So What Is an NFT?

If there is one topic that has overtaken even Bitcoin prices in recent weeks, it's NFTs. From digital art to NBA Top Shot to buying and selling tweets, nonfungible tokens are having a moment—and millions of dollars are changing hands because of it. But what exactly are these blockchain-based tokens? Are they the future of asset ownership as their supporters say? Or are they, as others warn, just a nonsensical bubble about to burst? As we always do here at Invity, we'll leave the choice of whether you want to buy NFTs up to you. But we do want to equip you with the background you need to understand the Twitter hype and to make an informed decision.

Nonfungible tokens: they're not Bitcoin

Even though they're experiencing a boom right now, NFTs aren't really anything new. You may recall our post about Ethereum, where we included a picture of this little guy:

Founded in 2017, CryptoKitties is one of the older examples of a decentralized application that uses the Ethereum network's flexible rules to make its own tokens. Each token represents a completely unique kitty that users can then trade on the Ethereum blockchain to make still different cats. Think of it like Pokémon over the internet, or, even simpler, trading cards.

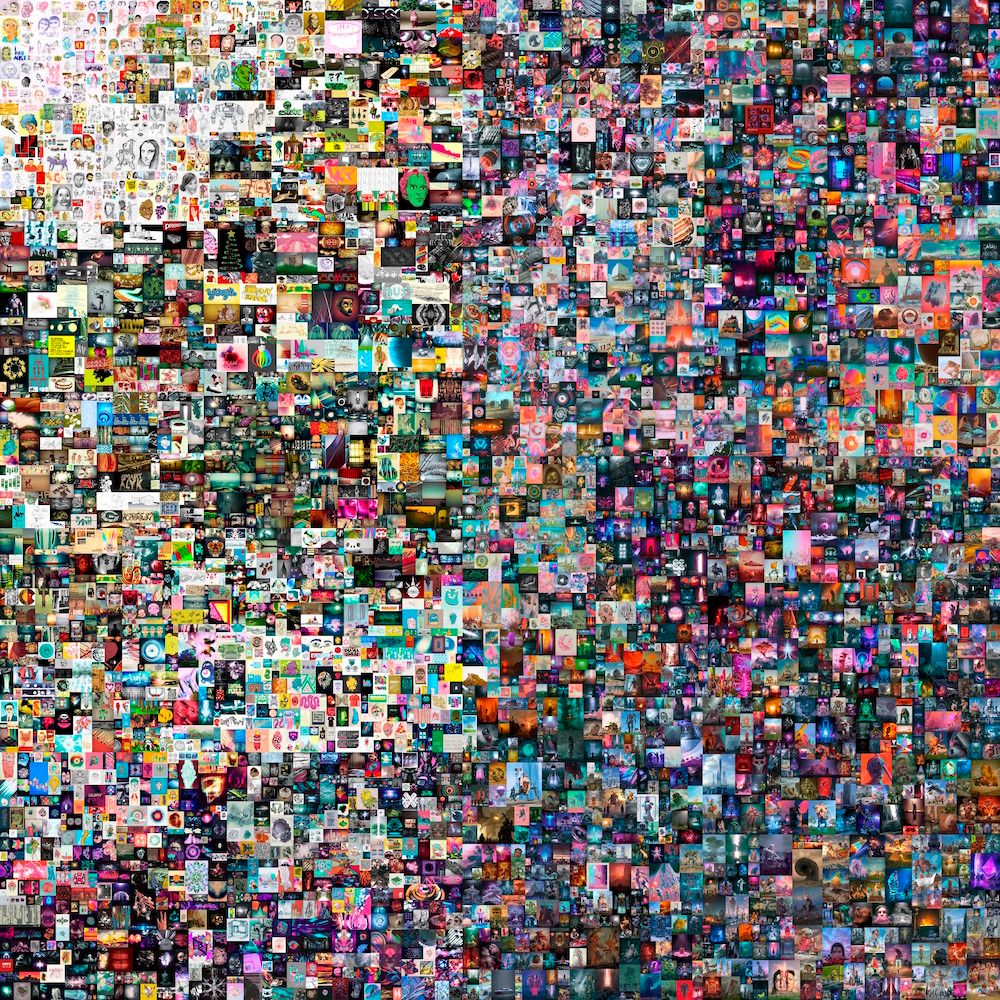

But what is potentially revolutionary is that these tokens don't need to represent cats: they can correspond to anything. That's the "nonfungible" part: Bitcoin is fungible—trade a Bitcoin token for a Bitcoin token and you still own some Bitcoin—whereas NFTs are nonfungible—trade an NFT of a cat for an NFT of a baseball card and each side ends up owning something completely different. The "tokens" of NFTs simply mean it's easy and secure to make these exchanges, and each token includes unique information about the asset it represents and everything is fully part of a cryptographic blockchain. Already NFTs have been used to represent all sorts of things including artwork, music, GIFs, tweets, and more. And people are willing to pay good money (both fiat money and crypto) for ownership of these tokens: the artist Beeple, for example, recently sold an NFT artwork for around $69,300,000. And no, there aren't any extra zeros.

So what's the problem with NFTs?

People are buying ownership of something and giving money in return—that's how markets work, right? Well, yes, but the idea of ownership is a sticky one when it comes to NFTs. Let's back up for a moment: when we said that NFTs can correspond to anything, what we really meant is that they can correspond to anything digital. So the Beeple art wasn't on canvas: it was digital art, a collection of pixels in a JPEG file. When shared, image files like this can be downloaded by anyone—go ahead, right click on the photo above and "save image as". In this sense, you too "own" this photo, just without the token to back it up.

