Bitcoin in 2024: What can we expect?

As we enter 2024, let's take a closer look at what's shaping up to be an eventful year in the world of Bitcoin. We'll break down the key highlights and what they mean for all of us.

Bitcoin halving: Embracing scarcity

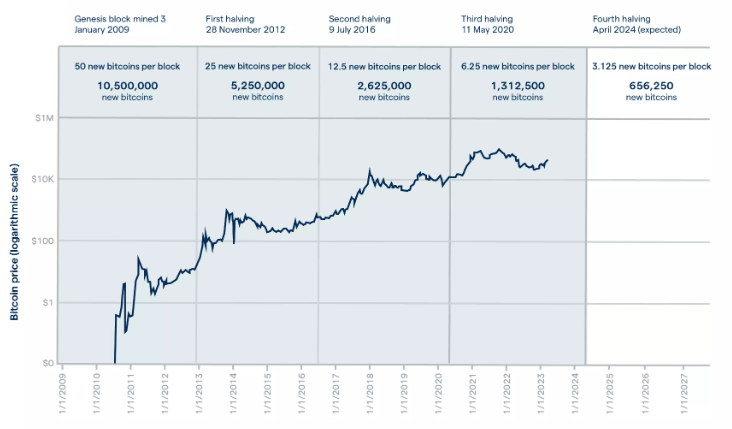

In April 2024, Bitcoin is gearing up for its fourth halving event. What's the deal with halving? Well, it's a fundamental part of Bitcoin's design, cutting the reward for Bitcoin miners in half and therefore reinforcing scarcity of the coin.

The idea of halving goes hand-in-hand with the idea of Bitcoin being a sort of “digital gold”. As miners continue to “dig” for it over time, it becomes increasingly more difficult and less fruitful, inspiring technological innovation, and making the already mined coins that more valuable.

History shows us that every time a halving occurs, Bitcoin's price tends to make significant upward moves. Especially with many traditional currencies facing uncertainty and inflation, Bitcoin's reputation and value might grow even stronger after the 2024 halving.

Bitcoin ETFs: Simplifying access

Now, let's talk spot bitcoin ETFs, or exchange-traded funds, which were approved mid-January by the SEC. 11 ETFs were already launched by some of the largest asset managers in the world, such as BlackRock and Fidelity. They make it easier for some individuals and institutions to get involved in crypto, possibly increasing the popularity and therefore price of bitcoin.

There has been a lot of excited anticipation in the run up to the approval throughout 2023. However, it’s good to remember that ETFs don’t come without their risks — you only buy shares in a fund that owns bitcoin but you don’t own the coins themselves. With the 2023 crashes of major exchanges like FTX and BlockFi, the importance of self-custody is more apparent than ever.

So, while ETFs will change the landscape in terms of accessibility, can be a good starting point for some traditional investors, and will probably result in a stronger media spotlight for Bitcoin, they also come with important considerations.

On a side note, Ethereum ETFs are also expected to be approved by the SEC in May. While this doesn’t affect Bitcoin directly, we can expect even more exposure for the crypto sphere in general.

