2022 Crypto tax guide, Part 1: What forms do you need?

No one really likes filing taxes, but they're one of life's certainties. This is true even for the newest developments in the economy like digital currencies, and the tax status of Bitcoin and other altcoins is one of the major questions that new users have when starting to invest in crypto. The rules concerning taxing Bitcoin and its relatives vary a lot from place to place and change frequently, and the reality is that dealing with crypto is rarely tax free. But we want to open up the world of crypto to everyone, so this series of two articles will look at how properly including virtual currencies in your annual tax return isn't as confusing as you might expect. Remember, Invity isn't a tax advisor and isn't here to provide tax advice, so you should always check on your specific case with a tax professional. Nonetheless, we hope our Bitcoin tax review will get rid of some of the intimidation factor that surrounds staying on Uncle Sam's good side, especially if your DIY spirit is strong. Even if you're not based in the United States, Part 1 includes a lot of terms you should know plus an international roundup at the end, so read on!

Cryptocurrency's tax status in the US and terms you need to know

As we hinted, this article will talk about taxes from a broadly US perspective. We get it: the world is much bigger than that. But as the world's largest economy, the US has a lot of clout when we're talking about regulations and money, so their rules often affect those in other places. Another reason for this is practical: this article would be better as a book if we attempted to cover every country and locality. This article also only concerns filing taxes for individual purposes; including crypto as part of a business follows generally the same rules, but may include a few wrinkles that aren't important to most users.

The main thing to keep in mind is that for tax purposes the IRS (Internal Revenue Service) classifies cryptocurrency as property. Even though many hope to see crypto become a medium of exchange like dollars or euros, for now it's a store of value like real estate or stocks. Put in official terms, this means crypto is a capital asset that can rise or fall in value—these changes are capital gains or capital losses. In order to calculate whether you have a gain or loss, you need to keep careful records about the cost basis of your crypto—how much (in US dollars) you actually paid for the crypto you bought or exchanged based on the fair market value at the time of the transaction—and how long you've had your crypto before spending or exchanging it—the holding period. We'll get into how these terms are important in Part 2, but they're good to know whether you're a crypto user or not.

While being classified as property may make developing digital currencies for everyday use a bit harder in the future, the good news is that this makes filing taxes fairly easy at this point: there's already a set procedure for declaring property on your taxes, so crypto doesn't require any unique forms. The last time IRS updated its recommendations was late 2019, and this article contains the most up-to-date info. Here's a list of the documents you'll need.

