A deeper dive into dollar-cost averaging in crypto investing

Buy low, sell high. This classic investing mantra sounds great, but it's stressful to apply to ever-changing real-world markets—especially crypto. So what if you could instead step back from trying to time the perfect investment while still profiting from Bitcoin? Then dollar-cost averaging (DCA) may just be the investment strategy for you.

Key takeaways

- DCA is a strategy of buying smaller amounts of Bitcoin on a regular basis instead of lots of Bitcoin all at once.

- DCA helps make profitable investments without much of the volatility, emotion, and stress of trying to time markets for maximum return and minimum losses.

- DCA, however, can mean slightly lower overall profits.

DCA refresher

We've already introduced some DCA basics from a relatively theoretical angle, but it's good to get on the same page anyway. Dollar-cost averaging is a strategy where investors allocate a fixed amount of money at regular intervals—regardless of the asset's price—to mitigate the impact of volatility. This allows you to consistently build up your position over time, purchasing more assets when prices are low and fewer when prices are high, averaging the purchase cost.

Benefits of DCA

DCA is particularly popular in the crypto community for a few very good reasons.

- Easing volatility: Assets like Bitcoin are notorious for overnight bull runs, flash crashes, and sometimes years of quiet in between; this is much of what distinguishes Bitcoin from investments like S&P 500 index funds, which are much less…"exciting". Spreading your purchases over time means you don't feel downturns as sharply and won't need to recover as much ground when prices again start to rise.

- Emotional discipline: While hodling BTC will likely get you good returns in the long run, the ups and downs along the way can bring FOMO, pessimism, or panic—more than one investor has kicked themselves for pulling out of BTC years too early. Sticking to a DCA investment plan, on the other hand, helps you minimize emotional reactions to market fluctuations.

- A more relaxed approach: Compare DCA to lump-sum investing, or taking out a large position all at once in hopes of stockpiling assets when prices are cheapest and hoping prices rise from there. Trying to time a volatile market like this is a challenge even for seasoned, professional investors; when planning for your financial future with crypto, a slow and steady strategy is more sensible.

- Personalized and flexible: DCA can be tailored to suit your situation. Some may choose to buy €30 of BTC every week, €100 once a month, or, like one Twitter (sorry, "X" 🙄) user, $10 per day. If you get a pay raise and can afford to purchase a little more or a little more often, great; if times get tough and you need to cut back, buying a little BTC is better than none at all. The Invity app makes this even easier by letting you set up automatic recurring purchases that fit you best.

Try Invity mobile app for one-time and recurring bitcoin purchases:

Drawbacks of DCA

Despite DCA's many benefits, we also want to be honest about the full picture.

- Opportunity costs: Avoiding putting a lump sum into the crypto market at a low point can mean you lose out on buying lots of Bitcoin cheap and profiting hugely. This is especially true if you're persuaded by crypto media stating "we're still early" or encouraging investors to "buy the dip". Having any Bitcoin at all means you'll benefit from rising prices, but strictly sticking only to a conservative DCA strategy may mean slightly lower total profits.

- Transaction fees: Buying BTC regularly means you'll have to pay transaction fees each time you buy rather than just once. While this slightly shaves down how many sats you can stack each time, this shouldn't discourage you: average Bitcoin transaction fees are currently less than €1.

Subscribe to The Invity Beacon newsletter

Case studies

By using Invity's dollar-cost averaging calculator, we can put a few different DCA strategies into concrete terms.

