Block Rewards and Halvings

Block rewards and halving events are crucial components of cryptocurrencies like Bitcoin. Understanding both terms will allow you to appreciate one of the most readily praised features of these cryptocurrencies: their potential to serve as a store of value.

Further, block rewards play an important role in decentralization, the process that allows cryptocurrencies like Bitcoin to operate on a peer-to-peer basis without any involvement from banks or other intermediaries.

What is a block reward?

As a brief recap, cryptocurrency mining is the process that allows Proof of Work (PoW) cryptocurrencies like Bitcoin to stay decentralized. "Miners"—computers scattered across the globe—compete to be the first to find the mathematical phrase that adds a block to the blockchain, which irrevocably adds new transactions to a publicly available record.

A block reward is an amount of crypto given to the miner who first verifies the legitimacy of a block. Block rewards are simply a way to incentivize people to participate in this system. When the network successfully verifies a block, new coins are automatically created by the crypto network and given as a reward to the miner who helped out. The transaction fees included in the latest block are also paid to the winning miner.

Block rewards have always been a part of Bitcoin’s core design, dating back to the original white paper that first outlined Bitcoin in 2008. Back when the currency was still an entirely new addition to our world, miners would compete for the chance to receive a reward of 50 BTC and all of the transaction fees involved in a block. Keep in mind, however, that 50 bitcoin was worth substantially less back then than it is today.

Importantly, block rewards are the only time in which new bitcoins are ever created. As we’ll discuss in the following sections, there is a fixed limit to the amount of bitcoin that will ever exist. But this isn't a linear process: block rewards reduce by half over time as a way of gradually introducing a portion of the currency’s maximum supply into circulation.

What is block halving?

