined in a white paper back in 2008. It was conceived of as a way to allow the first cryptocurrency, Bitcoin, to be both functional as a way to make secure payments and transparent without the need for intermediaries or a central authority.

The beauty of storing information on a blockchain is that it allows the network to permanently record a history of everything that has ever happened since its creation. This introduces an exchange of information that is "trustless", as users do not have to trust that other members participating in the network are operating in good faith. Instead, they can simply check for themselves. Every transaction that has occurred on a blockchain is publicly viewable, and you can easily see which "accounts" (a.k.a. public keys) were involved in a transaction. Further, any information recorded in a block that has been approved by the network is virtually impossible to ever change, especially as the blockchain grows and a block's information is tied to more and more subsequent blocks.

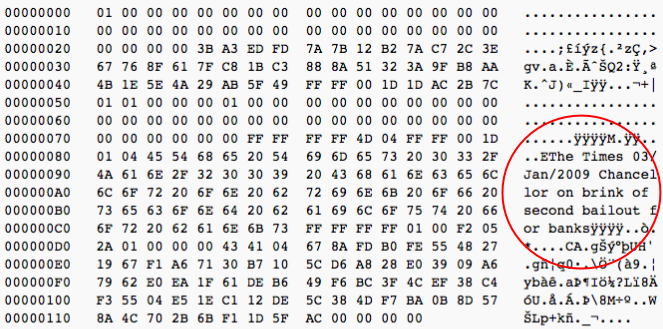

One lesser-known feature of blocks is that, in the same way they store transactions, they can store permanent and uncensorable messages too. This is by no means one of their main functions, but it does help demonstrate the power that comes from being able to permanently record information.

By putting text into various data fields in a block, it's possible to leave a plain text message that will never be censored or removed. For instance, searching the term “marry” on a public Bitcoin block explorer brings up several results of marriage proposals that will forever be immortalized on Bitcoin’s blockchain.

Better still, in addition to making the network's records immutable and transparent, the way that information is stored on a blockchain also makes the network itself virtually impossible to shut down. Participants in the Bitcoin network, for example, can download a complete copy of the entire blockchain—referred to as a "full node". Since a substantial number of users are running full nodes from all over the world, there is no single point of failure. If a government wanted to shut Bitcoin down, they would have to find every user across the globe one by one and get them to stop running these nodes. Even then, the Bitcoin network could easily re-emerge if someone simply distributed the most recent copy of its blockchain.

Are there any downsides to using blockchains?

The major downside of storing information in blocks and on a blockchain is that doing so is incredibly resource exhaustive by modern data storage standards. At the current point in time, the filesize of the Bitcoin blockchain is over 353.8 gigabytes Each block currently averages around 1 megabyte in size and a tremendous number of transactions are made daily. There are currently an estimated 13,000 Bitcoin nodes in operation, and each is hosting and regularly updating its own copy of this massive file.

If you compare this to a centralized network like a bank, where transaction information is only stored in one place (albeit a very large server and likely with a handful of backups), blockchains require more resources to maintain. So while they are more robust and immune to centralized control or a single point of failure, blockchains are, by design, a lot more redundant.

When a blockchain is under a period of high activity, confirming blocks begins to take a lot longer. As a consequence, the speed of sending a transaction can slow down and the cost associated with doing so can skyrocket. There have been some proposals about how to speed up blockchain transactions, for instance increasing the size of each block, but especially among Bitcoin maximalists these are often controversial since they directly affect the fundamental way the network functions.

Ultimately, blocks present a creative solution to storing information about transactions in a way that supports the existence of decentralized cryptocurrencies. They enable a system where both internal mechanisms and outside observers can verify that each action performed on the network is legitimate. In the time since blockchain technology was first proposed as the cornerstone of Bitcoin in 2008, it has taken on a life of its own for a wide variety of use cases in other sectors. These uses include, but are not limited to, healthcare, real estate, virtual collectables, supply chain management, the Internet of Things, and financial technology.