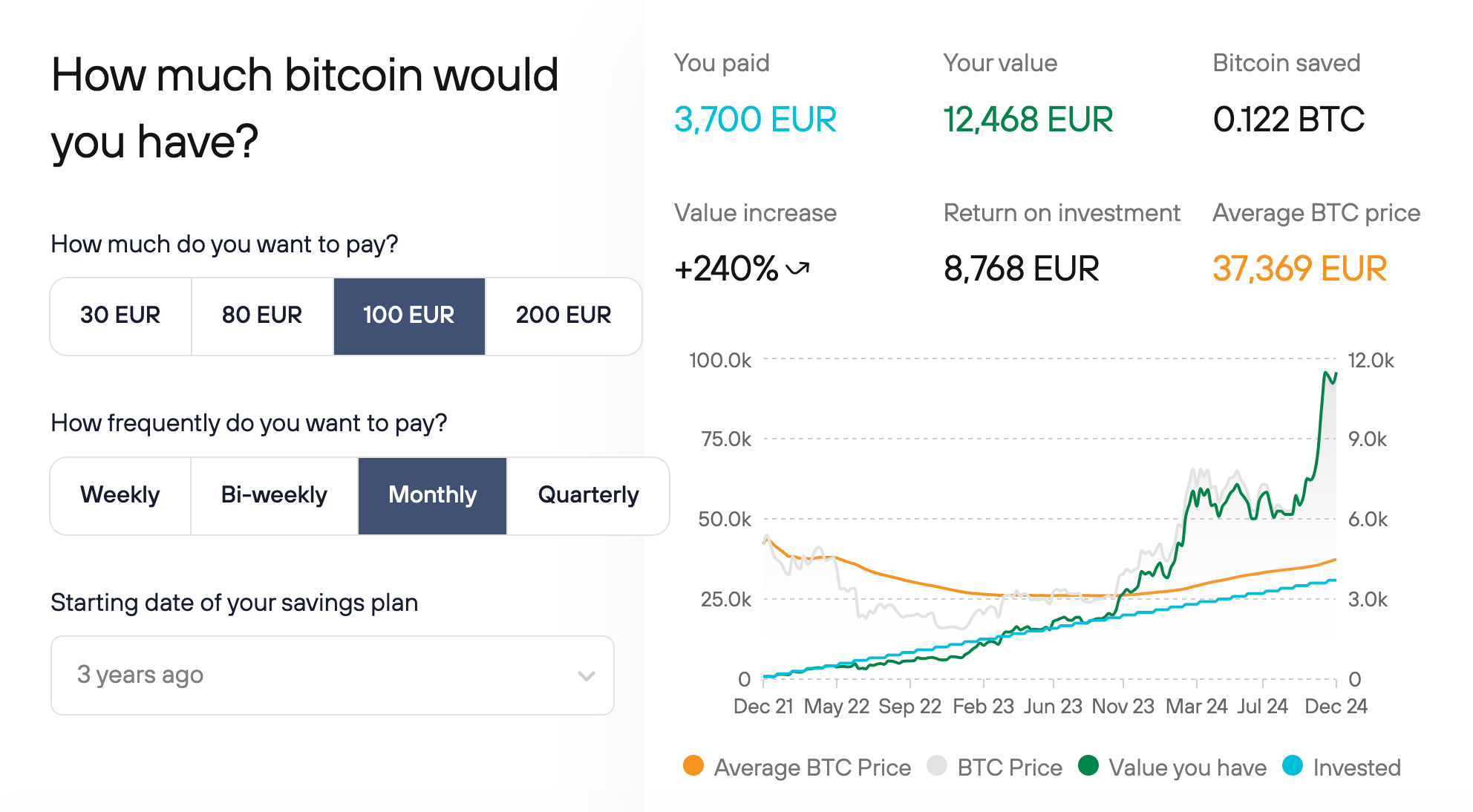

Case study 1: €100 per month for 3 years

With careful planning, most of us can probably find some extra money in our monthly paycheck. Let's say that, three years ago, you calculated that you could set aside €100 from your pay every month.

What's important to note here is how setting aside even this modest sum adds up: you would have put €3,700 into Bitcoin. This may sound like a lot, but over the course of three years, having €100 less every month probably didn't have much negative effect day-to-day.

For most of us, this approach is a lot less painful (and a lot more possible) than taking thousands out of your bank account all at once. And it certainly doesn't hurt that this €3,700 would now be worth €11,000. Building up large sums almost without noticing is the first secret weapon of DCA.