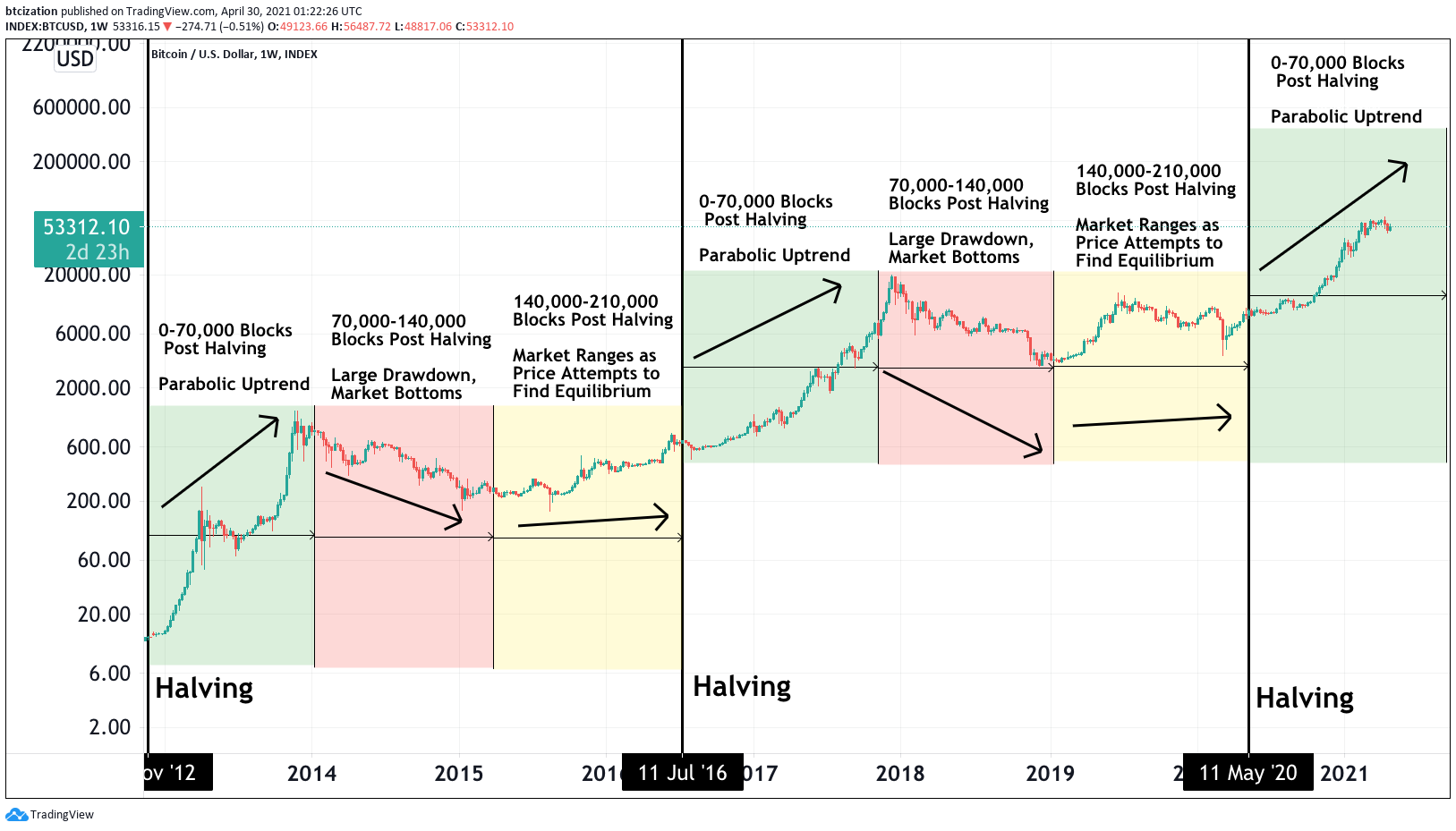

Block halving is an aptly-named process in which the block reward that miners receive gets cut in half at predetermined intervals. It is baked into Bitcoin’s original white paper—and the code of the Bitcoin network—which outlines that the reward for mining halves every time 210,000 blocks have been verified. Since the average block takes about 10 minutes to confirm, this works out to a halving event occurring roughly every four years.

For instance, miners received 50 bitcoin per verified transaction back in 2008, 25 BTC in 2012, and 12.5 BTC in 2016. Since May 2020, 6.25 coins are created every time a block is approved, and they are awarded to the person who helped confirm that block. The next halving is coming up already in April 2024, and the Bitcoin block reward will halve to 3.125.

Since halvings are a fixed part of the governance model that has been in place since the genesis of the Bitcoin network, they are never a surprise. Thanks to tools like BitcoinBlockHalf you can even follow a countdown to when the next halving event will occur.

Why is block halving important?

Bitcoin was first outlined in a white paper published by a figure or group that remains anonymous to this day. Crucially, its creator(s) envisioned a system that could store value and run without the need of any one person overseeing it.

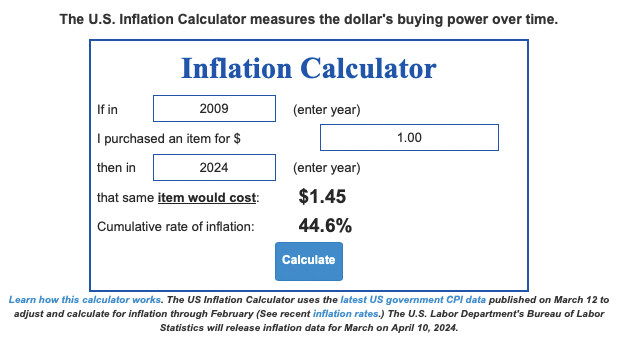

If we think about fiat currencies such as the US dollar, there is no real limitation to the amount of money that can be printed. However, when new money is created, it essentially lessens the value of the existing currency—each dollar becomes worth slightly less, and you'll end up paying more for the same products. This is a process known as inflation. In a system of fiat currency, we place faith in our leaders to make smart economic decisions that do not cause the value of our money to dip.

In contrast, an asset like gold has a fixed supply cap: there is only a certain amount of gold that will ever exist on Earth. As the limited supply of gold is mined and put into use by humans, the demand can theoretically outweigh the remaining supply and allow it to increase in value.

While Bitcoin aims to serve as a decentralized currency, it heavily borrows from assets like gold as a source of inspiration; in fact, Bitcoin is sometimes referred to as "digital gold". Like gold, bitcoins are designed to be scarce. Only a maximum of slightly less than 21 million bitcoin will ever exist. In addition, lost and destroyed coins cannot be replaced and further lessen this supply. This is supposed to guarantee that Bitcoin is immune from inflation.

The process of block halving ensures that new bitcoins are introduced into the system at a slower and slower rate over time, further insulating the network against inflation. Eventually, the process of block rewards will end altogether, around the year 2140. Since this process is entirely automated and is a fixed component of Bitcoin’s transparent code, we do not need to trust the system in the same way we have to trust governments and financial institutions to make decisions in our best interest. Instead, we can verify for ourselves that everything is as described and that there are no hidden surprises along the way.

What is the impact of block halving on Bitcoin’s price?

In theory, since block halving slows down the rate of new bitcoin creation, halving events should correlate with increases in the asset’s price. There is also the perspective that halvings attract periodic attention to Bitcoin and drive a new wave of investor interest. After all, it is a notable event in which the currency’s supply permanently slows down and demand is likely to increase.

However, while price hikes have happened around the same time as halving events in the past, as well as just before the 2024 halving, it is virtually impossible to pin the market’s movements on individual events. There are also merited schools of thought which state that halving events are already baked into bitcoin’s value in the eyes of investors, since everyone always knows when the next halving event will occur.

Ultimately, giving miners a block reward for their vital role in confirming blocks on a blockchain is a groundbreaking way of incentivizing participation in a decentralized environment. It also serves as a way to gradually introduce more coins into circulation. Block halving, on the other hand, is a way to ensure that a cryptocurrency like Bitcoin doesn't suffer from inflation and never surpasses a set maximum supply. The result is a system that can serve as a store of value while also escaping the confines of centralized intermediaries and self-interest.