Bitcoins and Taxes, Part 2: How to Calculate Crypto Taxes

Welcome back to Invity's explainer on crypto taxation! Part 1 made it clear that when you invest in crypto, taxation is always something you need to keep on your radar; if you haven't read its general overview of the tax status of Bitcoin and altcoins in the US, you should do that now. With that foundation, this time we'll go deeper: we'll offer a step-by-step Bitcoin tax review walking you through each form for the IRS and the principles behind the data they require you to report. Remember, Invity isn't a tax professional and isn't giving accounting advice, so you should consult an advisor to make absolutely sure you're calculating cryptocurrency taxes correctly for your situation. If you do, think of this article as a way to check their work; if you choose to do things on your own, this should give you an idea of the steps you need to take. Luckily, there are really only seven steps to reporting cryptocurrencies on your taxes, so let's dive right in!

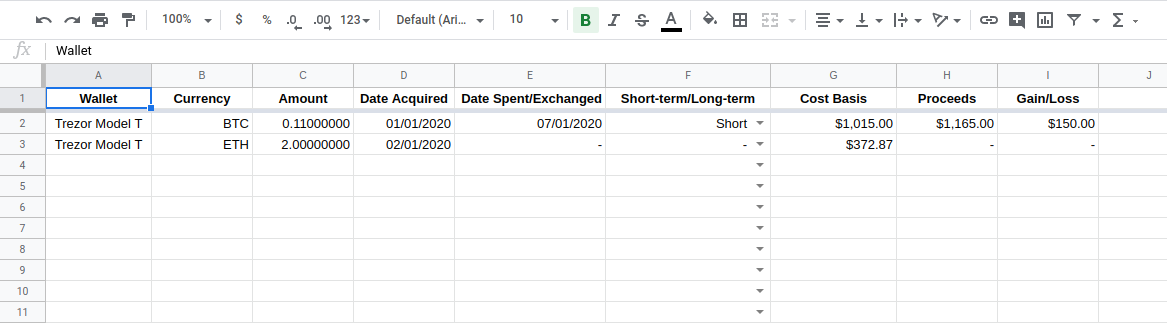

Keep records throughout the year

This is the simplest part of the process, but can also be the hardest to remember to do regularly. Make sure you keep track of all the crypto wallets you use and the holdings in each one, and do the same for each crypto exchange you use. When you buy crypto with fiat currency, make sure you note down the date, exactly how much cryptocurrency was involved in the transaction, and the total cost you were charged in USD, including transaction fees. Then take down the same info every time you make a crypto exchange (like BTC for ETH) or sale (like converting your BTC to USD or making a purchase with Litecoin). Note that when you're exchanging, you'll need to record both currencies' values in USD. Keep all this data in a single spreadsheet that you back up frequently.

But as we mentioned in the last article, completing this process manually can lead to mistakes, and especially for higher-volume traders it can get very tedious. To greatly reduce the risks of errors or forgetfulness, it's a much better idea to use a specialized service to keep track of your trades instead. CoinTracking.info and CoinTracker.io are two of the friendlier options, and they'll even put out a finished Form 8949 for you—meaning you could actually skip the next few steps in this article. CryptoTrader.Tax, BitcoinTaxes, TokenTax.co, and Accointing all have their benefits as well, so look around and see what works for you.

Also keep in mind that if you make 200 transactions or more or transactions involving USD 20,000 or more, you'll also need a form 1099. These records will likely be kept and issued by the exchange(s) you use to make the qualifying transactions, which makes your bookkeeping easier. For these purposes, we'll keep things very simple and assume that you haven't made many trades.

Determine your cost basis

When it's time to file your taxes, you'll need to know the cost basis of each crypto asset you purchased. In other words, since crypto is considered property, you need to know the starting value of the property at the time you acquired it. For example, say you invested USD 1,000.00 in Bitcoin on 1 January 2020 and you got around BTC 0.11. Now imagine that the exchange you used charged a transaction fee of 1.5% of the total transaction price, which is fairly typical. You would have spent a total of USD 1,015.00; this is your cost basis for this bitcoin.

You can use a simple formula to determine your cost basis after the fact, but it's far better to simply note down all the information at the time that you make your purchase, including any fees involved; therefore this should be included as part of the recording step above.

Determine the fair market value at the time of spending/exchanging

Now say you waited six months and then converted all the bitcoin you bought into cash. The "selling" price of the coins at the time you got rid of them is the fair market value of the coins; in IRS forms the selling price is also referred to as your proceeds. In our example, let's say that on 1 July 2020, you converted your BTC 0.11 to cash and got USD 1,165.00; these are your proceeds for this transaction.

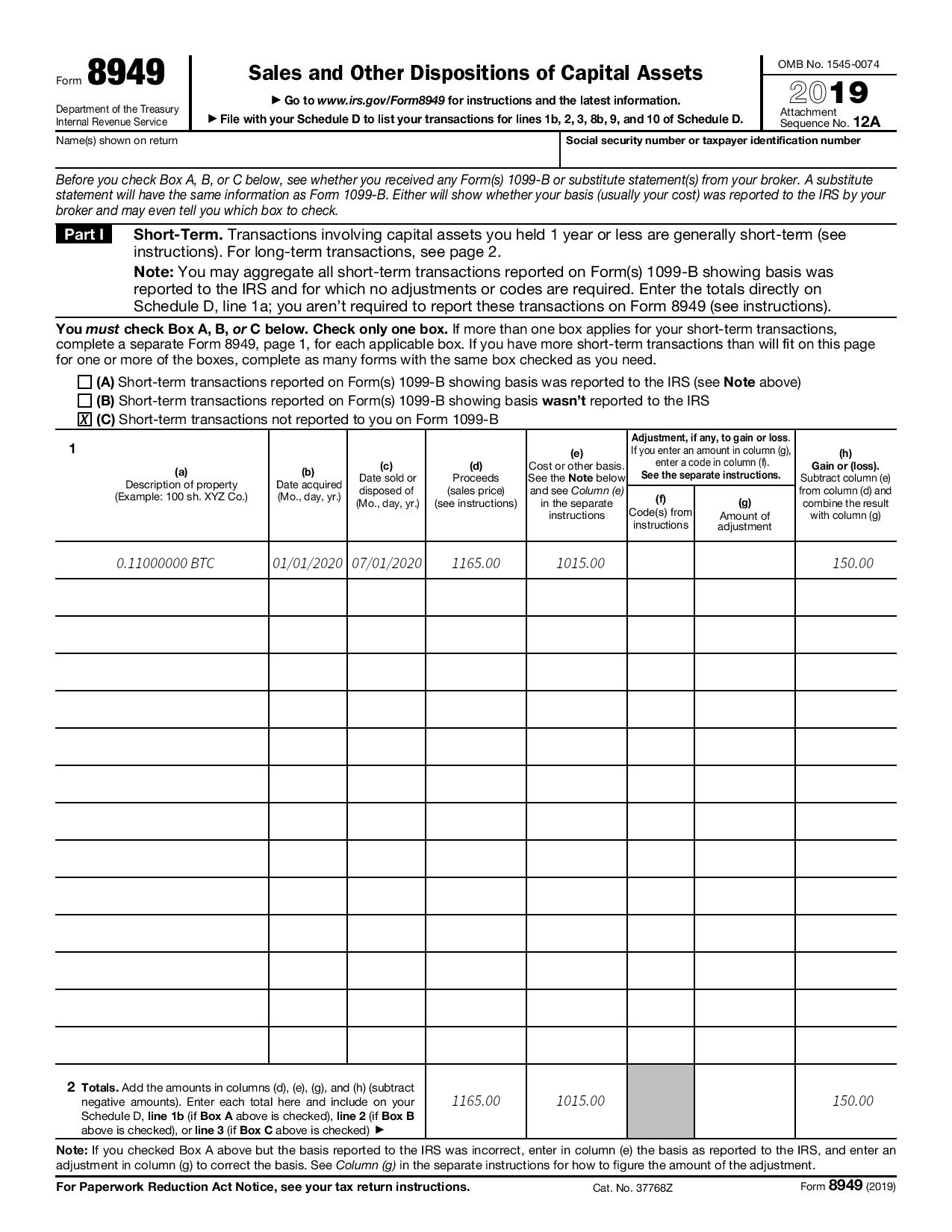

Calculate your gains and complete Form 8949

Here's where some math comes in: the difference between the cost basis and the fair market value will either be a gain or a loss; it's this gain or loss that is actually taxed. Just use subtraction to find out the capital gain or loss of your investment:

Proceeds - cost basis = capital gain/loss

So in our example,

USD 1,165.00 - USD 1,015.00 = USD 150.00

You made a small profit—hooray!

Now go to Form 8949 and consult your records to identify which currency you actually spent. Here's where things get a bit tricky, since there's no official IRS guidance. First-in first-out is the most straightforward, which means that you consider the first crypto you bought to be the first one that you spent. Unsurprisingly this can get very complicated very quickly, but what's important is that you use the same method throughout your tax filing. Thankfully most of the tracking services mentioned earlier in this article will be able to show you which method saves you the most money from a tax perspective and will complete your 8949 for you.

Whichever method you use, where exactly your transactions go on the form is determined by the holding period of the crypto, or how long you kept it before spending or exchanging it. The holding period begins on the day after you acquired the asset. So if you spent or exchanged coins that you've had for a year or less (365 days or less), it's considered "short-term"; anything longer than a year (366 days or more) is "long-term". All short-term gains and losses go on page 1 of Form 8949 (and be sure to check A, B, or C), and anything long-term goes on page 2 (check D, E, or F). For each taxable event you performed, enter the amount of crypto you spent or exchanged in column a and fill in all the other columns with the appropriate data, reading the instructions to make sure you include everything that applies to you. Repeat for each transaction you made and total everything at the end—one form down!

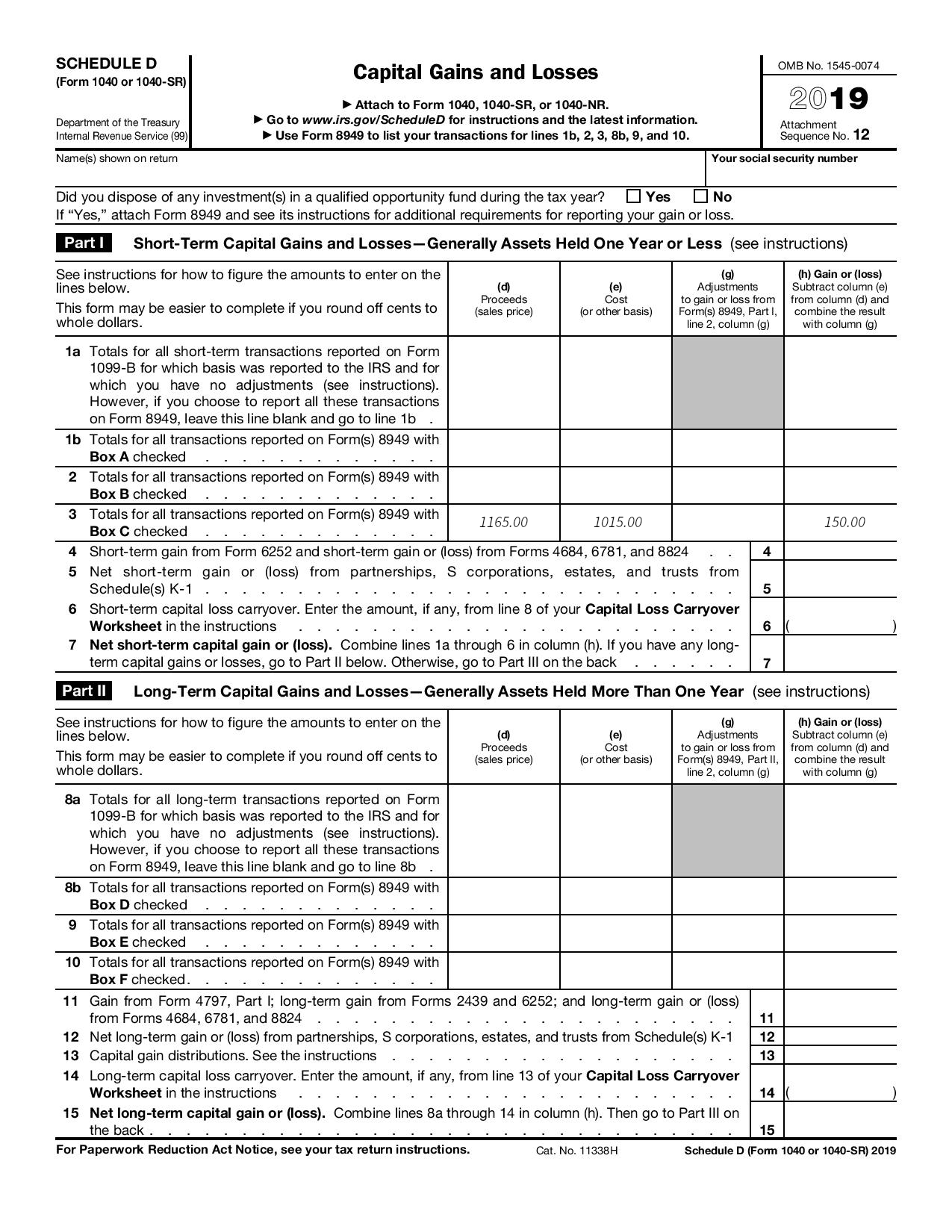

Complete Form 1040 Schedule D

Now you have to determine how the data you included in Form 8949 fits into the rest of your gains and losses. Go to Schedule D and fill in 1b, 2, or 3 using the total from the first page of Form 8949, and fill in 8b, 9, or 10 with the total from the second page of 8949. Follow the directions to fill in the rest of the sheet and total them all at the end. For this example, we've assumed that crypto is the only asset you have—form two complete!

Complete Form 1040 Schedule 1

Before you finish the main part of your tax filing, take out out Form 1040 Schedule 1. Make sure you check "yes" next to the very first question. If you only have gains or losses from crypto trading or spending, you don't need to to anything else on this form. If you have more complicated crypto income—from mining, for example—you may have to fill in line 8; this, however, is a subject for a different article. This is the simplest form you have to fill, so on to the grand finale!

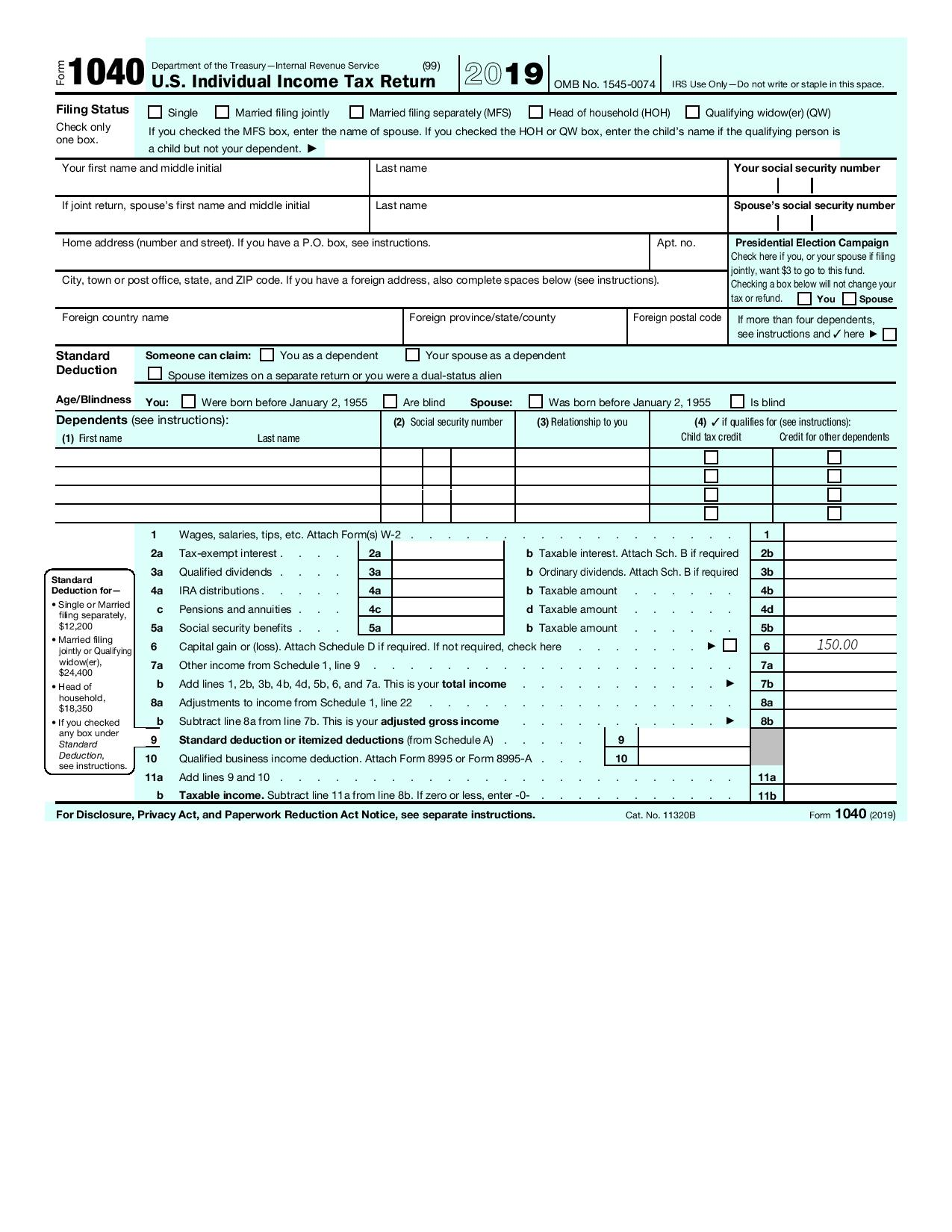

Finish with Form 1040

Go to Form 1040 and fill in your basic information. When you get to line 6, carry over the total from Schedule D. Proceed with filling in the rest of the all your forms according to your situation. Once everything is complete, put all your forms together and you're ready to submit—another tax year on the books!

What are the cryptocurrency tax rates?

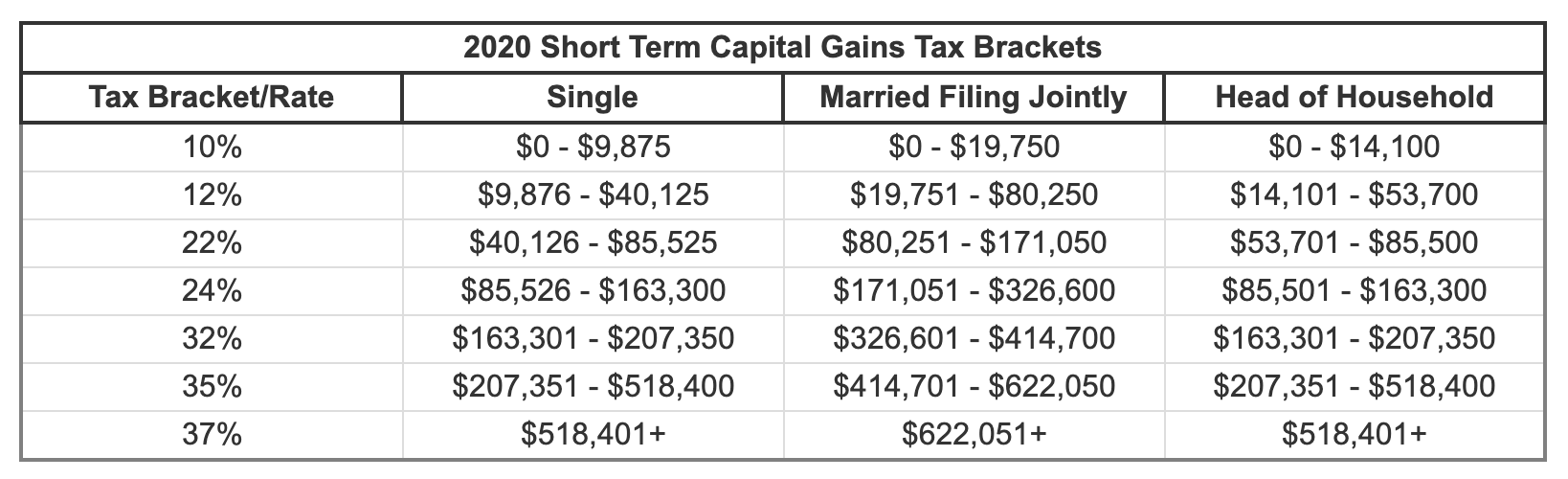

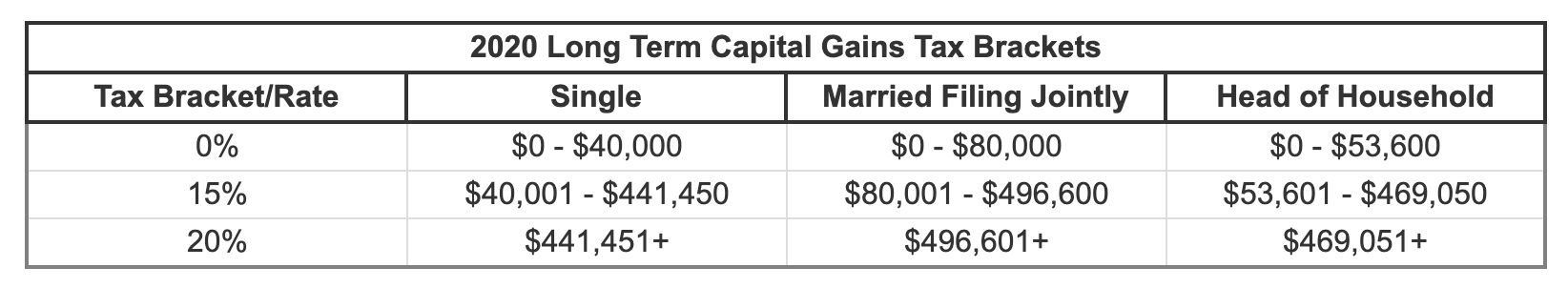

Crypto tax rates are determined just like any other capital gain or loss—while this process may not seem straightforward, there's plenty of up-to-date guidance. Your gains are determined according to your tax bracket, or basically how much income you make in a year and the category in which you file. There are also different rates for short-term and long-term gains. So depending on your overall financial position and the type of transactions you've performed, the percentage of the gains you owe to the government changes, sometimes drastically. Here are two simple tables laying out each bracket.

If you've made it this far, you deserve a big round of applause: it's been a long road, but you're now at the end of the tax-filing process for when you use virtual currencies. We hope, however, that by laying it out step by step you'll see that it's not overwhelmingly difficult to do your crypto taxes right—and like everything here at Invity, we want to help you do things right the first time and every time. To see how simple we've made the rest of the crypto economy, visit our Buy crypto or Exchange crypto features, and stay tuned to our blog for even more explainers!

Cover photo: Accounting by 401(K) 2012, licensed under CC BY-SA 2.0.