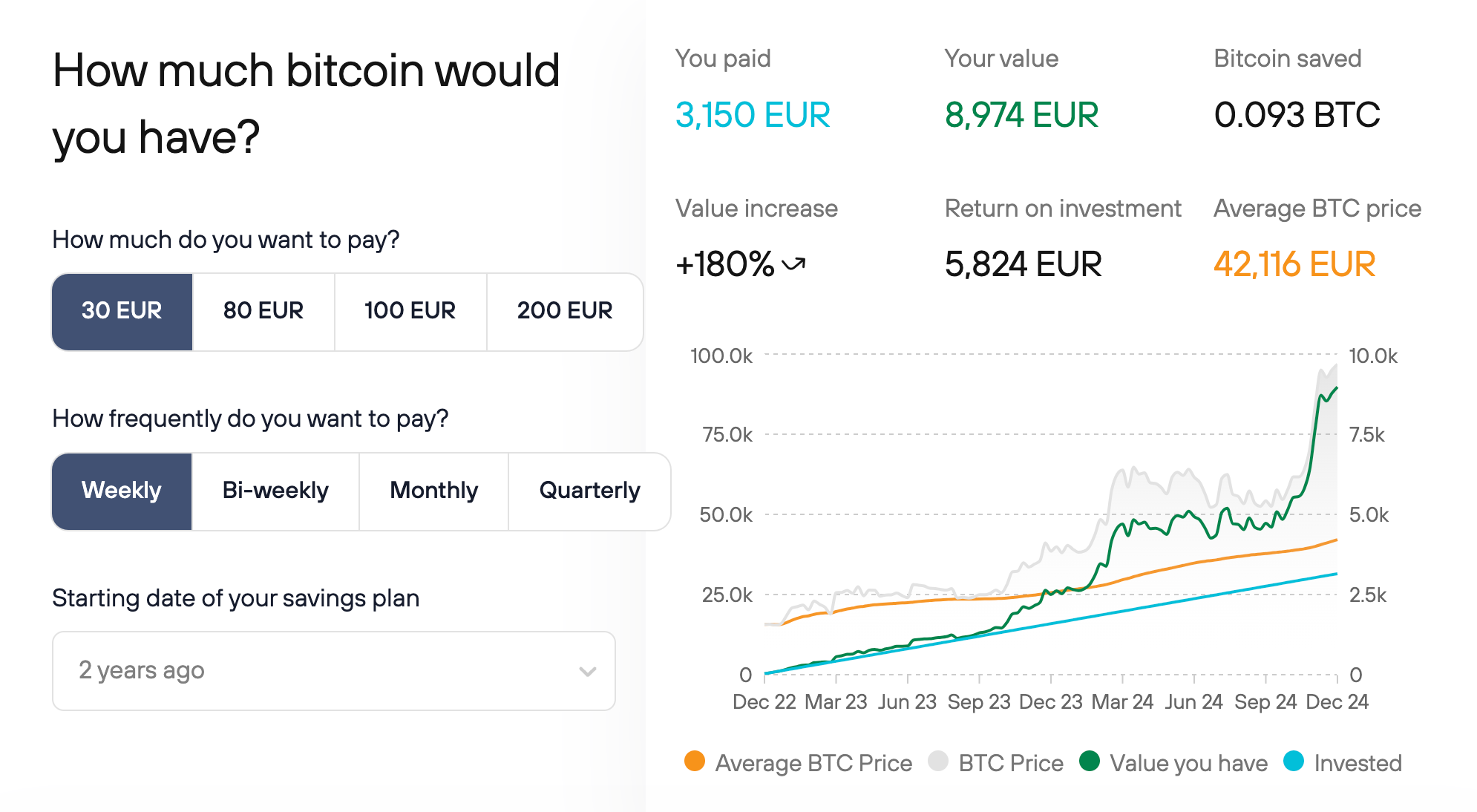

Case study 2: €30 per week for 2 years

Say you cut back on a daily Starbucks on the way to work and, as a treat, put that money in crypto instead. This would work out to about €30 of Bitcoin every week. If you had started this strategy in just late 2022, here's what you would be looking at today.

This time, let's look more closely at the ROI. DCA-ing across this time period would have almost tripled your money—a €3,150 investment would be worth just under €9,000. Not bad at all by any metric.

Of course, if you had been lucky enough to have an extra €3,150 lying around and put that lump sum into BTC in December 2022, you may be a little dissatisfied. You would have caught the market at a relatively low point, and today your 3k would be worth 17k. No denying that's a bigger number.

But if you had waited around—maybe you still weren't entirely sure about Bitcoin or you needed to work hard to save up your lump sum—investing €3,150 a year later in December 2023 would leave you with just $7,500 today. You would have missed out on an extra €1,200 by not DCA-ing. This is where the wisdom of a DCA strategy really becomes apparent: removing the need to time the market is dollar-cost averaging's second, bigger secret weapon.

Implementing your own DCA strategy

Hopefully now it's clear why DCA really is a crypto investor's best friend. It may not make you rich beyond your wildest dreams, but starting early, starting small, and sticking to the strategy really does pay off in the long run. As a bonus, you get a lot less stress and a lot less risk along the way.

Here at Invity, we truly believe in this strategy. That's why we've designed the Invity app with easy-to-use dollar-cost averaging top of mind: investors like you can choose how much to spend on Bitcoin and how often, then automate your recurring buys all in one place. Check in on your investment and update your DCA parameters as your life changes, or set it and forget it—just imagine the nice surprise in your wallet after a year or two or five.

Get started now or simplify your existing DCA strategy by downloading the Invity app today!

Try Invity mobile app for one-time and recurring bitcoin purchases: