Investment options and you: Bitcoin vs S&P 500

Chasing big returns often means living with risky investments, but opting for predictable ways to grow your money usually means settling for smaller profits. This article compares two of the most popular ways to invest—the S&P 500 and Bitcoin—that sit on opposite ends of the return and risk spectrums so you can choose the right investment mix for your financial goals.

Key takeaways

- Bitcoin offers high potential for returns (around 50% per year) but less predictability and thus higher risk.

- The S&P 500 offers lower returns (around 10% per year) but high stability and low risk.

- Mix both investment vehicles based on your desire for returns and your appetite for risk.

Defining terms

The S&P 500 is a market index that tracks the stock performance of the largest US companies. This list has evolved over its 100-year (or 70-year, depending on who you ask) history, but today it includes major household names in software, hardware, retail, and finance. Everyday investors can gain exposure to the S&P through ETFs and mutual funds.

Since you're reading this, you probably don't need an overview of Bitcoin; if you do, our Bitcoin FAQ is a good refresher. For this article, Bitcoin acts more like the stock of a single company rather than the basket of companies that make up the S&P 500. Investors can buy Bitcoin directly through the Invity app, for example.

Returns

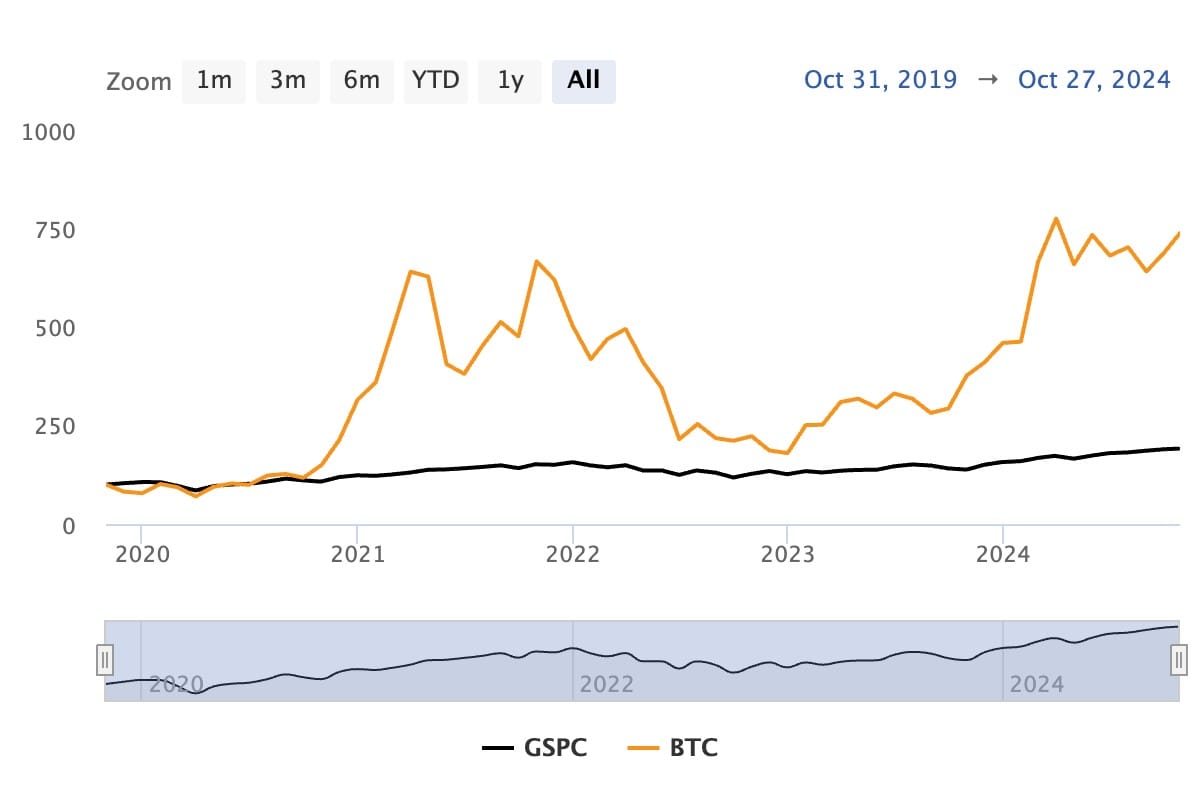

Both the S&P and BTC show positive growth trends over the last 5 years.

But a closer look at the numbers shows a huge difference in magnitude. The S&P is popular due to its consistent ability to provide about 10% average annual returns. This held true between early 2019 and early 2024, and the S&P slightly more than doubled in value. Not great, not terrible.

But during the same period, Bitcoin skyrocketed from around $4,000 to $70,000, a 17-fold increase. Put another way, Bitcoin returns grew on average 53% per year—five times the rate of the S&P. Now that's ROI.