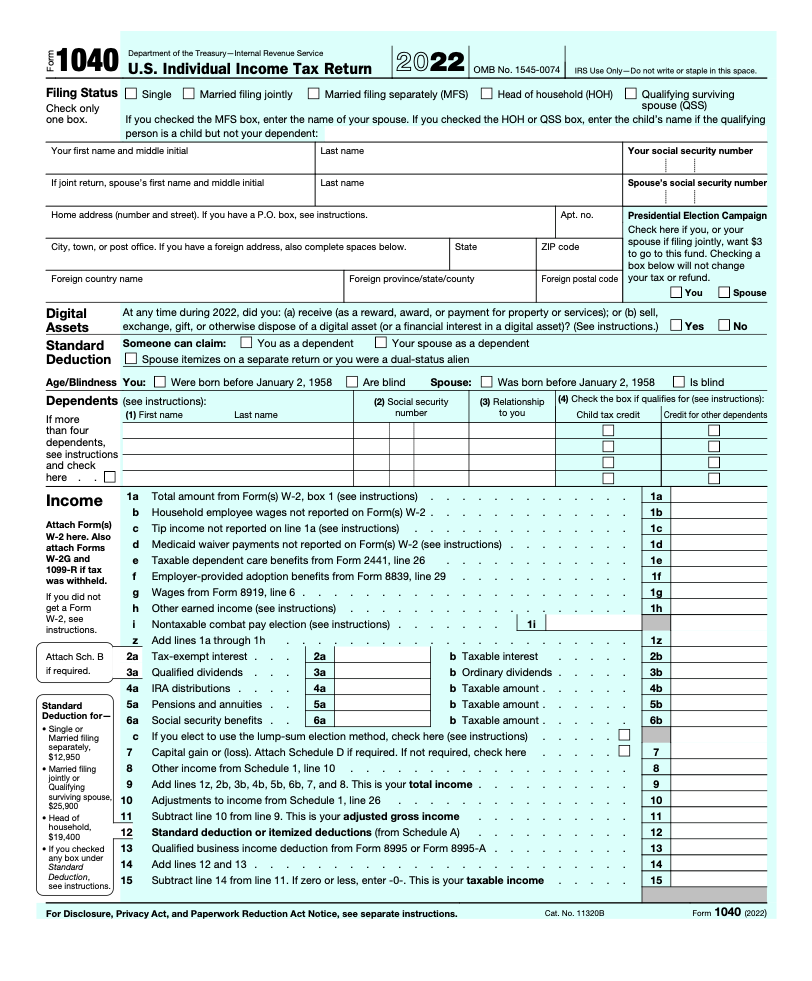

Form 1040, US Individual Income Tax Return

This is your typical individual tax return. It's probably what you file every year even if you don't have any crypto or other property. You'll use the information from Schedule 1 and Schedule D to complete this form.

Form 1040 summarizes your income tax for most people. Pay special attention to lines 7, 8, and 10, which require data from forms later in this article. (IRS.gov)

