How Bitcoin protects against inflation

Whether it's in high-level political debates or during your weekly grocery shopping, one topic is familiar to everyone nowadays: inflation. But the good news is that Bitcoin offer a way to protect yourself against the rising costs of everyday life - here's how.

Key takeaways

- Inflation means goods rise in price over time, and it's often caused by more fiat currency being printed.

- Bitcoin's supply increases slowly and will stop permanently at 21 million, removing two major sources of inflation.

- Bitcoin's volatility and closer ties to other market activities makes it a good inflation hedge, not a perfect one.

What's inflation anyway?

Inflation is when a currency loses value over time. The effects of this are complex, but the most basic is a loss in purchasing power: it costs you more units of a currency to buy the same thing; an espresso that was €1.00 a year or two ago may be €1.50 or €2.00 now.

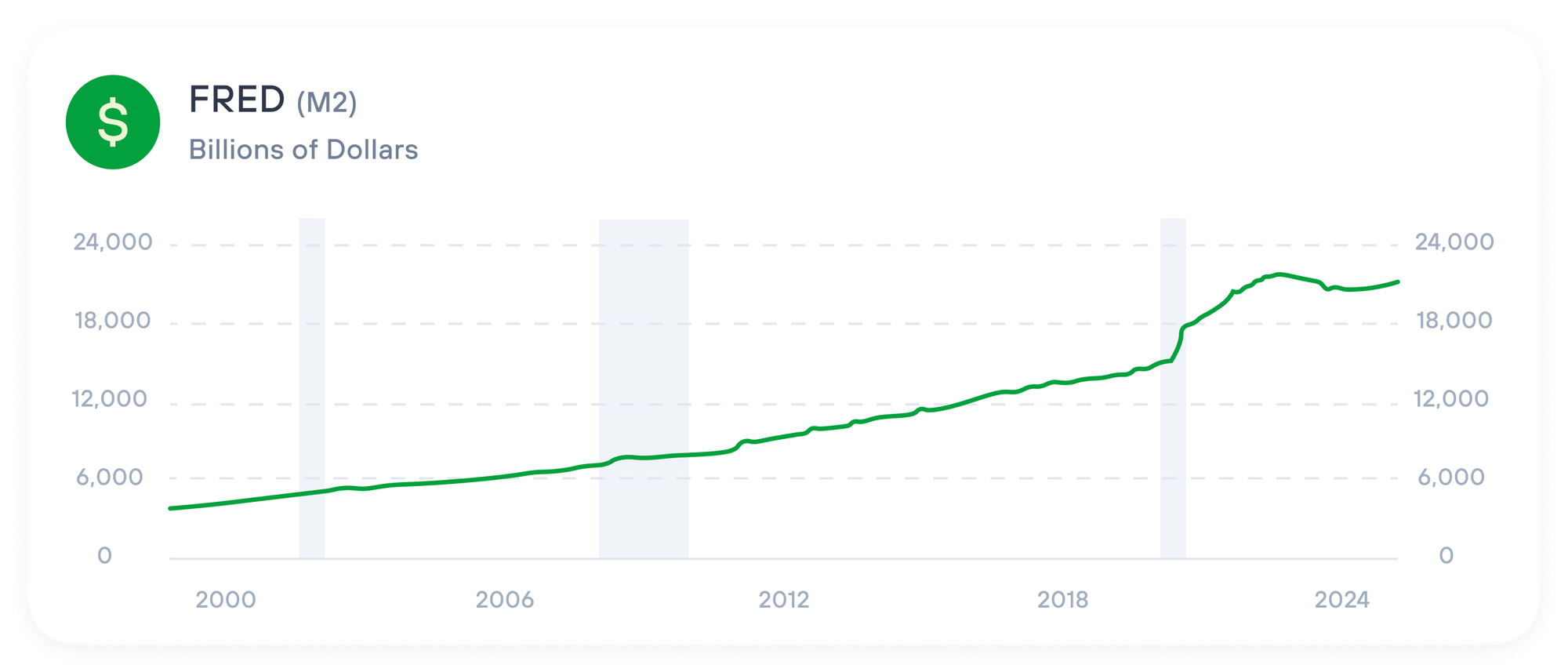

Inflation's causes are equally complex, but a major one is central banks choosing to print or otherwise introduce more fiat currency, or increase the money supply. This dilutes the economy: the same overall value is divided among the many more dollars or euros (or CBDCs) floating around.