So Bitcoin is definitely better for investors focusing only on big returns.

Volatility

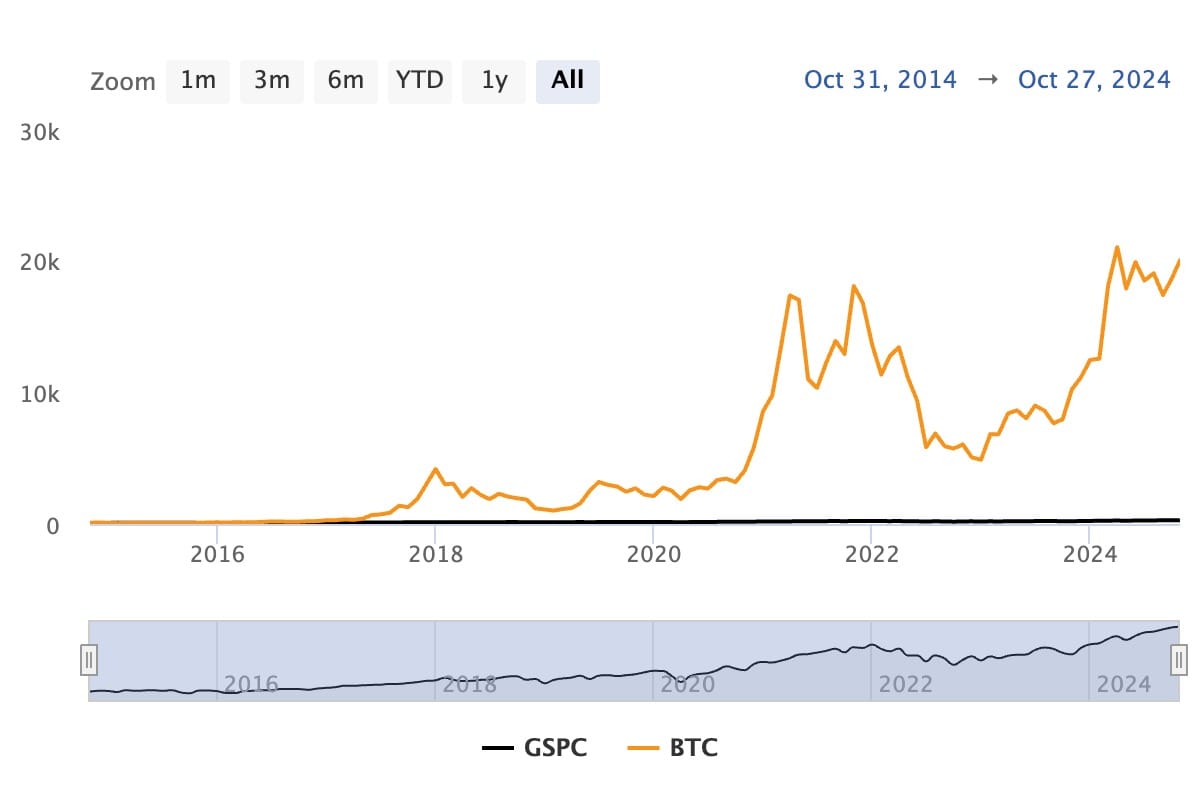

Zooming out to a 10-year view, however, puts a different spin on the S&P vs BTC.

Both show overall positive trends between 2014 and 2024 as well. But the S&P's line is obviously much tidier—it's a smooth upward slope. Even after a COVID-related drop in early 2020, the S&P 500 quickly recovered to its typical performance. This is thanks mainly to the diverse range of companies the index includes.

Bitcoin's story is less stable. Yes, there are multiple examples of BTC doubling (or much more) in value over a few weeks or months, but there are just as many times when the leading cryptocurrency lost 20%, 50%, or more of its value in a similarly short window. The 2014-2017 and 2019-2020 periods also saw Bitcoin's price remain essentially stagnant.

Not everyone has diamond hands: during Bitcoin's many volatile periods, it can be easy to sell your crypto to protect against even bigger losses or to seek returns elsewhere instead of hodling till the next upswing.

So the S&P 500 is a better choice for investors seeking reliable, comparatively stress-free returns—just set it and forget it.

Investment strategies

Going all-in on just Bitcoin or just the S&P 500 probably isn't smart. As Invity's founder, Štěpán Uherík, advocates, a diversified mix of crypto and traditional investments usually strikes a balance between risk and profitability over the long term.

Ultimately, only you can decide the best way to reach your financial goals within your risk appetite—we're not here to provide financial advice. What we are here to do is provide you with the tools to put your investment strategy into action. By downloading the Invity app, you can safely and easily get started building up the crypto side of your portfolio, even with just a few euros. Try it today!