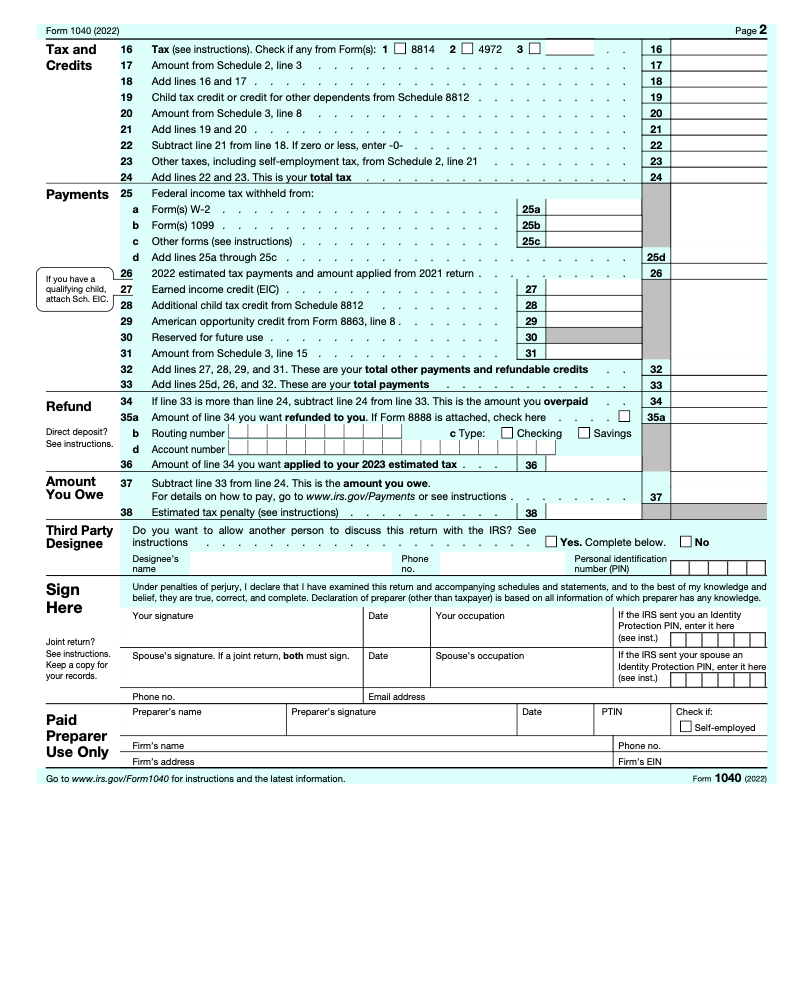

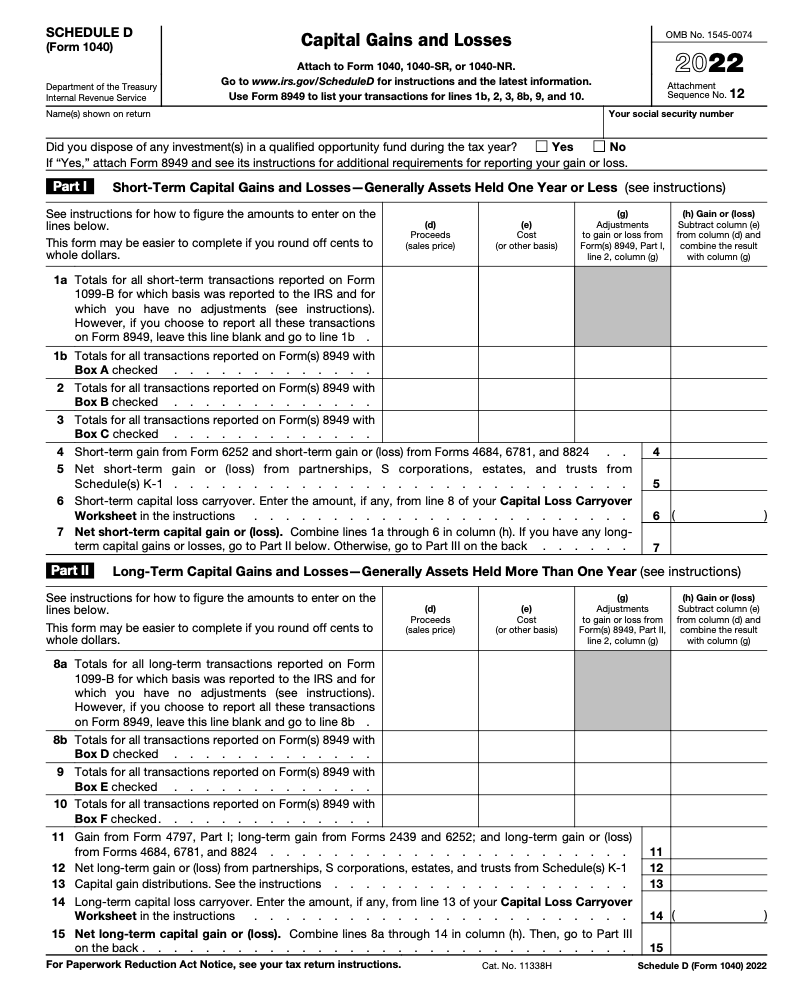

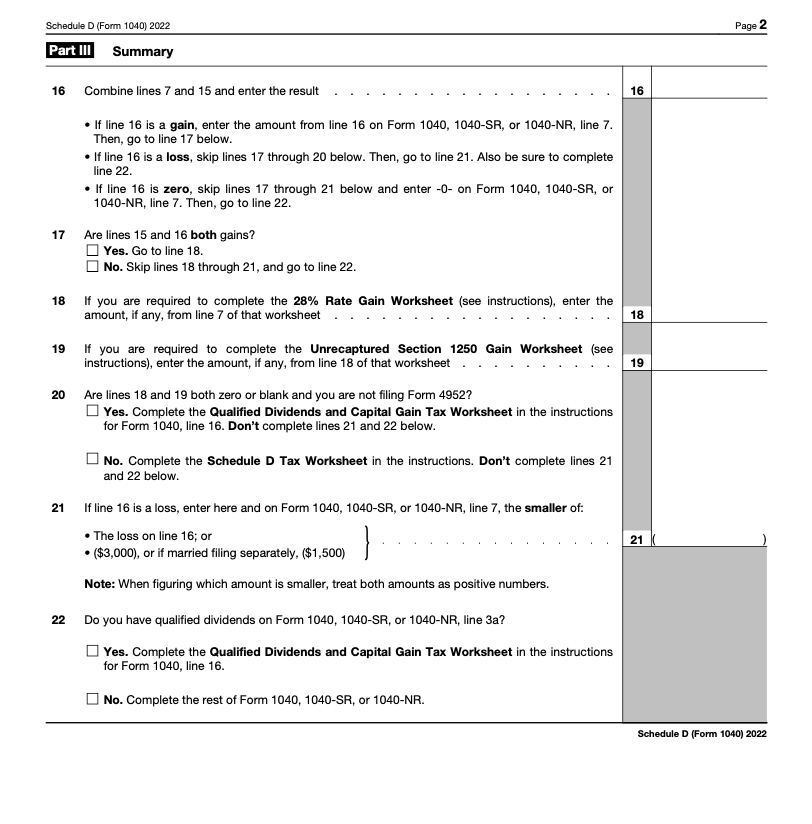

Schedule D (Form 1040), Capital Gains and Losses

This is where you record your total short-term and long-term capital gains and losses on all relevant property, including crypto.