Done extremely incorrectly, this can lead to hyperinflation like in Weimar Germany or Zimbabwe. Quantitative easing, trendy during the 2008 and COVID financial crises, is a less catastrophic example, but still one that has made life more difficult for millions.

Why Bitcoin is different

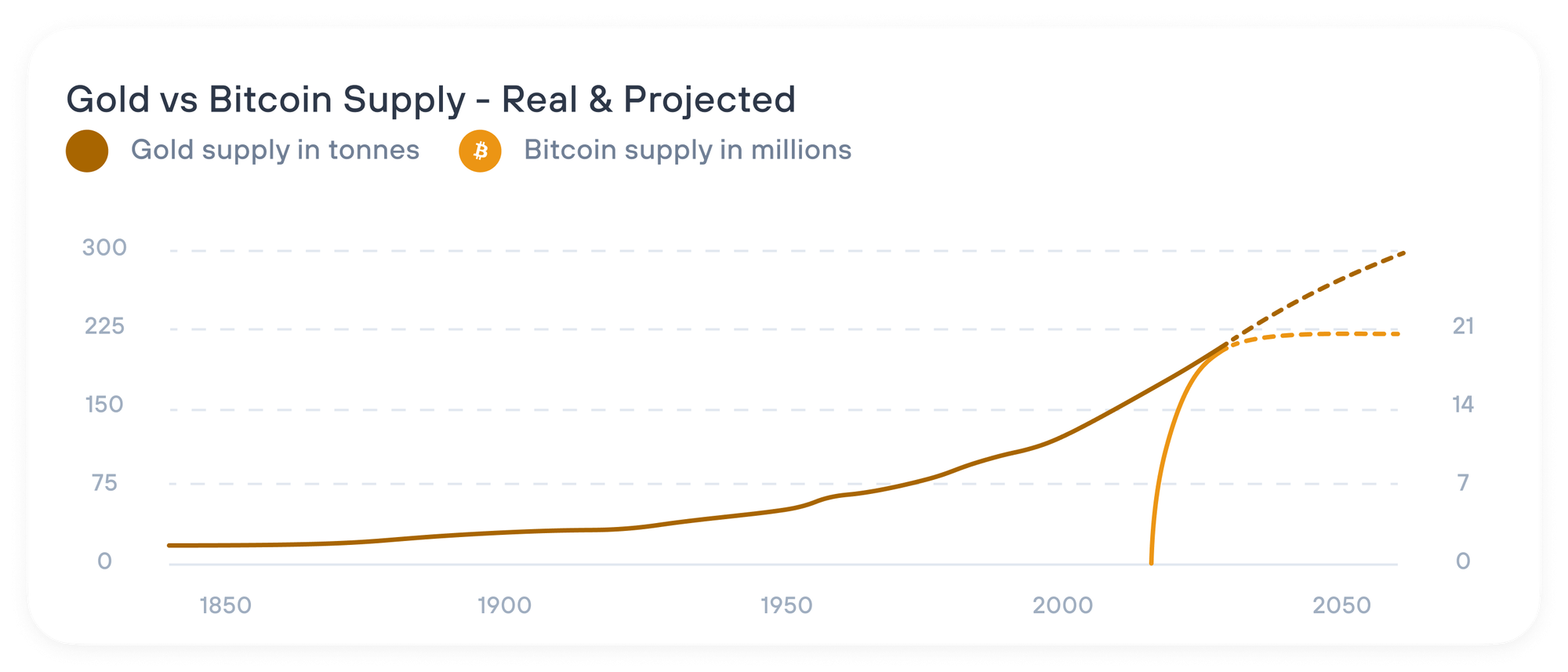

Bitcoin doesn't work the same way. Remember that BTC can only be minted through mining and block rewards. These rewards are issued at a fairly steady rate, currently about 450 new bitcoins per day. This means that Bitcoin is, technically, inflationary, but only slightly - about 75% less than the US inflation rate. This is also why Bitcoin is often compared to gold: there's more precious metal to go around as it's mined or reclaimed, but it's a slow process.

But Bitcoin's biggest inflation antidote—and what makes it different even than gold—is the cap on its supply. Satoshi wrote into its very code a hard limit of 21 million: once this limit is reached (in the year 2140), there will never be more than this number of bitcoins. Ever. We should also keep in mind that some bitcoins will be lost as some wallets become purposefully or accidentally inaccessible.

This all means that Bitcoin is a finite resource. No person, authority, or natural process can decide to add more; the value tied up in the Bitcoin economy can't be instantly subdivided like when a central bank chooses to increase the money supply. This is why converting at least some of your fiat to Bitcoin is seen as a good store of value that is strongly resistant to inflation.