Road to MiCA: Unveiling regulations

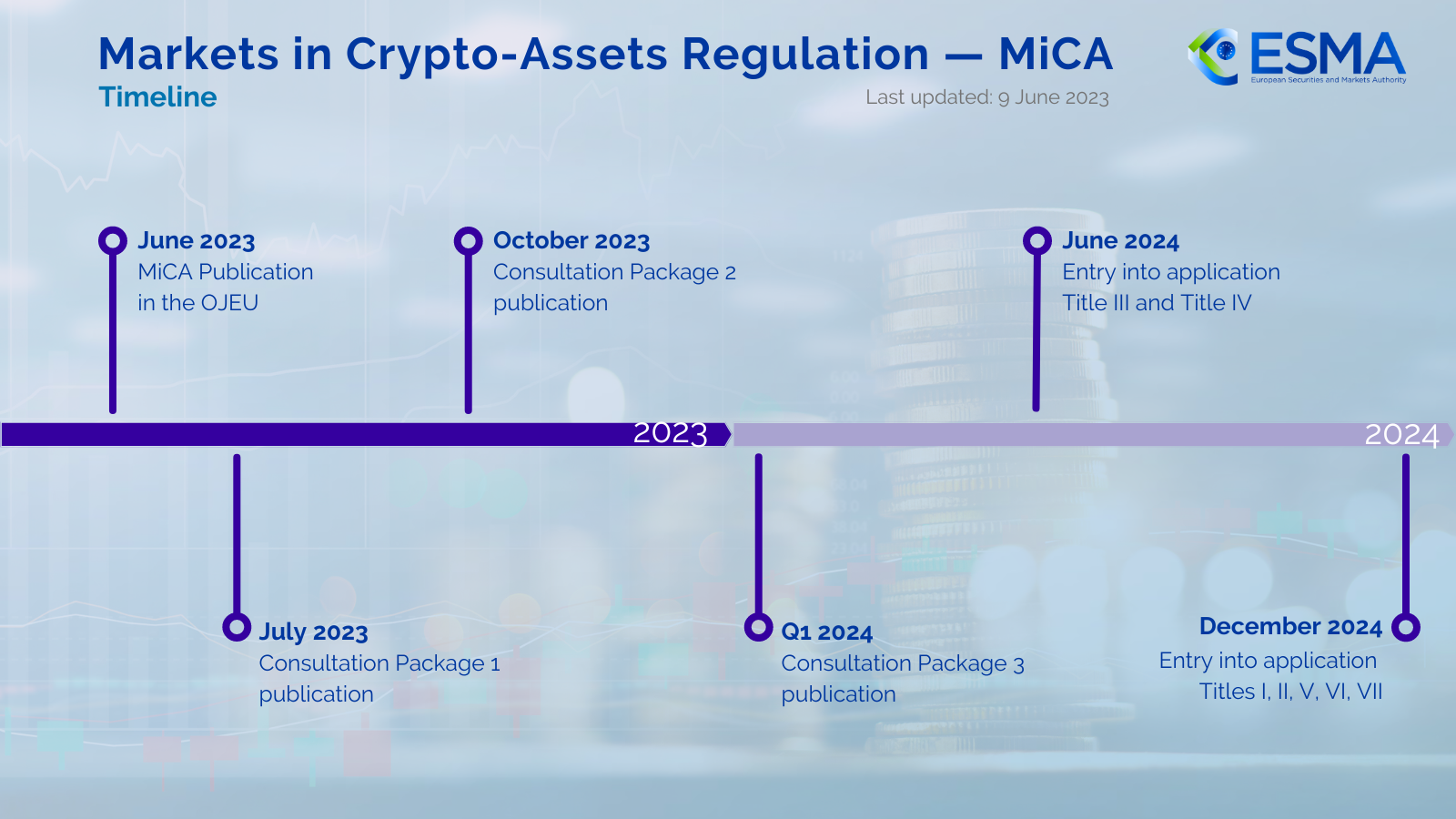

In 2024, the European Union is poised to pioneer comprehensive crypto regulations through MiCA, the Markets in Crypto Assets regulation. Spanning 27 countries representing a substantial share of the global economy, MiCA introduces clear guidelines to foster legal certainty in the crypto space.

Under MiCA, companies offering crypto services in the EU must obtain authorization from national financial regulators, while those issuing crypto assets must publish transparent white papers outlining risks. Unlike traditional finance rules, MiCA adapts existing regulations to accommodate innovative crypto instruments, reinforcing market integrity and security. A significant focus is on stablecoins, aiming to ensure they are well-governed and backed by suitable reserves.

Though MiCA brings legal certainty, it also faces challenges and uncertainties, such as tough compliance rules, concerns about dollar-denominated stablecoins, and ambiguity regarding NFTs. As EU agencies further define MiCA's implementation, its influence may extend beyond the EU, inspiring global crypto regulation standards.

MiCA regulations will apply from December 30, 2024, with stablecoin provisions starting already in June.

Global adoption: Bitcoin's growing influence

Here's an exciting story to wrap it up – Bitcoin is gaining more and more global popularity, especially in regions like Asia, Africa and Latin America. Initiatives in South Africa, Ghana, Nigeria, and many other countries, as well as the successful Bitcoin adoption in El Salvador stand out as shining examples for many communities.

In these and other areas, Bitcoin is stepping up as a stable alternative for everyday transactions and wealth preservation. It's gaining traction in places where traditional banking services are limited or the official currency has failed.

Furthermore, innovations like the Lightning Network, non-custodial wallets, and educational activities by many organizations such as Trezor, are making Bitcoin accessible, even in areas with limited resources.

So, there you have it – 2024 is set to be an exciting year for Bitcoin with the halving, ETFs, MiCA, self-custody, and global adoption taking center stage. Stay tuned as the crypto landscape continues to evolve!