Schedule D requires the totals of all your crypto gains or losses as well as income from other capital assets. (IRS.gov)

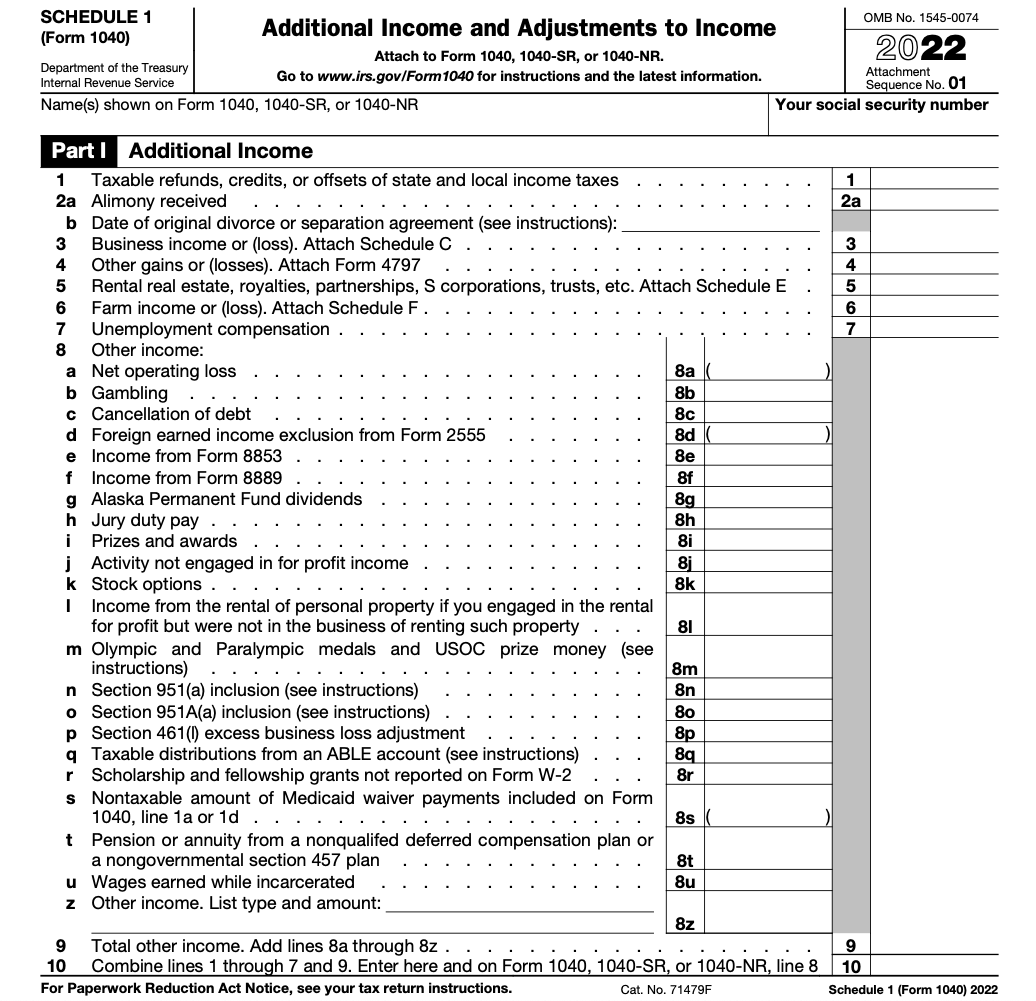

Schedule 1 (Form 1040), Additional Income and Adjustments to Income

Line 8z of this document applies to you if you received any crypto rewards and you're not self-employed—for example if you get your salary in bitcoin.

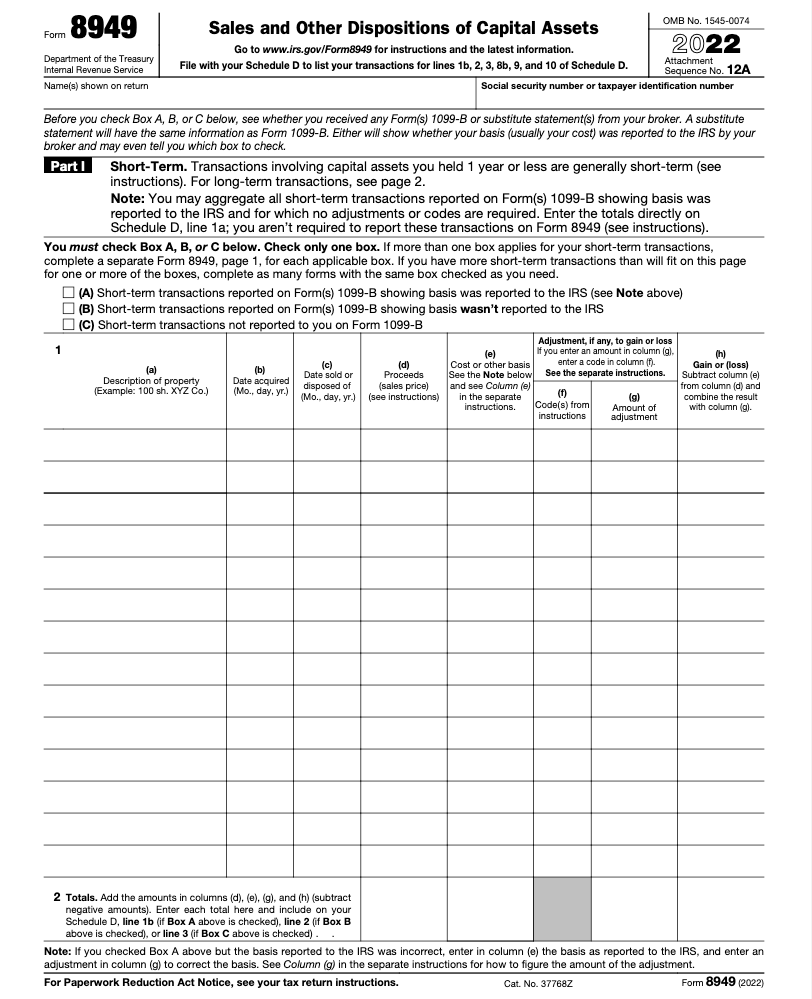

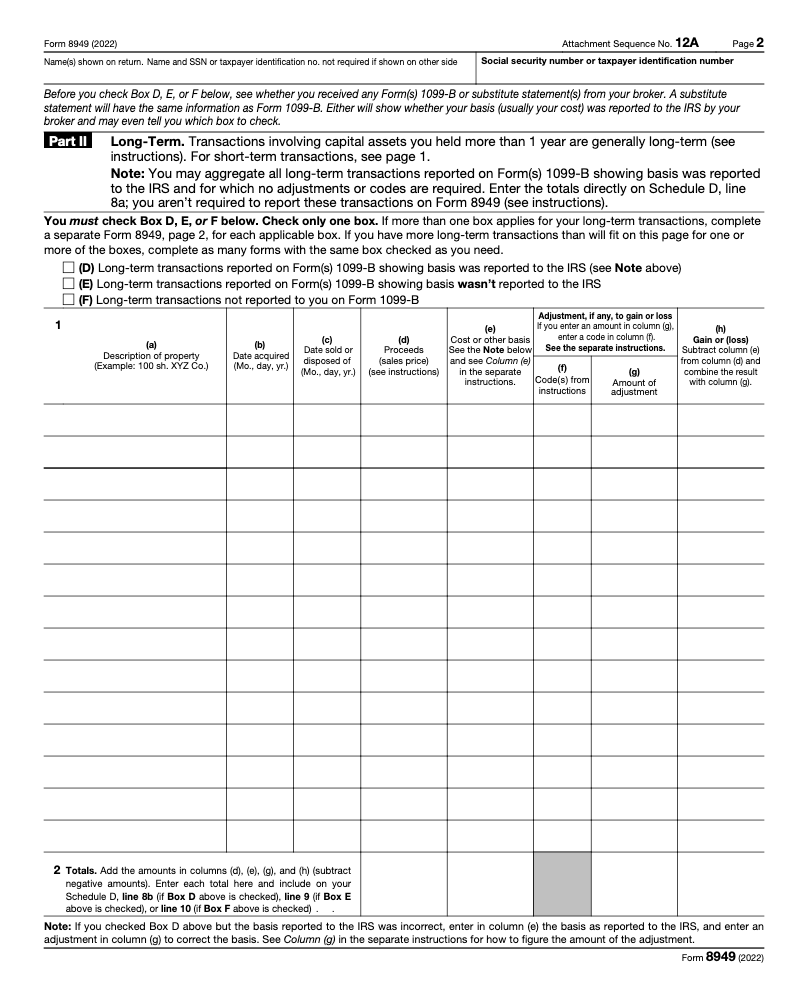

Form 8949, Sales and Other Dispositions of Capital Assets

Here's where you need to record all your transactions involving property, including cryptocurrencies. You need to be able to fill in a description of each crypto asset, the date you bought and spent the crypto, how much it was worth at the time of buying and of selling, and then some math to calculate gains or losses. The total from this page goes into Schedule D.

Form 8949 tabulates each taxable crypto transaction and tallies your capital gains and/or losses. (IRS.gov)

Other useful documents

Publication 544 provides background information about the rules for selling property; page 25 includes a whole section about virtual currencies. Publication 551 also sets out rules for determining the cost basis of your assets. Unfortunately this document doesn't have a specific section about crypto, but we'll explain best practices in Part 2. If you get really into crypto trading and make more than 200 transactions in a year or transactions worth more than USD 20,000, you'll also need Form 1099-B or 1099-K. Most reputable currency exchanges note when you've met the requirements for these forms and will send them to you automatically.

When do I have to report cryptocurrency on my taxes?

Okay, are you still with us? Finding out all the forms you need is the hard part—things get easier from here! Knowing the taxable events to include in your crypto filings is the next step. There are only a few categories of these events, but they cover most types of transactions.

- Exchanging crypto for fiat currency ("cashing out")

- Paying for goods or services (such as spending bitcoin to buy a pizza)

- Exchanging cryptos (in other words, buying one crypto with another crypto; think trading bitcoin for Ether)

- Receiving mined crypto

- Being paid in crypto or by airdrop

- Receiving crypto rewards

Most users will only need to worry about the first three. It's really important to note that buying crypto with fiat money is not a taxable event, though you'll still need to keep careful records of your purchases—you'll need this when you go to spend or exchange what you have. Making a crypto donation to charity, making a gift of crypto, and transferring your own funds between your own wallets are also not taxable events, though you should note these too just in case. In Part 2 of this blog post, you can take a step-by-step look at how to fill in each of the tax forms accurately.

Keep track of crypto transactions

Though there are relatively few types of events that are taxable, recording of all your transactions is of vital importance. You can do this by hand in a spreadsheet by noting how much crypto you bought or sold, the cost basis at the time of buying, the fair market value at the time of selling/exchanging, the date of buying, the date of selling/exchanging, and your capital gain or loss on each transaction. This can be tedious and prone to mistakes, so it's easier to use a service to track your crypto transactions instead; luckily there are some really good ones out there.

CoinTracking.info and CoinTracker.io are two of the friendlier options, since both offer free versions up to a certain number of transactions, both allow you to import data directly from exchanges and/or wallets (saving you from doing so manually), both offer convenient apps, and both work well with broader tax filing programs like TurboTax—they'll even put out a finished Form 8949 for you. You may also want to look into CoinLedger, BitcoinTaxes, or TokenTax.co; they do many of the same things but may have some features that better suit your needs.

International Bitcoin tax review

As we mentioned, the world doesn't revolve around the US, and tax regulations vary from location to location. That said, more and more countries are incorporating Bitcoin and altcoins into their tax codes, so we've collected a few informative sites to kick off your country-specific research. This handy guide includes basic information regarding most European countries. If you live elsewhere in the Anglosphere, the United Kingdom, Canada, and Australia all have fairly clear guides to the tax status of cryptocurrencies. Of course, it's even more vital to reiterate here that you really should check with your local tax advisor to make sure you're doing everything right in your part of the world!

So as you can see, taxes are definitely part of using crypto in practice. It takes a little work to make sure you have all the right pieces in one place, but once you do, things aren't too hard. For plenty more important info, Part 2 of this series goes step by step through each IRS form, so make sure to check it out! And to make getting into crypto easy, use Invity's Buy crypto feature!