And it's not just hardcore Bitcoiners saying so either: BTC has been endorsed as a hedge against inflation by investing icon Carl Icahn and powerhouse JPMorgan.

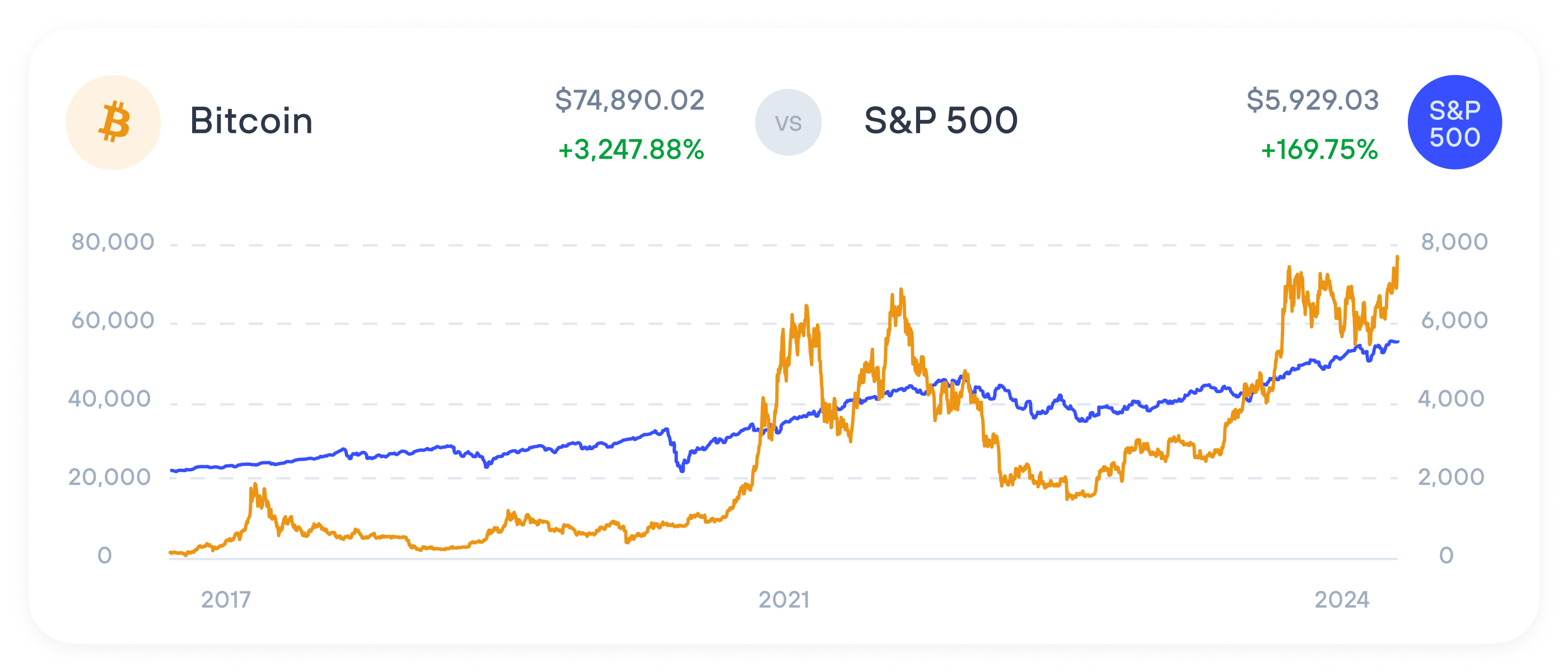

Inflation-resistant, not inflation-proof

Again, inflation is complicated—even Bitcoin isn't a perfect solution. As Bitcoin becomes more tied to mainstream investing tactics, such as through ETFs, its value may start to fluctuate similarly to other market-traded assets, many of which are heavily influenced by inflation, interest rates, and so on.

There's also Bitcoin's volatility to consider: though Bitcoin's overall value has grown well more than the rate of inflation, there are still times in recent memory when Bitcoin has swiftly lost much of its value or has stayed stagnant even as inflation did its thing elsewhere in the economy. BTC's eventual recovery still makes it a good hedge against inflation in the end, but one best approached with the long view in mind.

Luckily, our app is the best way to do just that. Even if inflation leaves you with just a few euros in your pocket, the Invity app lets you safely and easily build up and hodl on to your crypto portfolio over time. Try it today!

Try Invity mobile app for one-time and recurring bitcoin purchases: