Investing at a distance: Bitcoin ETFs

From Hong Kong to The New York Times Daily podcast, news that Bitcoin ETFs have been approved has been popping up everywhere in recent weeks. It's only understandable if you flipped past these stories with a big "BTC ETF? WTF?"—these aren't necessarily the most straightforward type of investment, especially when you can simply buy your Bitcoin directly on the Invity app. However, we're here to give some background on what ETFs are and why they're actually a good sign for crypto investors everywhere.

A primer on financial markets

Before we start talking about ETFs and Bitcoin ETFs in particular, it's probably a good idea to make sure we understand financial markets, or even just markets in general.

What makes a financial market?

Financial markets aren't actually that much different from traditional markets where humans have been coming together for thousands of years. Like your local farmer's market or spice markets on the Silk Road, financial markets are simply another place where people meet to buy, sell, and trade various goods. Exchanges are where financial instruments—or securities—are bought and sold. These are usually headquartered in the biggest financial and population centers in various countries, like New York, London, Tokyo, and Hong Kong, and they mostly cater to the people in and around those regions. Trading mostly happens throughout regular business hours on certain days of the week, and prices change according to supply and demand.

The main difference, of course, is the "goods" that are traded on financial markets. The most recognizable type of financial market is probably the stock market, where stocks or shares—ownership of a tiny fraction of a large company—are exchanged. Other parts of the financial market specialize in commodities (bulk raw materials like food and metals), bonds (loans to governments or companies), foreign currencies (forex), and more. Crypto is one such specialty, so crypto exchanges have come to make up their own, newer section of the overall financial market ecosystem. In a way, financial markets are wholesalers, offering a full range of options direct from the source with purchases usually made in large chunks.

How do people invest in financial markets?

For the most part, anyone can invest in things like stocks, bonds, and more. It's possible to do this as an individual through a broker—a person or an app like eToro or Robinhood—that buys instruments on behalf of you, the client. The assets you've bought are then effectively yours to do with what you like. Of course, while building up a healthy and diverse portfolio on your own is possible, for most individuals it's too time-consuming and complex (not to mention potentially nerve-wracking) to manage a full range of investments day-to-day.

That's why many people choose instead to invest in things like mutual funds. Mutual funds are pooled investments: large groups of people deposit into the fund, and money managers buy, sell, and keep an eye on financial instruments on behalf of the group. You don't actually own any of the financial assets, just a stake in the fund itself, so investors are one step removed from the actual financial instrument, so to speak. If financial markets overall are wholesalers, mutual funds are retail stores—the place where the average person can pick up a basket of various products all in one place without much hassle.

The upside of mutual funds is that investors gain convenient access to a wide range of assets. The fact that these are diverse investments actively managed by professionals also means there is typically less risk. Downsides, however, include annual fees, expenses, and commissions, which mean that your returns are typically lower. Mutual funds also move at a bit of a slower pace: redeeming your investment, or cashing out, can only happen at the end of each trading day, and what you receive is determined by the closing price rather than any highs or lows throughout the day.

What are ETFs?

ETF stands for exchange-traded funds. These are close relatives to mutual funds, but come with some important differences. In fact, the same might be said about the relationship between ETFs and stocks, so you might think of ETFs as the offspring of mutual funds and stocks.

Like mutual funds, ETFs give investors a stake in a pool of managed investments. This saves individuals the time of analyzing, picking, buying, and managing investments themselves. Investors also don't own the underlying assets that the ETF relies on. Most ETFs also come with added fees and expenses, which can affect your returns.

More similar to stocks, however, ETFs can be traded at any time throughout the trading day, not just after markets close. This means investors in ETFs get more flexibility: their investments are more liquid—-they can be cashed out more easily—and they more accurately reflect actual asset prices as they fluctuate based on supply and demand. This more accurate view also means investors can use strategies like short selling, which are more commonly associated with individual stocks and bonds.Finally, ETFs usually come with some tax advantages that may make them more attractive than mutual funds or individual stock trades. This varies based on where in the world you are, though, so always do your own research.

What is a Bitcoin ETF?

A Bitcoin ETF is exactly what it says on the tin: it's an ETF that uses Bitcoin as its underlying asset instead of stocks. Spot Bitcoin ETFs are the biggest news lately, as they require asset managers to actually hold Bitcoin. (These are different from Bitcoin futures ETFs, which have been around slightly longer but also add another layer of complexity.)

The approval of spot Bitcoin ETFs—first in early 2024 by the United States Securities and Exchange Commission (SEC) and more recently by Hong Kong's Securities and Futures Commission—have been welcomed by both the crypto space and broader financial markets for a few different reasons.

The fact that major regulators are opening the way for Bitcoin to be integrated into traditional financial markets is a signal that crypto has gained the legitimacy it has been seeking since the beginning. Regulators now see crypto as an established-enough asset class that it can be opened up to everyday investors who might not know or care about the founding principles of Bitcoin. To the average person, crypto is now simply a good thing to know about and potentially be involved in.

This newfound legitimacy and accessibility to average people also means a new wave of investment—in short, more demand for Bitcoin from big players. Since there is a limited supply of Bitcoins in the world—there will only ever be 21 million of them—this rising demand also means rising prices. The approval of ETFs, combined with this spring's halving event, contributed to Bitcoin reaching all-time high prices in early 2024 and prices remaining healthy ever since. This effect on price is probably the most important and long-lasting impact of Bitcoin ETFs: rising prices benefit all Bitcoin investors, whether you hold your own Bitcoin or are interested in ETFs instead.

Where are Bitcoin ETFs available?

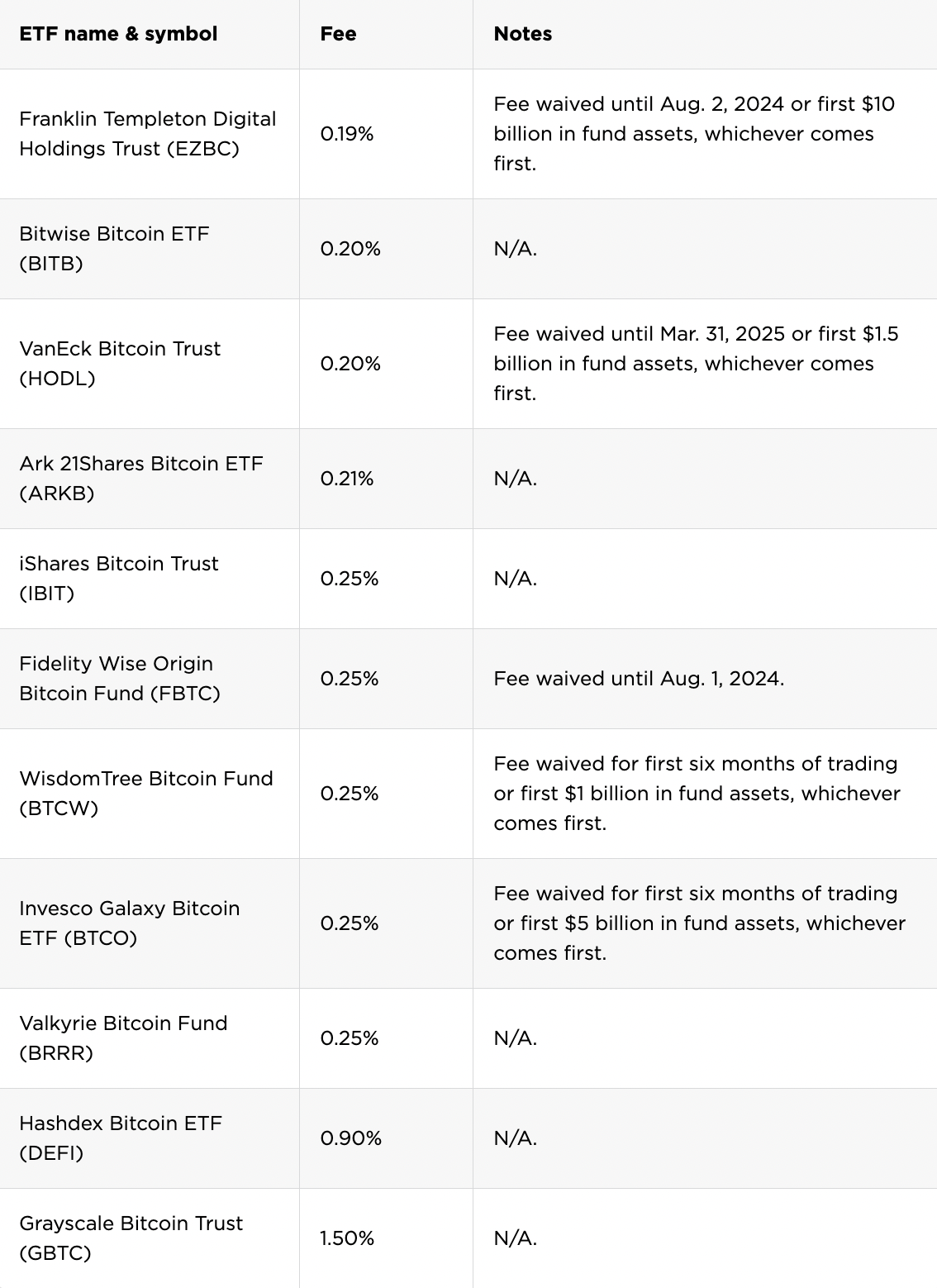

Currently, the SEC has approved 11 spot Bitcoin exchange-traded funds to operate in the US.

This was essentially the dam breaking: US financial markets and their regulators are usually leaders on the world stage, and many other major markets have followed in their path. Hong Kong—also a cornerstone of world finance—recently approved Bitcoin as well as Ethereum ETFs, and the UK, Australia, and Thailand are all moving in a similar direction. Each market has its own specifics and restrictions, but the trend is clear: Bitcoin is legitimate, the demand is there, and more traditional investors are going to get access sooner or later.

Why should Europeans care about Bitcoin ETFs?

One notable region missing from the list above is the European Union. European regulators, as they often are, are playing much more conservatively when it comes to finances and crypto in particular. Unfortunately there is no real Bitcoin ETF on the horizon for investors in Europe, though the European Securities and Markets Authority (ESMA) is considering taking baby steps by allowing Bitcoin to be included in larger mutual funds.

Still, it's good to keep in mind that the crypto market is a worldwide one. This isn't just one of its greatest benefits when it comes to moving your investments and fighting against censorship: it's also a way that international investors can benefit from developments in other countries. When Bitcoin prices rise thanks to actions in the US or Hong Kong, Bitcoin prices rise for investors everywhere.

Should I invest in Bitcoin ETFs?

Ultimately, this is a decision you need to make for yourself—Invity isn't here to provide investment advice. What we can say, though, is that ETFs might be a good way for more conservative investors or those intimidated by technology to benefit from exposure to crypto.

For other investors, ETFs simply add a barrier between you and your digital money. Particularly if you want to focus on just a few of the most reliable crypto investments like Bitcoin, super user-friendly options like the Invity app make it straightforward to buy, store, and manage your coins on your own. Why not simply buy and hold on to your own crypto and do with it what you like? And since the EU is so far more resistant to Bitcoin ETFs, investing directly is how European investors can make crypto part of their investment portfolio, benefitting both from rising prices in the short term and dollar-cost averaging for the long term.

Whatever you decide to do with your newfound knowledge about Bitcoin ETFs, there's one thing for certain: crypto isn't going anywhere. As traditional investment bigtimers take notice, that can only mean a bright future of crypto. If you're reading this, you're getting in while it's still early days, so keep at it, HODL on, and let's see what the years to come have in store.