Here's where the parallels between NFTs and traditional art or trading cards or cats breaks down. If you want to buy the Mona Lisa, there is only one—you buy it and it's yours to do with as you like. People can still buy prints of the Mona Lisa, but there will only ever be one honest-to-goodness canvas touched by da Vinci himself. That simply doesn't work in the digital space: JPEGs and data of any type can be replicated endlessly, identically, and by anyone. So what was the art collector actually buying when they handed over $69 million to Beeple? The concept of ownership.

To many, attaching the concept of ownership to a digital asset is not only nonsense, it challenges some of the core ideas of the digital age. The internet and personal computers promised an end to scarcity and free access to all of the world's knowledge, art, and entertainment. As we saw, NFTs don't put an end to this, but it may threaten it or put up unnecessary hurdles. At best, NFTs could be high-tech money-laundering operations that don't much change our digital society, but at worst NFTs could be the first signs of the privatization and enclosure of the internet as we know it. If that isn't enough, the current NFT boom has already seen its first round of hackings and thefts, proving security is still a hot topic many don't take seriously enough.

Are there upsides to NFTs?

To be fair, there still may be some reasons to avoid dismissing NFTs altogether. Buying NFT art, for example, is certainly a way to support artists who may not have markets or notoriety otherwise—in a sense, NFTs offer the option for a 21st century patronage system. On the other side of that equation, artists can use NFTs to support themselves. Owning a given NFT also comes with benefits like usage rights or, for some types of NFTs, the ability to earn a small income each time a digital asset is shared.

It's also good to remember that even if NFTs aren't something that popped up just a few weeks ago, they're still pretty new in the grand scheme of things. The current boom is mostly restricted to digital art and baubles, but there are already some attempts to link NFTs to real, nondigital assets. Nike's NFT patent links limited-edition sneakers to tokens so each pair of shoes has a verifiable chain of custody and ownership is proven via the blockchain. To get a little more experimental, tennis player Oleksandra Oliynykova is selling advertising space on her arm as an NFT, which is the sports merchandising equivalent of "a billboard in Times Square." As for the future, the secure, verifiable, and quick nature of NFTs may be well suited to property ownership and transfer, event ticketing, and more real-world assets.

So only time will tell if NFTs prove to be a fad restricted to speculators and niche collectors or whether they will make the jump to an indispensable tool that accompanies everything we buy. What is certain is that blockchain technologies of all kinds are living up to their disruptive reputations and may well open up a whole new world.

Cover photo: Cards by Jeffrey Smith, licensed under CC BY-ND 2.0.